Add this subsidiary to the company list

Kinh Bac Urban Development Corporation (stock code: KBC) has just approved an investment of VND 110 billion in Hung Vuong University in Ho Chi Minh City to acquire a 51.79% stake, making it a subsidiary.

KBC will invest VND 110 billion in Hung Vuong University in Ho Chi Minh City to acquire a 51.79% stake.

Prior to this, Mr. Dang Thanh Tam, Chairman of KBC’s Board of Directors, had long-standing connections with Hung Vuong University.

In August 2011, the Ho Chi Minh City People’s Committee decided to inspect Hung Vuong University comprehensively. In early 2012, Mr. Tam was temporarily suspended from his position as Chairman of the University’s Board of Directors, and Mr. Le Van Ly was temporarily suspended as Rector. Also, in the same year, the Ministry of Education and Training decided to stop enrolling students at the university.

Apart from Hung Vuong University, as of March 31, KBC had dozens of subsidiaries and associated companies. KBC had 229 employees, an increase of 3 people compared to the end of 2024.

In the first quarter of this year, KBC recorded revenue of over VND 3,116 billion (nearly 20 times higher than the same period last year) and after-tax profit of VND 849 billion, compared to a loss of over VND 76 billion in the same period last year (an increase of nearly VND 926 billion compared to the same period).

In the first quarter, KBC recorded a main business cash flow of over VND 7,272 billion negative.

In the first quarter, KBC recorded a negative main business cash flow of over VND 7,272 billion, compared to a positive cash flow of VND 5,143 billion in the same period last year. In addition, the investment cash flow was negative VND 122 billion, and the financial cash flow was positive VND 7,409 billion, mainly due to increased borrowing to make up for the business cash flow deficit.

Fertile Ground

Apart from KBC, numerous corporations and private companies have heavily invested in education, considering it a fertile ground as it is less affected by economic crises.

In the South, the Nguyen Hoang Group consecutively spent thousands of billions of dong to acquire universities. Specifically, in 2015, Nguyen Hoang acquired the Hong Bang International University. The market rumored the price to be around VND 600-700 billion. In 2016, Nguyen Hoang bought Ba Ria-Vung Tau University. Then, in 2018, they completed the purchase of Gia Dinh University.

Nguyen Hoang Group’s most significant acquisition was buying a majority stake in Hoa Sen University for over a thousand billion dong. In 2020, the group continued to acquire Dong Nai’s Dong Nai University of Technology.

Hong Bang International University was acquired by Nguyen Hoang Group in 2015.

Similarly, Hung Hau Group also has a system with several educational institutions, including Van Hien University and many colleges and intermediate schools.

Meanwhile, Thanh Thanh Cong Group holds a controlling stake in Yersin Da Lat University, Sonadezi Technology and Administration College in Dong Nai, and dozens of kindergartens, elementary schools, secondary schools, and high schools.

However, the most successful deal must be mentioned is the purchase of the Ho Chi Minh City University of Economics and Finance by Hutech Education Development Investment Joint Stock Company for over VND 100 billion. Hutech is also believed to own the Ho Chi Minh City University of Technology.

Van Lang University is owned by Van Lang Education Corporation.

Van Lang Education Corporation, an enterprise in the ecosystem of “tycoon” Nguyen Cao Tri, also acquired Binh Duong University of Economics and Technology. The corporation is also known to own Van Lang University in Ho Chi Minh City. FPT Corporation owns 100% of FPT University and a system of colleges and schools from elementary to high school.

Billion-dollar Revenue

The 2022 public reports of the schools showed that the education sector brings in billions of dollars in revenue for the universities. Specifically, there were nine universities in the country with revenues in the thousands of billions of VND, an increase of four schools compared to 2020, according to the Ministry of Education and Training.

Among these nine educational institutions, Van Lang University had the highest total revenue of VND 1,758 billion. This was followed by the University of Economics Ho Chi Minh City with more than VND 1,443 billion. FPT University achieved nearly VND 1,300 billion. Nguyen Tat Thanh University reached VND 1,163 billion. Ho Chi Minh City University of Technology reached VND 1,145 billion…

Many schools also had revenues close to a thousand billion dong, such as Hoa Sen University (over VND 918 billion), Hong Bang International University (VND 886 billion), Ho Chi Minh City University of Technical Education (VND 785 billion), Hanoi University of Industry (over VND 751 billion), etc.

Nguyen Tat Thanh University achieved revenue of VND 1,476 billion in 2023.

By 2023, FPT University led in total revenue with nearly VND 2,920 billion, an increase of 125% compared to 2021. This was followed by Van Lang University with VND 2,286 billion. The third place was the Hanoi University of Science and Technology with VND 2,137 billion.

The top revenue-generating universities in 2023 also included Nguyen Tat Thanh University (VND 1,476 billion), the National Economics University (VND 1,410 billion), the Ho Chi Minh City University of Technology (VND 1,260 billion), Ton Duc Thang University (VND 1,141 billion), and the Ho Chi Minh City University of Industry (VND 1,010 billion).

Hoa Sen University had a revenue of VND 870 billion per year, of which tuition fees accounted for VND 743 billion. The Foreign Trade University had a revenue of over VND 763 billion, including tuition fees of over VND 527 billion. The Ho Chi Minh City University of Economics and Finance had a revenue of VND 557 billion.

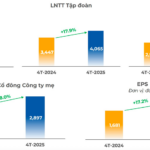

The Unstoppable Growth of FPT: Breaking Through with a 20% Surge

In the first four months of the year, the company’s net profit after tax attributable to shareholders (net profit) rose 18% to VND 2,897 billion.

“Maritime Enterprise Sets Sail with a June Dividend: A Whopping 4,000 VND Per Share”

With 40 million shares outstanding, Dinh Vu Port will dish out VND160 billion in dividend payments to its shareholders.

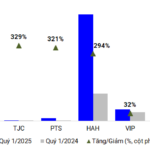

The Ocean Freight Industry: A Slow Start to Q1

The maritime transport industry witnessed a mixed performance in 2025, following two positive quarters in the latter half of 2024. While total revenues experienced a slight uptick, profits for many businesses took a hit due to extended Lunar New Year holidays, a weakened international market, and elevated repair and depreciation costs.