20 out of 28 banks experience a drop in CASA

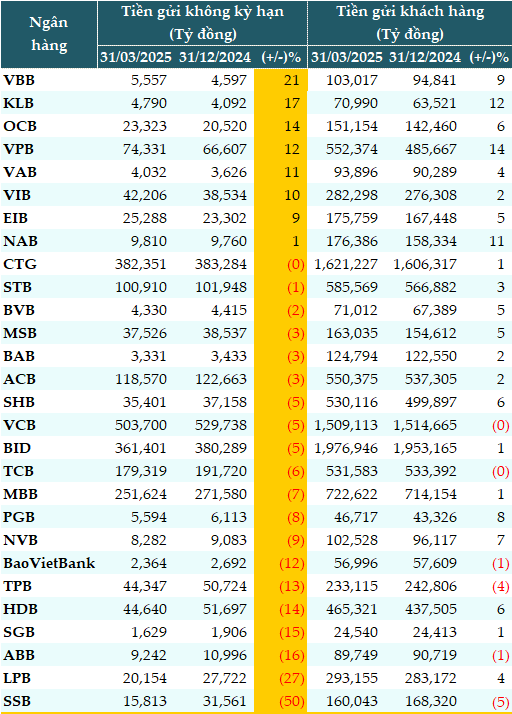

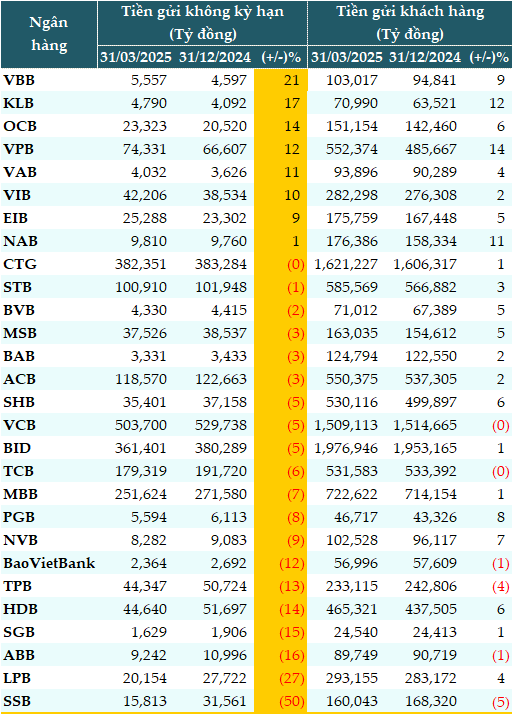

According to data from VietstockFinance, as of March 31, 2025, the total customer deposits at 28 banks reached nearly VND 11.5 quadrillion, up 2% from the beginning of the year. Of this, the total non-term deposits (CASA) were nearly VND 2.32 quadrillion, down 4% from the beginning of the year.

20 out of 27 banks saw a decrease in CASA compared to the beginning of the year, with SeABank (SSB) experiencing the largest decline (-50%), followed by LPBank (LPB, -27%), and ABBank (ABB, -16%)…

On the other hand, banks that recorded positive growth in CASA include Vietbank (VBB, +21%), KienlongBank (KLB, +17%), OCB (+14%), and VPBank (VPB, +12%) with an average growth rate of 12%.

In absolute terms, state-owned banks still hold the highest CASA, despite a decline compared to the beginning of the year. Vietcombank (VCB) decreased by 5%, reaching VND 503,700 billion; VietinBank (CTG) slightly dropped by 0.2%, to VND 382,351 billion; BIDV (BID) witnessed a 5% decline, amounting to VND 361,401 billion.

MB (MBB) maintained its leading position among private banks with VND 251,624 billion, despite a 7% decrease. This was followed by Techcombank (TCB), which experienced a 6% drop to VND 179,319 billion, ACB with a 3% fall to VND 118,570 billion, and Sacombank (STB), which saw a 1% decline to VND 100,910 billion.

|

CASA of banks as of March 31, 2025

Source: VietstockFinance

|

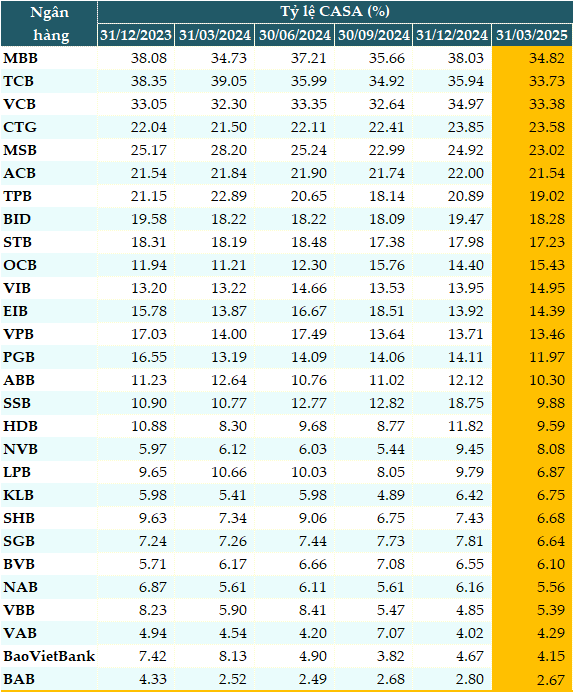

As of the end of the first quarter of 2025, 22 out of 28 banks witnessed a decrease in their CASA ratio compared to the beginning of the year. MBB led the industry with a CASA ratio of 34.82%, despite a slight decline. This was followed by TCB at 33.73%, VCB at 33.38%, and CTG at 23.58%.

Conversely, some banks achieved growth in their CASA ratio, including OCB, VIB, Vietbank, and Eximbank…

|

CASA ratio of banks at the end of Q1/2025

Source: VietstockFinance

|

Where is the cheap capital flowing?

The decline in the CASA ratio across 22 out of 28 commercial banks, including several large banks renowned for their digitalization and non-term fund-raising capabilities, indicates a noticeable withdrawal of cheap capital – the “lifeblood of profits” for some banks.

Beyond being a mere financial indicator, the decrease in the CASA ratio also signifies a shift in market sentiment and money flow, reflecting the strategies of individual and corporate customers, as well as the expectations of investors regarding the economy, interest rates, and profit opportunities.

Mr.

Funds may have been redirected to speculative channels such as gold, securities, and real estate. In the first months of the year, domestic and global gold prices repeatedly reached new peaks, attracting individual and institutional money as a haven and speculative investment.

The fear of missing out (FOMO) was prevalent in the stock market, especially with speculative stocks, leading many investors to withdraw idle money from banks in search of higher short-term returns.

Meanwhile, despite not fully recovering, some segments of the real estate market, such as land, peripheral areas, and shophouses, are attracting money again through short-term “deals” that typically use cash or flexible payment accounts.

It is evident that money is being “restructured” towards channels with higher expected returns.

Additionally, a significant portion of depositors are optimizing their assets by shifting from non-term to short-term deposits with higher interest rates, especially as there are signs of a slight recovery in the base lending rate. Businesses are also increasing their use of working capital for production and business activities during the recovery cycle, reducing the amount of “idle” money in their accounts.

Strategy to Reconquer CASA – Retaining Money in Banks

To restore and improve their CASA ratios in the context of fierce competition for funds, banks need to adopt a comprehensive strategy.

Firstly, restructure the bank to become a financial transaction center, not just a place for deposits. Enhance instant payment, transfer, salary payment, and periodic payment services, connect with e-wallets, and provide customers with reasons to keep their money in their accounts for longer. Develop interest-bearing transaction accounts and integrate flexible investment and savings options directly within the banking app.

Secondly, banks should build a multidimensional digital ecosystem. Connect banking with e-commerce, insurance, ride-hailing, dining, entertainment, and healthcare to create a closed-loop spending ecosystem that keeps money within the banking system. Embrace the “banking-as-a-platform” model to prevent users from withdrawing money from the banking ecosystem for their daily needs.

Thirdly, enhance digital experiences and personalized AI. Analyze transaction behavior to personalize offers and provide tailored suggestions for spending, investing, and saving. Implement financial AI to help customers manage their finances, spend wisely, and automate financial decisions, keeping money in the bank instead of withdrawing it.

Finally, improve products and services for the SME business segment. Develop smart transaction account packages that integrate electronic invoices, accounting, and B2B payments. Establish real-time business cash flow management solutions that support cash flow forecasting and capital usage optimization.

CASA is not just an indicator but a measure of trust and the bank’s position in the profit, liquidity, and market confidence race. A decline in CASA is not merely a loss of non-term deposits but a stark reminder that banks must adapt to a dynamic financial market with higher yield expectations. It entails transforming the operating model from “borrowing-lending” to a “smart financial services center.” Building a vibrant, versatile, and experience-rich ecosystem is key to retaining money in the era of digitalization and volatility.

The bank that effectively manages CASA will be the master of the profit, liquidity, and market confidence game.

– 08:00 22/05/2025

The New Deposit Dash: VPBank, SHB, and HDBank Surge Ahead as Vietcombank, TPBank, and SeABank Stumble With Negative Growth

“Customer deposits at Vietcombank dipped by over VND 5.5 trillion in the first quarter of the year, following two consecutive booming quarters in 2024. TPBank and SeABank also went against the grain, witnessing decreases of nearly VND 9.7 trillion and VND 8.3 trillion, respectively. Conversely, VPBank experienced its strongest quarter ever in terms of attracting deposits.”

“The Big 7 of Vietnam’s Stock Market”: 4 Banks & 3 Vingroup Stocks with a Combined Market Cap of $81 Billion

The “MAG-7 Vietnamese Stocks” group holds a significant weightage, and their fluctuations greatly impact the VN-Index.