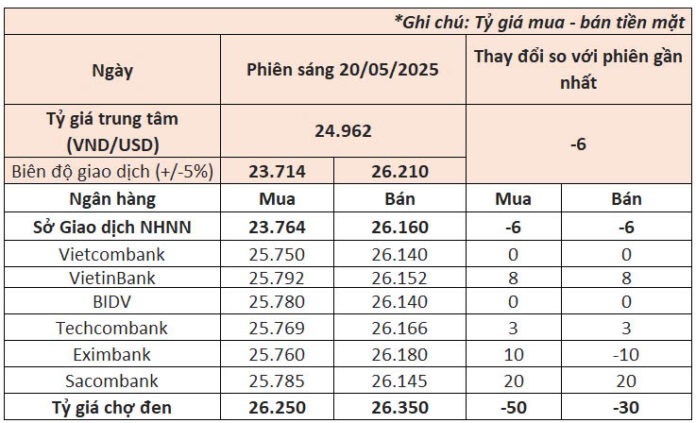

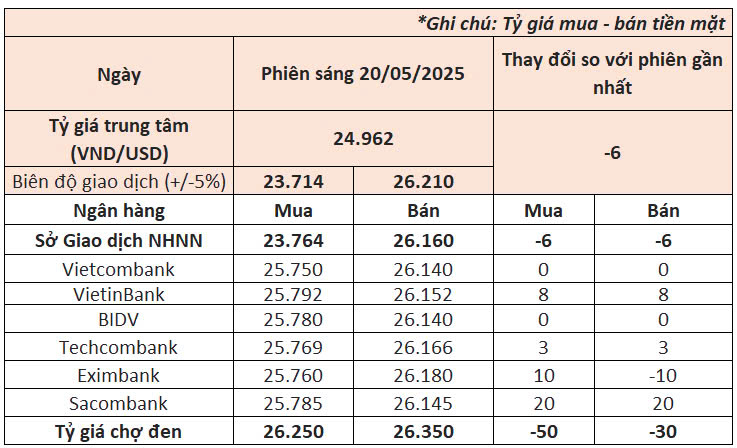

The State Bank of Vietnam devalued the daily reference exchange rate by six dong to VND 24,962 per dollar on May 21, marking the second consecutive day of devaluation since the beginning of the week.

With a band of 5%, the exchange rate ceiling and floor are now VND 23,714 and VND 26,210 per dollar, respectively.

State Bank of Vietnam’s trading arm also lowered its buying and selling rates by the same margin to VND 23,764-26,160 per dollar.

Commercial banks saw a slight upward trend in their dollar rates.

Vietcombank, the country’s largest lender by foreign currency turnover, kept its rates unchanged from the previous day at VND 25,750-26,140 per dollar as of 9 am.

BIDV also maintained its dollar rates, while VietinBank raised its buying and selling rates by eight dong each.

In the private sector, Techcombank increased its buying and selling rates by three dong each. Eximbank raised its buying rate by 10 dong while reducing its selling rate by the same amount. Sacombank, on the other hand, increased its buying and selling rates by 20 dong each.

The interbank exchange rate closed at VND 25,968 per dollar on May 20, marking a further increase of 23 dong compared to the previous session.

In a related development, the State Treasury of Vietnam (STV) announced on May 20 its intention to purchase foreign currency from commercial banks, with a maximum volume of 100 million USD.

Since the beginning of the year, STV has made nine such purchases, totaling nearly 1.6 billion USD. The purchases made from March to May were particularly significant, ranging from 100 to 300 million USD each.

In the free market, the dollar retreated after surging on the previous day. As of 9 am, it was traded at VND 26,250-26,350 per dollar, with the buying and selling prices decreasing by 50 dong and 30 dong, respectively, compared to the previous day.

Internationally, the US Dollar Index (DXY), which measures the greenback’s strength against other major currencies, fell sharply to 99.7 points.

The dollar weakened in the previous session following negative economic news from the US.

Fed officials on Tuesday reiterated their concerns about the impact of the Trump administration’s trade policies on the US economy. St. Louis Fed President Alberto Musalem stated that while trade tensions between the US and China have eased recently, the labor market appears to be weakening and prices are rising.

The greenback also faced pressure as President Donald Trump failed to convince House Republicans to support his sweeping tax legislation. Trump met with Republican lawmakers on Wednesday to pressure them into backing the bill.

Earlier, the dollar had come under pressure as the US government’s credit rating was downgraded and trade tensions escalated.

On May 16, Moody’s downgraded the US rating from the highest level of Aaa to Aa1. According to Macquarie analysts, Moody’s downgrade further weakens the dollar, which is already suffering from policy uncertainty and the erosion of economic norms that affect global confidence.

On the trade front, US Treasury Secretary Scott Bessent stated in television interviews on Sunday that President Donald Trump would impose tariffs at the levels he had threatened last month on trading partners who are not negotiating in good faith.

The Dollar and Gold Prices Plummet: May 15th’s Market Shockwave

The morning witnessed a unanimous drop in USD exchange rates across banks, with fluctuations more pronounced than previous sessions. Domestic gold prices also took a hit, plunging by 2 to 2.5 million VND per tael.

“May 14th: Central Bank Keeps USD Exchange Rate at Peak, Significant Differences in Gold Ring Prices Across Brands”

The USD exchange rates at banks witnessed a mixed trend as the SBV kept the daily reference rate unchanged at 24,973 VND/USD. Domestic gold bar prices witnessed a slight dip on Thursday morning, while gold ring prices showed a significant variation across brands.