Livzon Pharmaceutical Group Inc. (China) has just announced the acquisition of 64.81% of shares in Imexpharm Pharmaceutical Joint Stock Company (stock code: IMP) by purchasing shares from SK Investment (under SK Group – South Korea), Binh Minh Kim Investment Joint Stock Company, and KBA Investment Joint Stock Company.

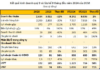

According to the announcement, the indirect subsidiary of Livzon Pharmaceutical Group and the sellers signed an agreement to purchase a total of 99.8 million IMP shares, holding 64.81% of the capital at Imexpharm.

Of these, 73.4 million IMP shares were owned by SK Investment, 15 million by Binh Minh Kim, and 11.3 million by KBA Investment.

The deal value is estimated at nearly VND 5,731 billion, in which Livzon will pay SK Investment more than VND 4,216 billion, Binh Minh Kim VND 863 billion, and KBA VND 652 billion.

Imexpharm’s factory in Vietnam. Source: Imexpharm

After the transaction, Livzon Pharmaceutical Group becomes the largest shareholder of Imexpharm.

The reason for Livzon Pharmaceutical Group’s acquisition is said to lay a solid foundation for the group’s further expansion in foreign markets, supporting its internationalization strategy and sustainable development in the pharmaceutical field.

On May 23, Imexpharm sent a document to the State Securities Commission and the Ho Chi Minh City Stock Exchange (HoSE) to confirm this transaction.

Livzon Pharmaceutical Group Inc. was established in 1985 in China. The group operates in the fields of researching, developing, manufacturing, and trading pharmaceutical products.

Meanwhile, Imexpharm, formerly known as Pharmaceutical Company Grade II, was established in 1977 in Dong Thap. The company is currently a leading pharmaceutical manufacturer in Vietnam, owning four clusters of factories in Dong Thap, Ho Chi Minh City, and Binh Duong, including three EU-GMP-standard clusters with a total of 11 production lines.

In 2024, Imexpharm recorded revenue of VND 2,205 billion, up 11% compared to the previous year. After expenses, the company’s after-tax profit reached VND 320 billion, up 7% compared to 2023.

“Revolutionizing Vietnam’s Pharmaceutical Landscape: The Industrial Park Advantage.”

“Developing pharmaceutical industrial parks is pivotal to Vietnam’s strategy to modernize its pharmaceutical industry and propel it to the forefront of the economy. With a focused approach, these industrial parks have the potential to become hubs of innovation, fostering a vibrant ecosystem that attracts leading global pharmaceutical companies and spurs the development of a robust domestic industry.”

“Imexpharm Hosts Investor and Analyst Conference: A Mid-Year Review of 2024”

On August 5, 2024, Imexpharm hosted an Investor and Analyst Conference, attended by over 50 representatives from investment funds, financial institutions, securities companies, and both domestic and international media outlets.

“Imexpharm Hosts Investor and Analyst Conference: Committing to Even Stronger Growth in H1 2024”

On August 5, 2024, Imexpharm hosted an Investor and Analyst Conference, attended by over 50 representatives from investment funds, financial institutions, securities companies, and both domestic and international media outlets. The conference served as a platform to announce the company’s financial results for the first half of 2024 and engage in vibrant discussions regarding business strategies and plans for the latter half of the year.

“Imexpharm Receives Prestigious ‘Vietnamese Medicine Star’ Award for the Second Time.”

Imexpharm Joint Stock Pharmaceutical Company was recently bestowed with the prestigious Viet Medicine Star Award for the second time. This acclaimed award, organized by the Drug Administration of Vietnam and the Ministry of Health, recognizes and celebrates outstanding contributions made by domestic pharmaceutical manufacturers to the well-being and health care of the community.