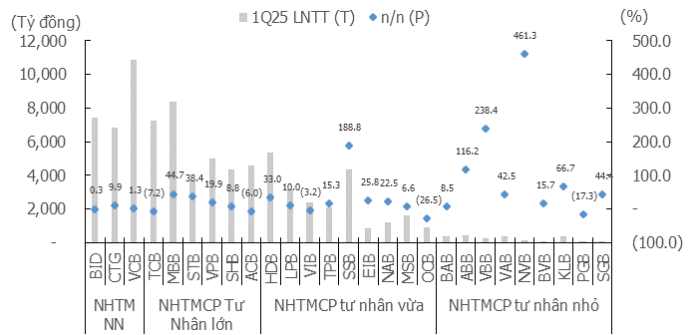

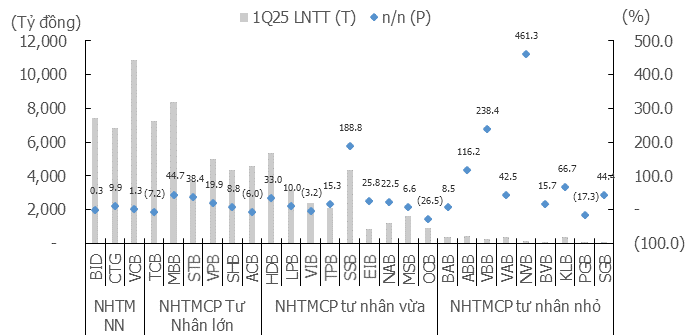

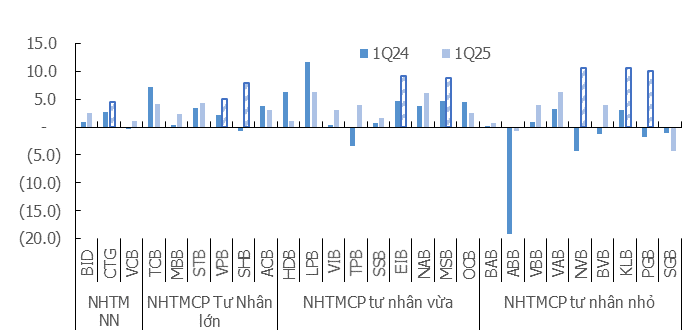

Private JCBs Report Better Profit Growth in Q1 2025

According to KIS Securities, the combined income and pre-tax profit growth of 27 banks in Q1 2025 increased by 9.3% and 14.5% year-over-year (yoy), respectively. However, excluding SSB’s income from the sale of its subsidiary, income and profit growth stood at 7.6% yoy and 10.9% yoy, respectively. This performance was driven by strong credit growth, higher non-interest income, and controlled operating and credit risk provision expenses. Meanwhile, fee income, foreign exchange trading, and investment activities yielded less favorable results in Q1 2025.

Private JCBs outperformed their state-owned counterparts. Notably, MBB, STB, and VPB among large private JCBs; HDB, SSB, EIB, and NAB among medium-sized private JCBs; and ABB, VBB, VAB, NVB, KLB, and SGB among small private JCBs reported impressive growth.

Chart 1: Pre-tax Profits of Banks

Source: FiinproX, Banks, KIS Research

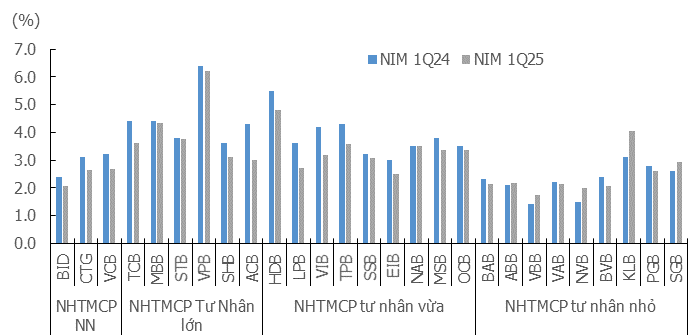

Higher Credit Growth in Q1 2025

Credit growth for the industry (TTTD) at the end of Q1 2025 reached +3.93% quarter-to-date (qtd), outpacing the +1.24% qtd growth in Q1 2024. In Q1 2025, TTTD was driven by corporate lending. Additionally, banks mostly reduced their holdings of corporate bond investments amid a sluggish corporate bond market.

Compared to the previous year, most banks (21/27) improved their loan disbursement rates. Some notable performers in TTTD by group include: CTG among state-owned JCBs; SHB and VPB among large private JCBs; EIB and MSB among medium-sized private JCBs; and NVB, KLB, and PGB among small private JCBs.

Chart 2: Credit Growth of Banks

Source: FiinproX, Banks, KIS Research

In 2025, the State Bank of Vietnam (SBV) set a TTTD target of 16%, the highest in seven years. The government’s push for increased public investment and support for select industries will contribute to higher credit demand and stimulate the economy in the coming quarters. In Q1 2025, credit outstanding reached VND 500,000 billion, equivalent to 3% of total loans, with preferential interest rates for infrastructure and technology sectors, boosting credit growth.

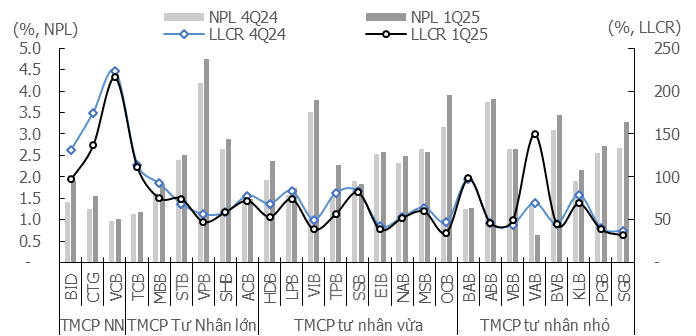

Net Interest Margin (NIM) Dipped in Q1 2025

Compared to the previous year, NIM in Q1 2025 declined due to lower asset yields, while funding costs remained low, thanks to stable deposit rates across the industry. KIS Securities attributes the stagnant asset yield to: (1) pressure to lower lending rates to support the economy, (2) intense competition among banks, and (3) the slow recovery of medium- and long-term lending, which typically offers higher yields. NIM decreased for most banks, with 21/27 banks reporting lower NIM in Q1 2025, including state-owned banks, lenders specializing in corporate lending (such as MBB, TCB, SHB, HDB, LPB, SSB, MSB, OCB), and those focusing on consumer lending (like ACB, VPB, STB, VIB, TPB).

Chart 3: Net Interest Margin of Banks

Source: FiinproX, Banks, KIS Research

Non-Performing Loans (NPLs) Increased Again in Q1 2025

Chart 4: NPLs and NPL Ratios of Banks

Source: FiinproX, Banks, KIS Research

Note: NPL: Non-Performing Loan Ratio, LLCR: Loan Loss Coverage Ratio

Compared to the previous quarter, the NPL ratio increased, with 20/27 banks reporting higher NPLs. The increase was mainly driven by a rise in Group 3 (substandard) and Group 5 (doubtful) loans. The lack of improvement in credit quality is also reflected in: 1) loan write-off ratios remaining unchanged year-over-year, and 2) a decline in loan loss provisions, which are still considered thin relative to the high NPL ratio. Going forward, the legalization of Resolution No. 42/2017/QH14 is expected to positively impact the speedy handling and recovery of NPLs, enhancing banks’ operational efficiency and profitability. Banks with low NPL ratios in the industry include VAB, VCB, TCB, BAB, and ACB.

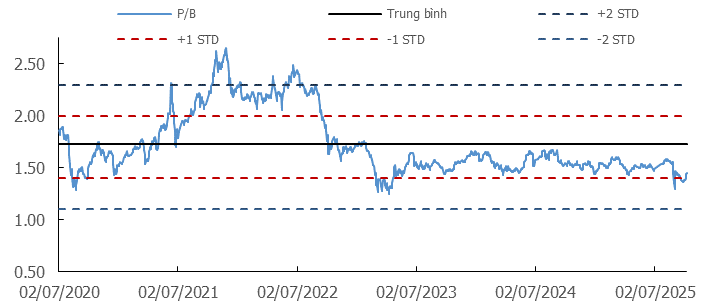

Maintain Moderate Profit Growth in Q2 2025 and Attractive Sector Valuation for Long-Term Accumulation

Credit demand in Q2 2025 is expected to remain robust. The SBV has set an ambitious credit growth target of 16% for the entire banking system in 2025, the highest in seven years. However, adverse developments in global tariff policies could impact credit demand and growth targets. Declining asset yields may disrupt the NIM recovery trajectory in Q2. NIM for 2025 is projected to remain stable in the base case scenario and decline slightly in the adverse scenario. Credit risk provisions may increase due to additional allowances for bad debts, given the persistently high NPL ratio.

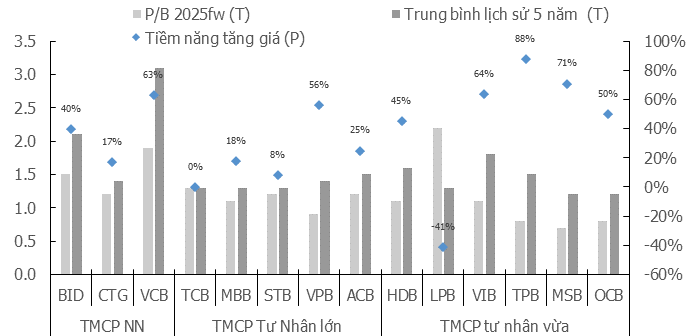

The banking sector currently trades at a P/B of 1.45x, below its five-year historical average of 1.73x, making it an attractive sector for long-term investment accumulation. KIS Securities favors private JCBs with strong profit growth and attractive valuations.

Risks: Slower-than-expected economic recovery, adverse tariff policy changes, a sharp rebound in NPLs, and shifts in monetary policy pose potential risks to the sector’s growth outlook.

Chart 5: Sector P/B Valuation

Source: FiinproX, KIS Research

Note: Data as of May 16, 2025

Chart 6: P/B Valuation of Banks

Source: Bloomberg, KIS Research

Note: Data as of May 16, 2025

The Tech, Steel, Retail, Banking, and Industrial Real Estate Sectors: Unlocking Post-Tariff Growth Potential

Most listed companies reported stable financial results in Q1, but signs of a slowdown are starting to show.

Are Bank Stocks “Exhausted” After Leading the VN-Index Past the 1,300-Point Mark Last Week?

The banking sector has witnessed a stellar performance in the past week, with bank stocks surging ahead. Despite this recent rally, the industry’s valuation remains attractive for long-term investors. With a current price-to-book (P/B) ratio of 1.37x, the sector is trading below its five-year average of 1.73x, presenting a compelling opportunity for those seeking sustainable returns.

Maximizing Your Marketing Potential: Crafting Compelling Copy for a Competitive Edge

After a recent audit, DDG reported a net loss of over VND 63 billion in 2024, attributed to provisions for bad debt and a decrease in financial revenue. Despite a surprising surge in the stock’s price during the May 16th session, DDG’s share price remains lower than a cup of iced tea.

The End of Easy Profits: What’s Next for Banks to Sustain Profitability?

In the first quarter, banks navigated a challenging environment marked by a continuing compression in net interest margins (NIM). Lending rates were lowered to support the economy, while funding costs remained relatively high to attract deposits. This squeeze on interest rate margins impacted the core income stream from credit activities, directly affecting the bottom line of banking institutions.