On May 19, TLG announced its resolution to approve plans for its subsidiary, Tan Luc Mien Nam JSC (a wholly-owned subsidiary of TLG), to invest in Phuong Nam Culture Joint Stock Company. In a reciprocal move, PNC also submitted documents to its upcoming Annual General Meeting of Shareholders, scheduled for late May, seeking approval for a waiver of the mandatory public offering with Tan Luc Mien Nam as the acquiring party (a subsidiary of the TLG Group).

This information was previously alluded to during TLG’s Annual General Meeting on April 10, 2025, where Ms. Tran Phuong Nga, CEO of the TLG Group, shared: “TLG is approaching the final stages of an M&A deal, but due to confidentiality commitments with our partner, we cannot disclose details at this Assembly.”

Market experts observe that this impending transaction is a highly synergistic union as both TLG and PNC are well-established brands with a nearly half-century-long presence in the Vietnamese market. They share a common goal: to provide knowledge-based, high-quality products that cater to the lifelong learning journey of Vietnamese consumers nationwide. This acquisition aligns with TLG’s strategy of “deep diversification” and its commitment to “staying true to its core business,” focusing on expanding its offerings of knowledge-based products that foster creativity and learning among Vietnamese consumers.

According to Mr. Nguyen Dinh Thu, Director of Strategy & Investment at TLG and Director of Tan Luc Mien Nam, the investment in PNC is a strategic move in TLG’s development and a significant step forward in expanding into new product categories, particularly toys and lifestyle goods, which TLG has been building and developing over the past years.

By merging PNC’s network of 50 stores nationwide with its own, TLG gains a substantial foothold in developing its retail system for lifestyle products and toys.

Since 2022, TLG has established its own retail chains, CleverBox and Peektoy, offering stationery products and a creative world of toys and gifts through DIY and STEAM products. With their rich and diverse offerings, TLG’s retail chains have provided exciting shopping experiences for customers, allowing them to express their individuality, preferences, and unique personalities, especially among young consumers. Currently, CleverBox and Peektoy have 12 stores across various provinces and cities in the country.

TLG’s representatives also shared their appreciation for PNC’s capable personnel and the system they have built over nearly 45 years. Building on this solid foundation, TLG intends to implement specific plans to maximize synergistic values.

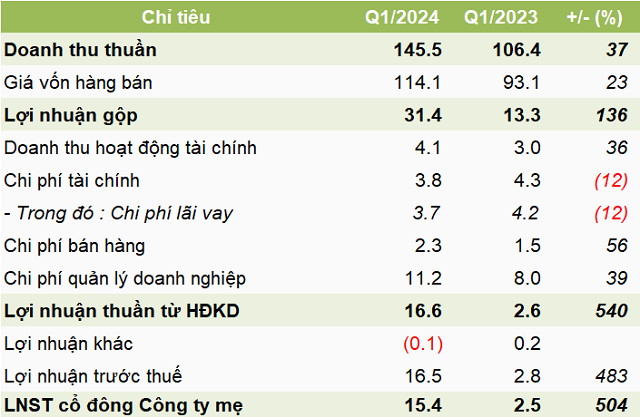

For the year 2025, TLG aims to achieve a net revenue of VND 4,200 billion, a 12% increase compared to the previous year, and a profit of VND 450 billion. This M&A deal will provide a strong growth impetus and open up new opportunities for TLG in the years to come.

Regarding TLG’s M&A strategy, Ms. Tran Phuong Nga, CEO of the Group, had previously shared that the company approaches such transactions with caution, not pursuing M&A “at all costs” and remaining true to its core business.

The Market Beat: Where Does the Money Flow?

Today’s trading session ended with the VN-Index climbing over 1 point to 1,245.76, while the HNX-Index gained 0.4 points to reach 224.86. The market remains in an accumulation phase with low liquidity. The total trading value across the market barely surpassed 12 trillion dong, with more than 3 trillion dong coming from negotiated trades.