Joining hands and sharing with its shareholders, SHB pays dividends of 16% for 2023, of which 5% are paid in cash

|

Bank for Investment and Development of Vietnam Joint Stock Company (HOSE: SHB) has published documents for its 2024 annual general meeting of shareholders. The bank determines that this year is a pivotal year for transformation, enhancement of internal capacity and to continue on a path of sustainable and effective growth.

SHB has set a target of pre-tax profit of VND11,286 billion, an increase of 22%. The total assets are expected to reach VND701,000 billion, charter capital of VND40,658 billion, up nearly 12%; strictly controlling the bad debt ratio below 3%. SHB‘s target confirms a strong advance to scale up and meet the economy’s increasing demand for capital; actively increase competitiveness in the international integration process and meet the interests and expectations of shareholders.

In 2023, the world and domestic economic situation faced difficulties due to geopolitical instability, decreasing demand, high inflation, tightened monetary policy, etc. However, the bank still recorded positive results. Pre-tax profit reached VND9,239 billion. As of December 31, 2023, total assets reached VND630,501 billion, up 16%; charter capital was VND36,194 billion. Stable business efficiency, CIR ratio at 23.7% – notably, SHB is the bank with the best cost management in the market thanks to focusing on risk management, reducing costs, and regularly reviewing business mechanisms towards flexible adaptation.

Credit rating agency Moody’s maintains a B1 rating for SHB as an acknowledgement of the Bank’s safety and efficiency, demonstrating the Bank’s intrinsic strength and forming a platform for further breakthrough growth in the next phase.

“The Bank joins hands” with shareholders, customers, and the country.

At the general meeting, one of the important contents is that SHB proposed to its shareholders to pay a dividend of 16% for 2023, including 5% in cash and 11% in shares. The bank has maintained a policy of paying regular dividends to shareholders over the years, accompanying them during difficult times of the economy. This is also what creates shareholder trust and attachment to the bank.

This year, the plan to pay dividends partly in cash is the bank’s effort to share and support shareholders in the context that the economy is in recovery.

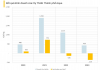

Besides, maintaining the payment of dividends partly in shares also helps the bank to continue to strengthen its charter capital foundation. Over the past 10 years, SHB‘s charter capital has increased by nearly 4 times and reached VND36,629 billion by early April.

Recently, SHB‘s Vice Chairman of the Board of Directors, Mr. Do Quang Vinh, registered to buy over 100.2 million SHB shares during the period from April 19 to May 17, expecting to increase his ownership to 101.1 million shares, equivalent to 2.79% of SHB‘s capital. If the transaction is successful, Mr. Vinh will be the one with the highest ownership rate of SHB ‘s shares in the bank’s Board of Directors. It is as an affirmation of the young leader’s journey of accompanying the bank, other shareholders, and confidence in SHB‘s future.

After the above information, SHB shares increased to the ceiling price in the trading session on April 15. However, the sharp decline of the overall market caused SHB shares to narrow their gains. At the end of the session, SHB shares were the only ones to remain green in the banking sector and the VN30 group, and were also among the top 10 stocks with the strongest increase in the market. Foreign investors also net bought over 2.7 million SHB shares in the session. The stock performance partly shows investors’ confidence in the bank’s leadership and SHB‘s ambitious plan.

Entering its 31st year of operation, SHB is heading towards a new development phase. In January 2024, the Board of Directors approved the Transformation Strategy for the period 2024-2028. Many policies will be deployed across all the bank’s operations, aiming for SHB to become a leading financial institution.

Inheriting a strong financial foundation and core values, combined with a mindset of innovation and creativity, SHB continues to conquer new heights, enthusiastically contributing to the country’s economy and the prosperity of the people.

Affirming its position as one of the top banks in the system in terms of charter capital and total assets, over the years SHB has always actively promoted the flow of capital to the economy through preferential credit programs for customers, especially for individuals and small and medium-sized enterprises (SME) with reasonable interest rates.

Throughout its three decades, SHB has been and is playing a good role as a capital channel for key sectors of the economy, funding production and business sectors encouraged for development by the Government and the State Bank of Vietnam (SBV).