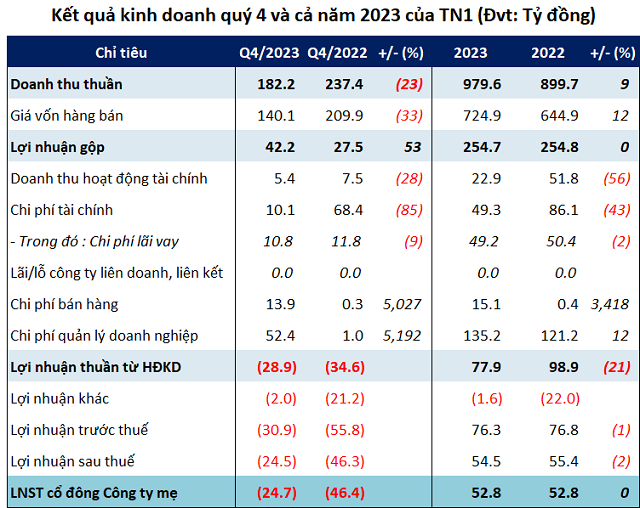

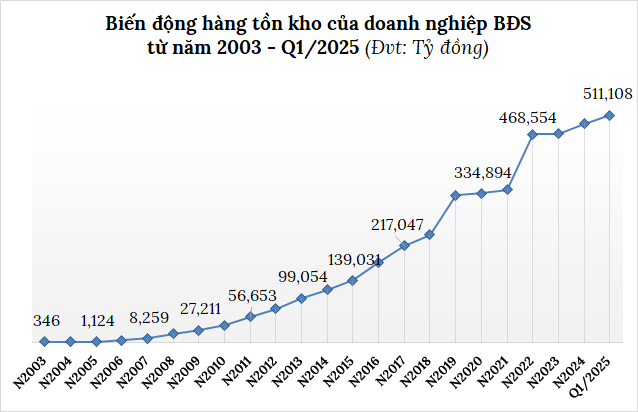

Inventory Levels Continue to Rise

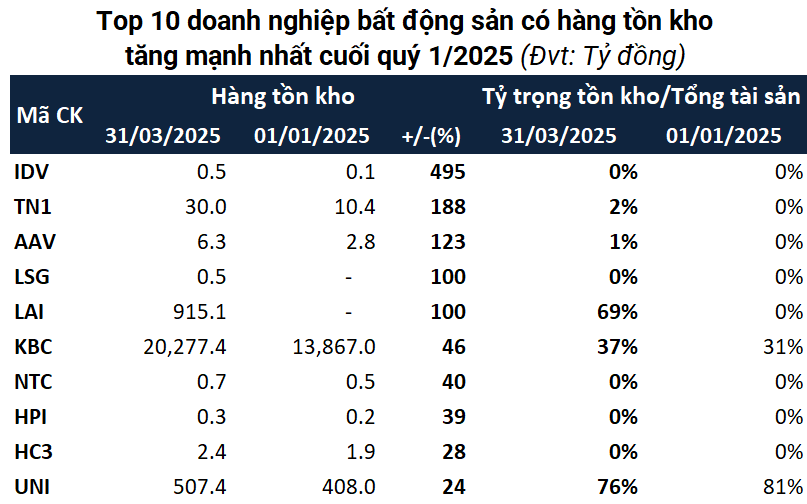

According to data from VietstockFinance, the latest financial statements from 104 companies (listed on HOSE, HNX, and UPCoM) in the real estate sector, including residential and industrial properties, show that inventory levels continued to climb to a record high of over VND 511.1 trillion as of Q1 2025, a 2% increase from the beginning of the year. Of these companies, 44 reported higher inventory levels, 26 remained unchanged, and 34 saw a decrease.

Source: VietstockFinance

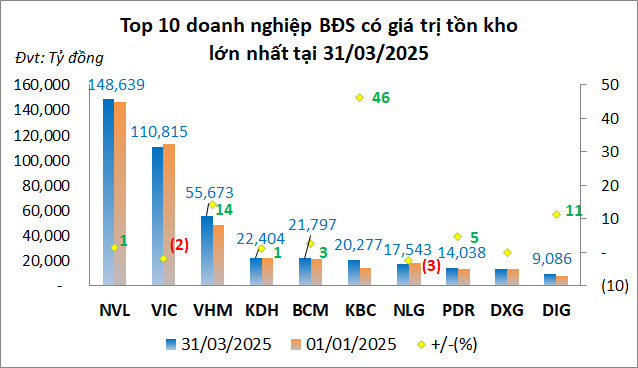

|

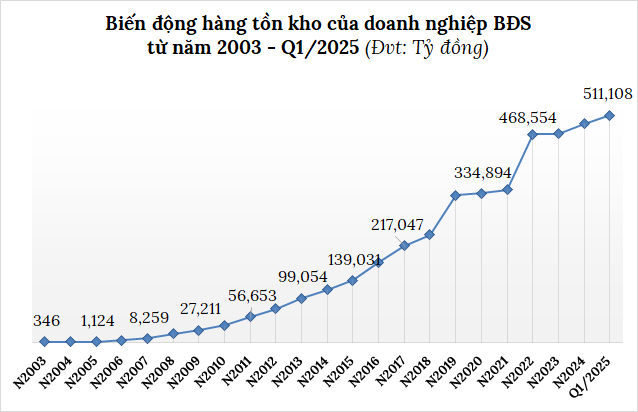

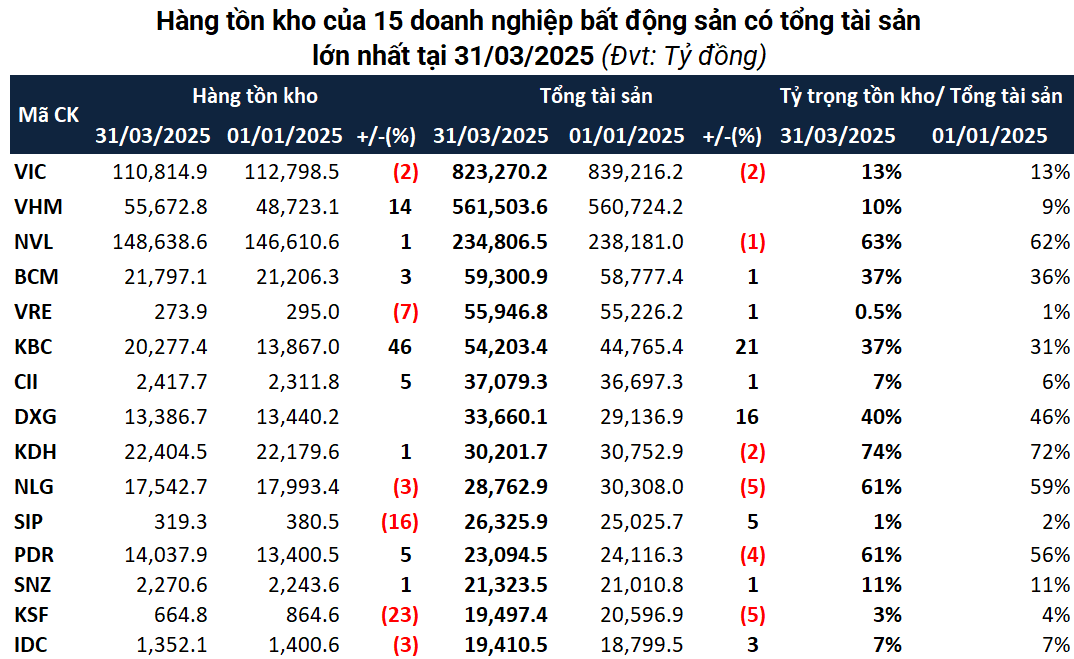

Novaland (HOSE: NVL) maintained its top position with inventory valued at more than VND 148.6 trillion, a 1% increase, accounting for nearly one-third of the entire industry. The majority of this comprises real estate under construction, totaling nearly VND 141 trillion, with completed products accounting for over VND 8 trillion. Compared to pre-COVID-19 levels, current inventory levels have surged by 2.6 times.

Source: VietstockFinance

|

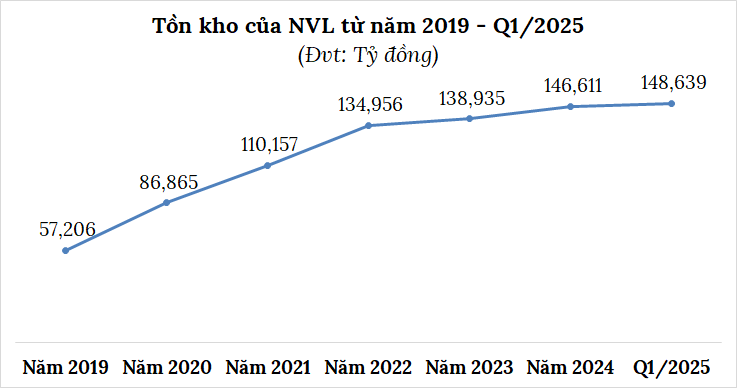

Vingroup (HOSE: VIC) followed closely with over VND 110.8 trillion in inventory, a 2% decrease from the start of the year. Approximately VND 66.8 trillion of this comprises real estate projects under construction, while the remaining comprises finished goods and products from the manufacturing segment, totaling over VND 15.5 trillion. Conversely, its subsidiary, Vinhomes (HOSE: VHM), witnessed a 14% increase in inventory, reaching over VND 55.6 trillion, mainly attributed to large-scale urban projects such as Vinhomes Ocean Park 2 and 3, Grand Park, Smart City, and other township projects.

In the industrial real estate sector, Becamex IDC (HOSE: BCM) took the lead with nearly VND 21.8 trillion in inventory, a 3% increase, largely consisting of infrastructure construction costs, land clearance expenses, and land use rights. Notably, Kinh Bac City Development Holding Corporation (HOSE: KBC) recorded a remarkable 46% surge in inventory, reaching nearly VND 20.3 trillion. This included the Trang Cat Township and Services project, which increased by 83% to nearly VND 15.5 trillion, the Phuc Ninh Township project with over VND 1,119 billion, the Tan Phu Trung Industrial Park and Residential Area project with nearly VND 989 billion, and the Nenh social housing project with approximately VND 569 billion.

Several other prominent companies with inventory levels exceeding VND 10 trillion include Nha Khang Dien (HOSE: KDH) with over VND 22.4 trillion, a 1% increase; Nam Long (HOSE: NLG) with more than VND 17.5 trillion, a 3% decrease; Phat Dat Real Estate (HOSE: PDR) with over VND 14 trillion, a 5% increase; and Dat Xanh Group (HOSE: DXG), which remained relatively stable compared to the beginning of the year, with inventory levels of nearly VND 13.4 trillion.

Source: VietstockFinance

|

When Inventory Dominates the Balance Sheet

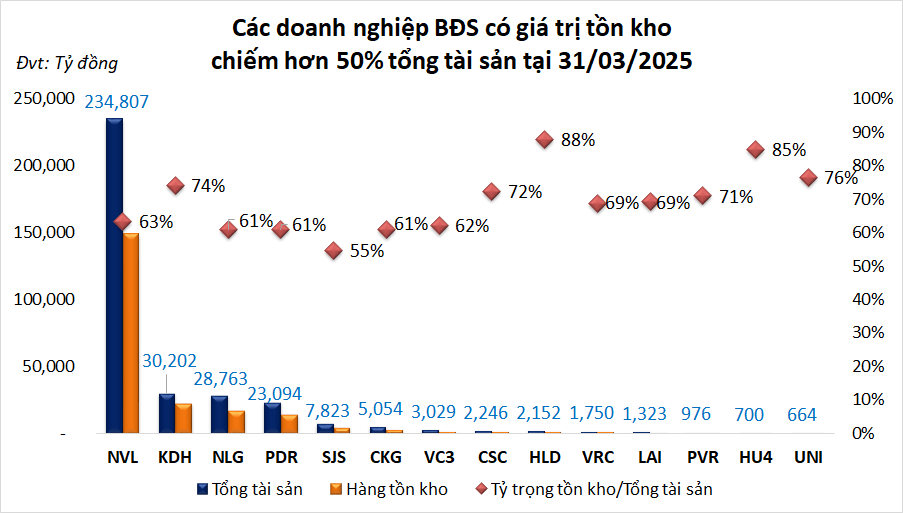

As of Q1 2025, 14 real estate enterprises had inventory levels accounting for over 50% of their total assets, predominantly from the residential real estate segment.

Topping this list is HUDLAND Real Estate (HNX: HLD), with inventory making up 88% of its total assets, valued at nearly VND 1.9 trillion, a 3% increase from the beginning of the year. Meanwhile, Construction and Investment HUD4 (UPCoM: HU4) reported inventory comprising 85% of its total assets, equivalent to nearly VND 600 billion, despite a slight 2% decrease. SJ Group (HOSE: SJS) also falls into this category, with nearly VND 4.3 trillion in inventory, representing 55% of its total assets, a slight increase from the start of the year.

Source: VietstockFinance

|

In terms of total assets, the big three—VIC, VHM, and NVL—accounted for nearly 62% of the entire industry, with inventory levels surpassing VND 315 trillion, a 2% increase from the beginning of the year. In the industrial real estate sector, BCM, KBC, and Sonadezi (UPCoM: SNZ) made up approximately 8% of the industry, with total inventory levels of nearly VND 42.4 trillion, a 20% increase from the start of the year.

Source: VietstockFinance

|

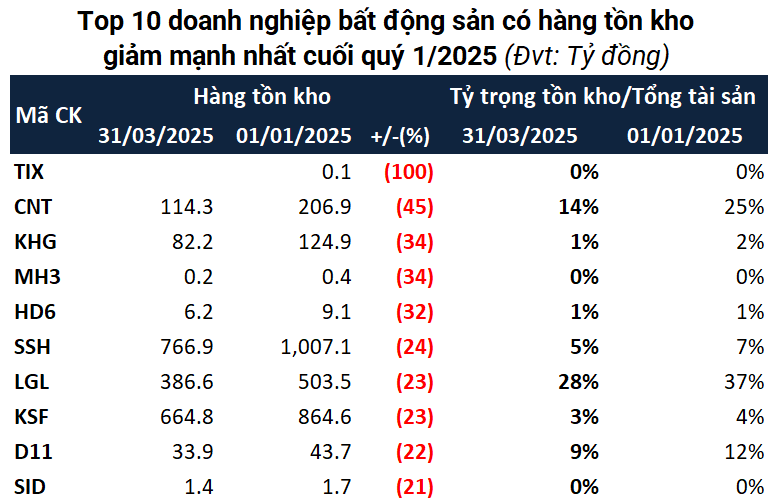

CNT Group (UPCoM: CNT) and Khai Hoan Land Group (HOSE: KHG) witnessed significant decreases in inventory levels, down 45% and 34%, respectively, to VND 114 billion and VND 82 billion.

Source: VietstockFinance

|

According to the Ministry of Construction, real estate inventory in Q1 2025 amounted to approximately 23,400 units/plots (including apartments, detached houses, and land plots). Land plots dominated with 11,685 plots, followed by apartments at 2,339 units—twice and two-and-a-half times higher than the previous quarter, respectively. Conversely, the number of detached houses decreased by 16% to 9,376 units.

These figures indicate that despite supportive policies and low-interest rates, market liquidity has not rebounded as expected. Inventory remains a significant challenge for investors, especially with the persistent financial pressures from loan obligations and development costs.

– 10:00 22/05/2025

The Giant Golden Turtle Back Exhibition Center: On Track to Break Global Records with an Unprecedented 10.5-Month Construction Sprint

The Vietnam National Exposition Center, a world-class exhibition center, is set to break records and become a new landmark in the capital city. With an ambitious timeline of just 10 months for the main exhibition hall and a total project completion time of 10.5 months, this project is a testament to the exceptional capabilities and reputation of Vingroup. This state-of-the-art facility, ranking among the top 10 globally, will not only be a magnificent addition to the city but will also revolutionize the construction industry, marking a significant milestone as the nation celebrates its 80th anniversary of independence.

“Novaland Seeks Shareholder Approval for Debt-for-Equity Swap with Major Investor”

“Novaland seeks shareholder approval for a proposed issuance of additional shares to facilitate a debt-for-equity swap, as requested by its major shareholder. This strategic move underscores Novaland’s commitment to exploring innovative avenues to enhance its financial standing and foster sustainable growth.”

Expert Opinion: Consider VN-Index’s Probability of “Giving Back Points”, Not an Attractive Price Region for Further Investment

The VN-Index is expected to fluctuate and consolidate around the 1,300-point level next week. This neutral scenario predicts a sideways movement for the index, which presents an opportunity for investors to assess their strategies and plan their next moves. With the market showing signs of uncertainty, a cautious approach is advised until a clearer trend emerges.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)