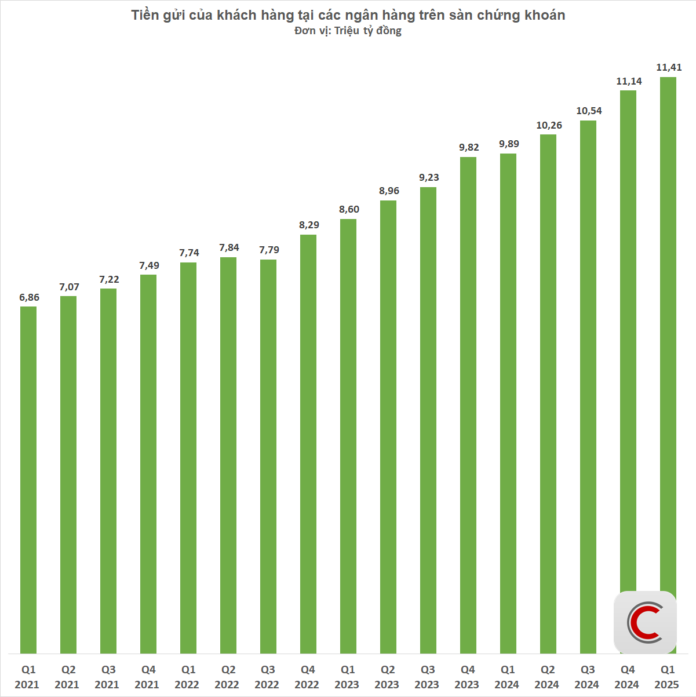

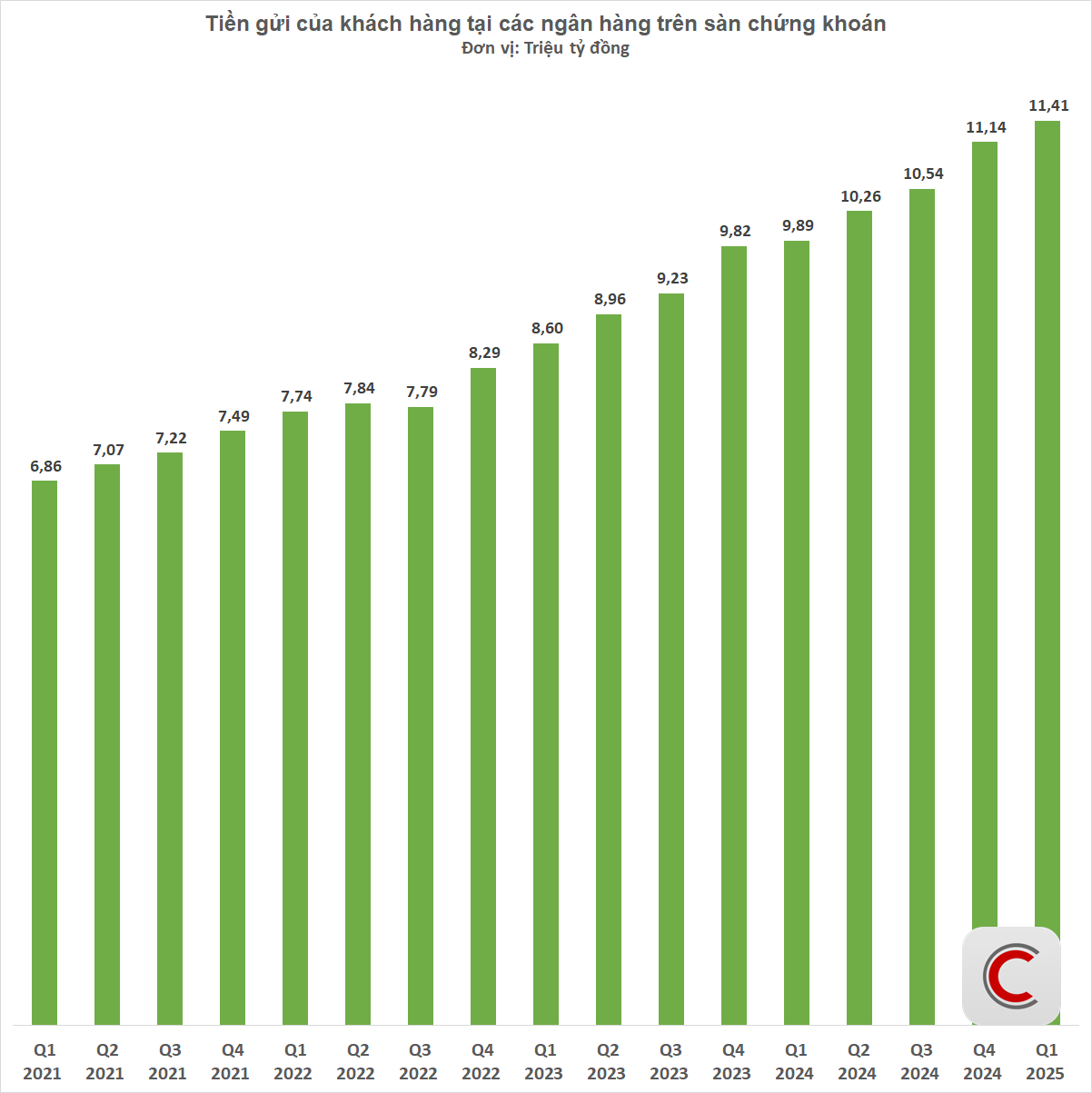

The latest data from the financial reports of listed banks on the stock exchange reveals that customer deposits have reached a new peak. As of the first quarter of 2025, total deposits amounted to over 11.41 million trillion VND, marking a 2.44% increase from the end of 2024. Analyzing the trend from the first quarter of 2021 to the first quarter of 2025, we observe a consistent upward trajectory in customer deposits among listed banks, except for a minor dip in the third quarter of 2022.

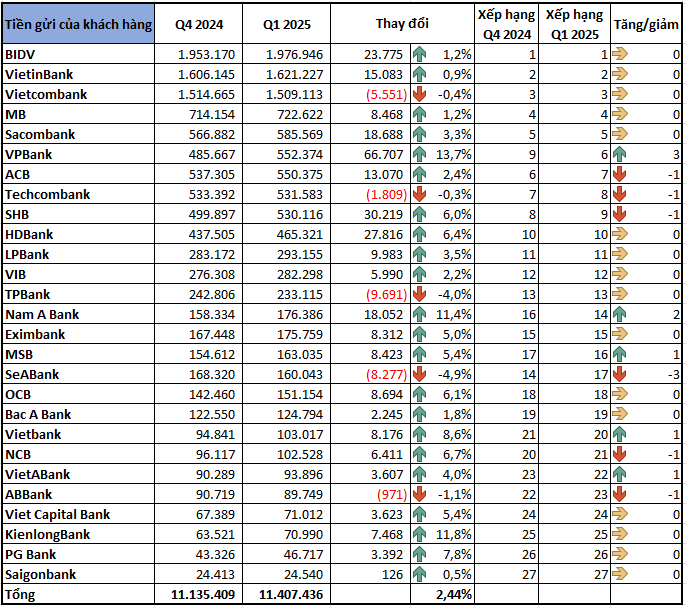

Among the listed banks, VPBank stands out with the most significant growth in customer deposits during the first quarter of 2025. VPBank witnessed a remarkable increase of 66,707 billion VND, equivalent to a 13.7% surge compared to the end of 2024. This substantial growth propelled VPBank three positions upward in the industry rankings, from ninth to sixth place, in terms of customer deposit scale. Furthermore, the first quarter of 2025 marked the highest quarter for VPBank in terms of deposit attraction.

VPBank’s successful deposit mobilization can be partially attributed to the highly anticipated VPBank K-Star Spark in Vietnam 2025 event, featuring the renowned artist G-Dragon. This event is expected to further boost the bank’s deposit levels in the upcoming period.

SHB and HDBank also displayed impressive growth in customer deposits for the first quarter. SHB recorded an additional 30,219 billion VND, representing a 6% increase, while HDBank’s deposits grew by 27,816 billion VND, equivalent to a 6.4% surge. Thus, VPBank, SHB, and HDBank were the top three banks with the most significant deposit increases during the first quarter of 2025.

Additionally, Nam A Bank and KienlongBank deserve recognition for their outstanding quarterly growth rates of 11.4% and 11.8%, respectively. These notable increases brought their total deposits to 176,386 billion VND and 70,990 billion VND.

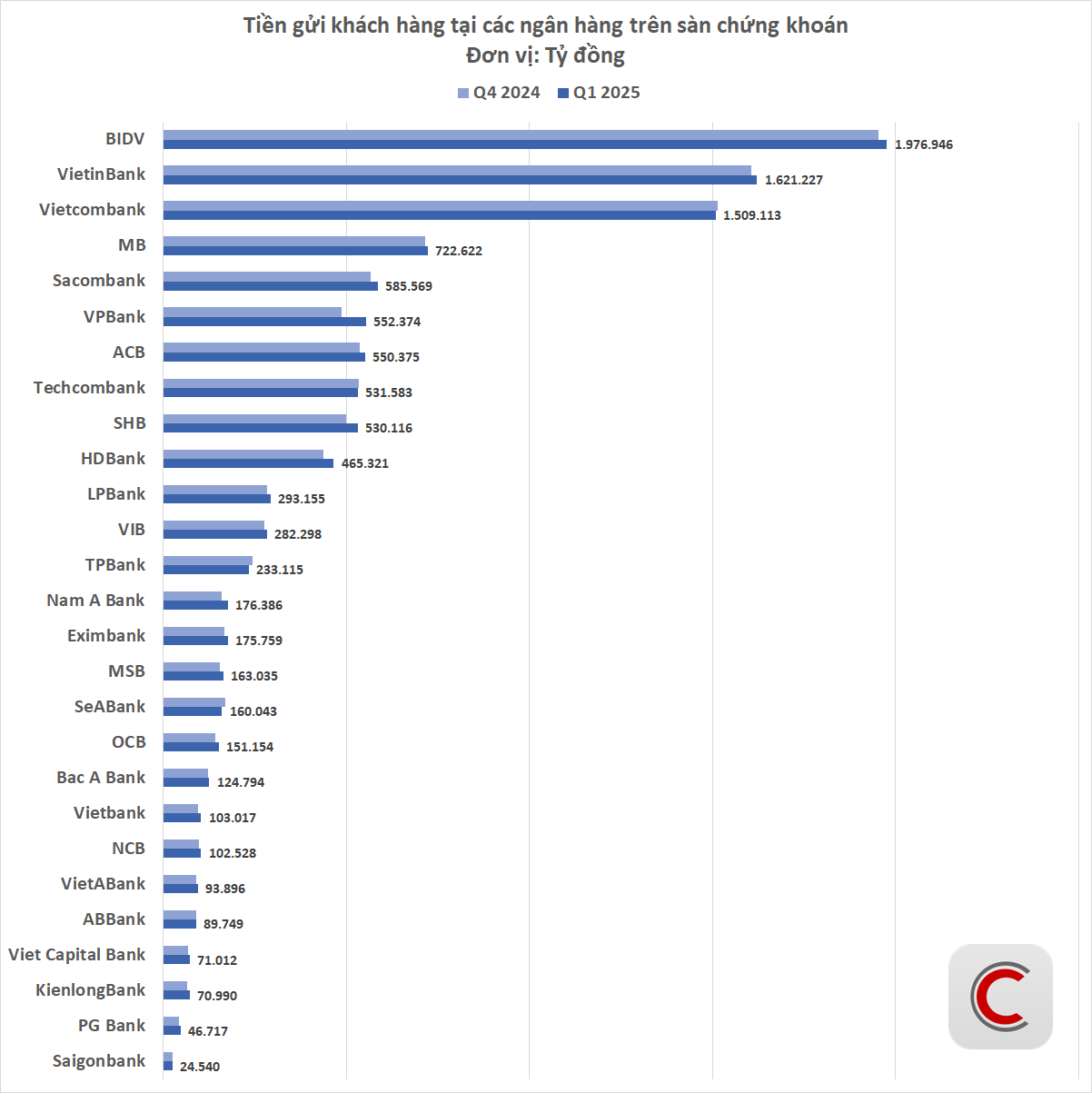

Among the large listed banks, BIDV maintained its leading position with nearly 1.98 million trillion VND in customer deposits, reflecting a 1.2% increase from the end of 2024. VietinBank followed closely with 1.62 million trillion VND, marking a 0.9% increase. Vietcombank secured the third position with 1.51 million trillion VND.

However, it is noteworthy that Vietcombank experienced a decrease of 5,551 billion VND (-0.4%) in customer deposits during the first quarter of 2025. Similarly, Techcombank, TPBank, SeABank, and ABBank also witnessed deposit reductions. These declines can be attributed to strategic adjustments in funding structures and competitive interest rate offerings from private banks.

According to a survey conducted by the State Bank of Vietnam on the business trends of credit institutions in the second quarter of 2025, the interest rates for VND deposits and loans showed a slight decrease compared to the previous quarter. Credit institutions forecast that deposit interest rates for VND will remain stable in the second quarter of 2025, with a minor increase of 0.02% for terms exceeding six months and a slight increase of 0.17% for terms of six months or less for the entire year.

Meanwhile, lending interest rates for VND are expected to continue decreasing slightly by 0.03-0.08% in the second quarter and throughout 2025. In a recent report to the National Assembly, the State Bank of Vietnam acknowledged the challenges in maintaining interest rate stability due to various factors, including the deep lending rate cuts in the past, the anticipated surge in capital demand for production, business, and consumption, potential competition from other investment channels, and the unpredictable global financial market.

Moving forward, the State Bank of Vietnam remains committed to closely monitoring market dynamics and economic developments to proactively, flexibly, and effectively manage monetary policy. This includes coordinating with fiscal and other policies to promote robust economic growth while maintaining macroeconomic stability, controlling inflation, and ensuring the economy’s balance.

The Quiet Korean ‘Chaebol’ Makes a Move in Quang Nam

“In a significant move, one of the top 30 economic conglomerates in South Korea has chosen to adopt LNG as the energy source for its industrial complex in Quang Nam. This decision underscores the company’s commitment to sustainable practices and positions it at the forefront of Korea’s energy transition.”

“Japanese and Middle Eastern Conglomerates Eye $6 Billion Investment in Ho Chi Minh City”

“Huge investments are pouring into Ho Chi Minh City, with foreign conglomerates committing a staggering 6 billion USD for various projects. This significant influx of capital underscores the city’s thriving business landscape and its appeal as a prime investment destination.”

The Ultimate Guide to the Fast Food Boom in Vietnam: Unveiling the Top Players in the Game

The fast-food market in Vietnam is experiencing a significant surge in 2025, with an impressive 110 new store openings. This thriving industry is witnessing a rapid expansion, indicating a strong appetite for quick, convenient, and delicious dining options among Vietnamese consumers. With each new store, the market accelerates, catering to the diverse tastes and preferences of its customers.