According to VietstockFinance, the combined revenue of 29 warehouse and port enterprises (listed on HOSE, HNX, and UPCoM) in Q1/2025 reached nearly VND 9,600 billion, up 27% over the same period. However, the industry’s net profit decreased slightly by 6.1%, mainly due to the impact of abnormal factors of some enterprises.

Many ports hit new peaks

In the North, Doan Xa Port (HNX: DXP) stood out with revenue more than triple that of Q1 last year, reaching VND 86 billion. Besides a sudden income of VND 50 billion from the sale of goods (most likely asphalt), the 74% increase in port service revenue was the main driver of the 168% surge in business results, the highest in many years.

Similarly, Cai Lan Port Investment (UPCoM: CPI), a member of VIMC, also had a prosperous quarter with an over 83% increase in revenue to more than VND 18.3 billion, of which the port service segment alone increased by 27%. CPI‘s profit hit a record high since Q4/2022.

In the Central region, Cam Ranh Port (HNX: CCR) and Danang Port (HNX: CDN) benefited from the increasing cargo volume passing through the port. CCR reported a profit of VND 5 billion, up 32%, the highest in three years, while CDN set a new record.

In the Southern region, Dong Nai Port (HOSE: PDN) made an impression with a 13% increase in revenue to over VND 354 billion, with container and general cargo volumes increasing by nearly 14% and over 7%, respectively. PDN‘s gross profit margin remained at 40%, helping the company set a new record in business efficiency this quarter.

Vip Green Port (UPCoM: VGR) – a member of Container Vietnam – recorded the highest-ever profit thanks to the application of new price lists and insurance compensation for damages caused by Typhoon Yagi.

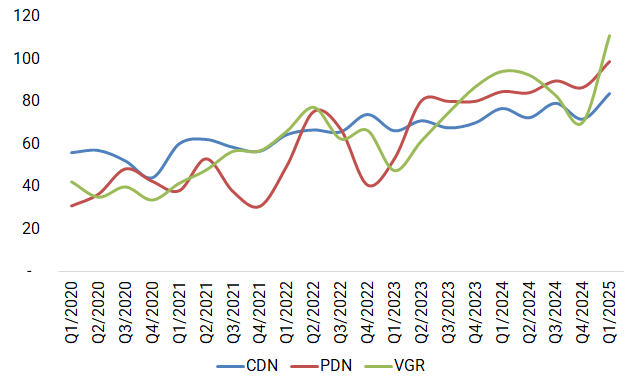

|

Net profit of CDN, PDN, and VGR hit new highs in Q1/2025 (Unit: VND billion)

Source: Author’s compilation

|

Increasing cargo volume and improving profit margins

The ports belonging to Tan Cang Saigon Corporation, such as ILB, TCL, and IST, all had stable growth in Q1. ICD Tan Cang – Long Binh (HOSE: ILB) promoted the exploitation of warehouses, with an occupancy rate increase of over 18%, pushing the gross profit margin up to 45%, positively contributing to the overall results.

The “giant” Gemadept (HOSE: GMD) no longer enjoys the advantage of financial income as in the previous year, but its core business still shows potential. Port operation revenue increased by 27% to VND 1,270 billion, along with profits from associated companies – mainly from Gemalink Port – continued to increase. GMD‘s profit of VND 403 billion is also at the highest level ever, excluding abnormal income.

Saigon Port (UPCoM: SGP) broke through when profits from joint ventures such as SP-PSA International Port and SSIT contributed nearly VND 50 billion, doubling its profit to VND 110 billion.

The increasing cargo volume led to a 14% and 18% improvement in revenue and profit for Southern Waterway Transport Joint Stock Company (Sowatco, UPCoM: SWC), respectively. Accordingly, the parent company Southern Transport and Warehousing Joint Stock Company (Sotrans, HOSE: STG) also welcomed favorable results.

Vietnam Container Shipping Joint Stock Corporation (Viconship, HOSE: VSC) was no exception, with revenue and net profit increasing by 16% and 80%, respectively, thanks to its subsidiaries such as Green Port, Vip Green Port (VGR), and Nam Hai Dinh Vu Port continuously improving their cargo volume.

Hai Phong Port (UPCoM: PHP) improved its gross profit margin from 38% to 43%, although revenue and profit remained almost unchanged.

|

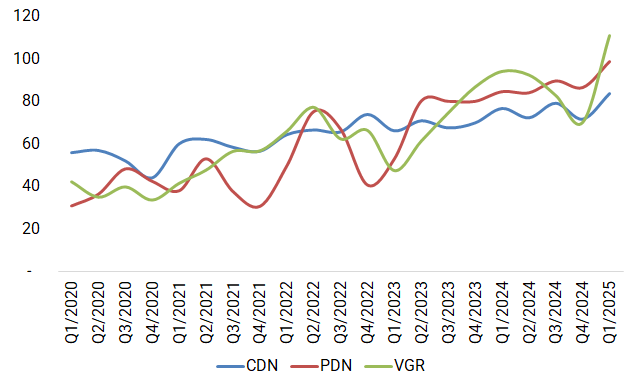

Most warehouse and port enterprises reported higher profits compared to the same period (Unit: VND billion)

Source: Author’s compilation

|

Exceptions to the overall positive picture

Although most port and warehouse businesses had a bustling Q1, there were still some dark spots as some enterprises faced the dual pressure of decreasing cargo volume and rising costs.

Quy Nhon Port (HOSE: QNP) and Nghe Tinh Port (HNX: NAP) are typical examples where the decrease in cargo volume through the port led to a decline in both revenue and profit. An Giang Port (HNX: CAG), a subsidiary of SCIC, continued to incur losses in the third consecutive quarter due to persistently low revenue.

Meanwhile, Phuoc An Port Investment and Exploitation of Petroleum (UPCoM: PAP) suffered a heavy loss of VND 123 billion as it could not offset operating expenses, despite recognizing revenue from the operation of the first phase of Phuoc An Port, bringing the accumulated loss to nearly VND 154 billion by the end of March.

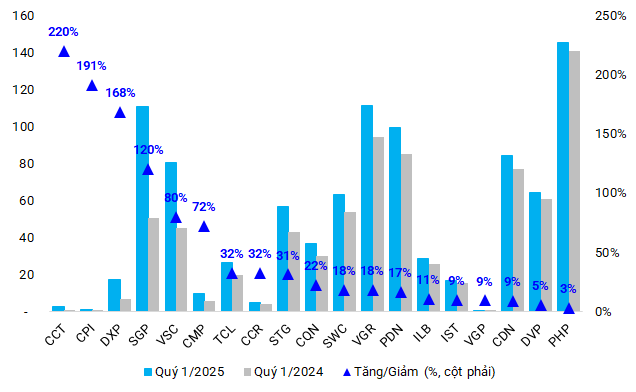

|

A few companies reported lower profits or continued losses (Unit: VND billion)

Source: Author’s compilation

|

Risks still lurk after the initial growth?

Despite the positive start in Q1/2025, with increasing cargo volume and record profits for many enterprises, the warehouse and port industry still faces potential risks from trade tensions and the US tax policy.

The decision of the Trump administration to postpone the imposition of retaliatory tariffs for 90 days is considered a “golden opportunity” for exporting enterprises to promote the shipment of goods. This is expected to continue supporting growth in Q2. However, if the scenario of a 46% tax imposition officially takes place after the grace period, negative impacts on cargo volume and business performance are inevitable.

At the 2025 Annual General Meeting of Shareholders, CEO of Sowatco, Dang Vu Thanh, warned that in the worst-case scenario, the company’s revenue and profit plan could decrease by up to 30% due to its high dependence on exports to the US (accounting for 75-80% at Long Binh Port and nearly 50% at Sotrans ICD). If this happens, the impact will extend to its parent company, Sotrans.

Gemadept also acknowledged that the tariffs would affect their business operations, although the extent remains to be monitored. However, according to CEO Nguyen Thanh Binh, the company is taking advantage of the “golden period” in the first half of the year to boost exports, with an estimate of completing 55-60% of the year’s plan within the first six months.

Meanwhile, some enterprises, such as Viconship, are less concerned, as the proportion of exports to the US accounts for less than 4% of the total cargo volume passing through the port.

– 08:19 24/05/2025

The Housing Bubble: A Ticking Time Bomb?

The Vietnamese real estate sector’s inventory picture as of Q1 2025 paints a telling tale, with a staggering figure of over VND 511 trillion, marking a 2% increase since the year’s outset. Notably, nearly a third of this substantial sum is attributable to Novaland, underscoring the significant role it plays in the country’s property landscape.

“The Ambition of Thien Long Group: Eyeing Phuong Nam Bookstore Chain”

The subsidiary of the Thien Long Group is set to acquire nearly 8.3 million PNC shares, equivalent to 76.81% of Van Hoa Phuong Nam’s charter capital.