TN1 has just passed a resolution to contribute capital to establish Sojo Hotel Consulting and Management Joint Stock Company, headquartered at 54A Nguyen Chi Thanh, Lang Thuong Ward, Dong Da District, Hanoi. The new company has a charter capital of VND 100 billion, with TN1 contributing 99.95%. The expected capital contribution period is in the first and second quarter of 2024.

Ms. Nguyen Phan Thuy Anh is the authorized representative managing all capital contributions of TN1 at Sojo Hotel.

With the capital contribution to establish Sojo Hotel, TN1 now has a total of 6 subsidiary companies.

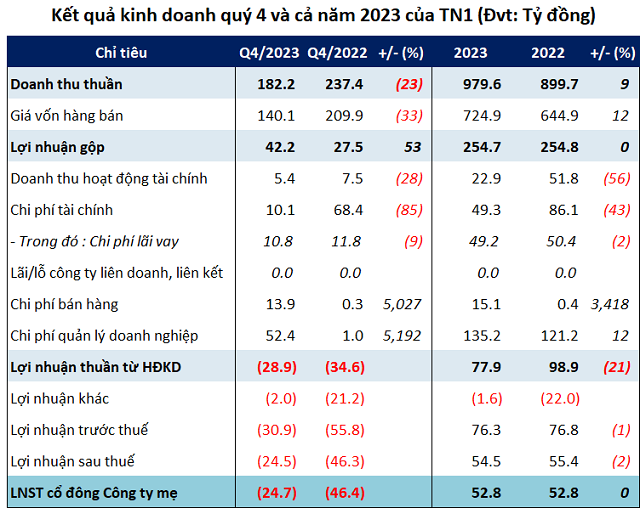

In terms of business results, despite a loss of nearly VND 25 billion in the fourth quarter of 2023 (compared to a loss of over VND 46 billion in the same period), TN1 achieved a net profit of nearly VND 53 billion for the whole year 2023, remaining stable compared to 2022.

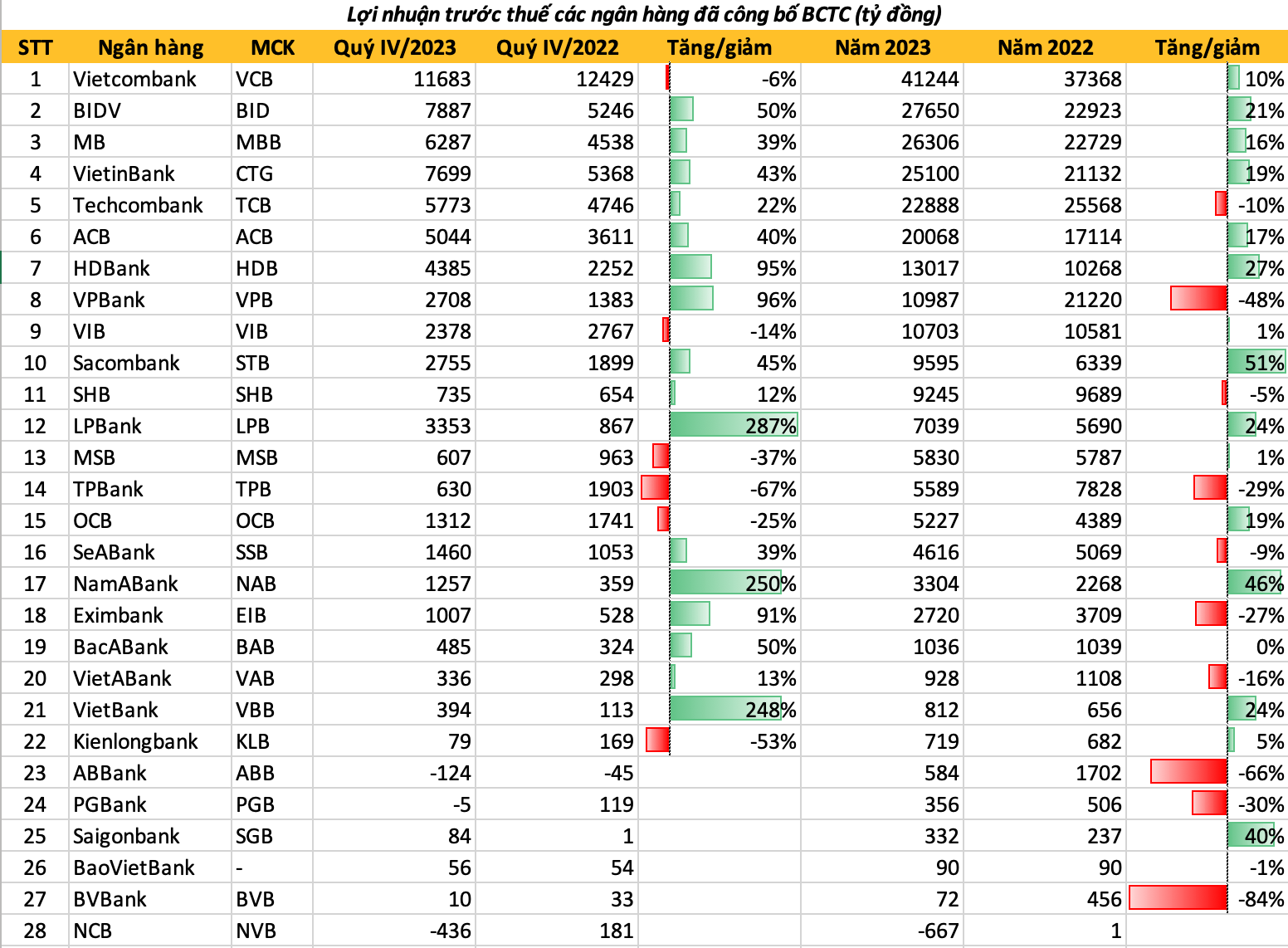

Source: VietstockFinance

|

Regarding the business results for the fourth quarter, TN1 stated that in 2023, the operating revenue was affected by the loss of one project, and some projects were delayed and could not be handed over within the period.

In addition, the selling expenses and business management expenses increased significantly due to subsidiary companies accounting for expenses related to office rent, organizing customer appreciation conferences, seeking new customers, and prepaying salary and bonus expenses based on the revenue completion rate per quarter, resulting in a decrease in the Company’s profit.

As of December 31, 2023, TN1 reported total assets of VND 1,689 billion, unchanged compared to the beginning of the year. Among which, the majority are short-term assets with over VND 1,411 billion, accounting for 84% of total assets, a decrease of 5%. The remaining inventory is VND 130 billion, and the equivalent cash is VND 263 billion, decreasing by 8% and 14% respectively.

On the liabilities side, TN1 has a total debt of VND 766 billion to be paid. In which, the total borrowing and financial lease liabilities are nearly VND 498 billion, accounting for 65% of the total liabilities and 29% of TN1‘s source of funds.

As of the end of 2023, TN1 had a total of 2,161 employees, a decrease of 117 personnel compared to the beginning of the year.