|

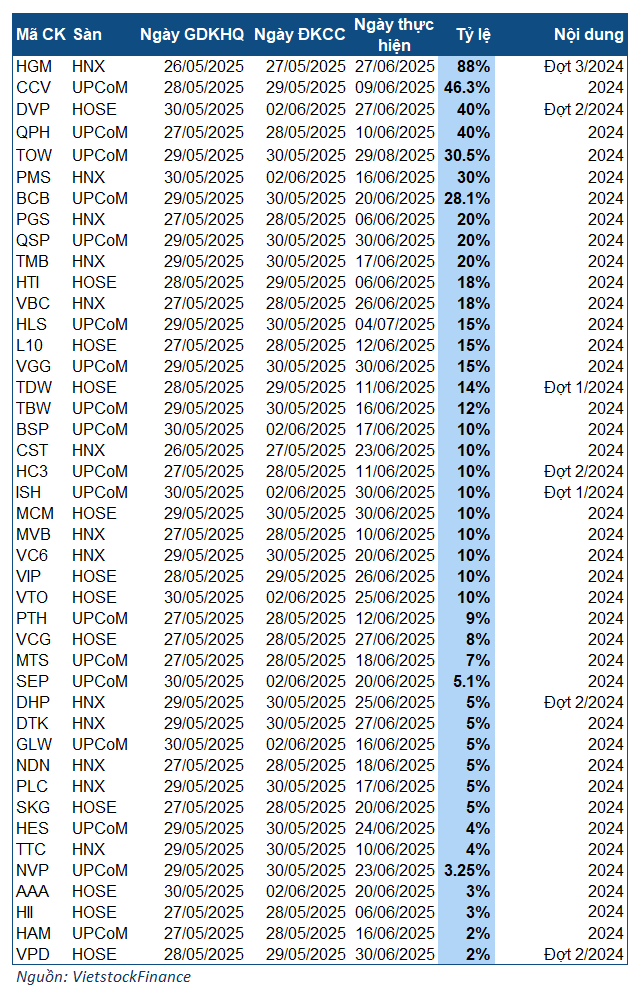

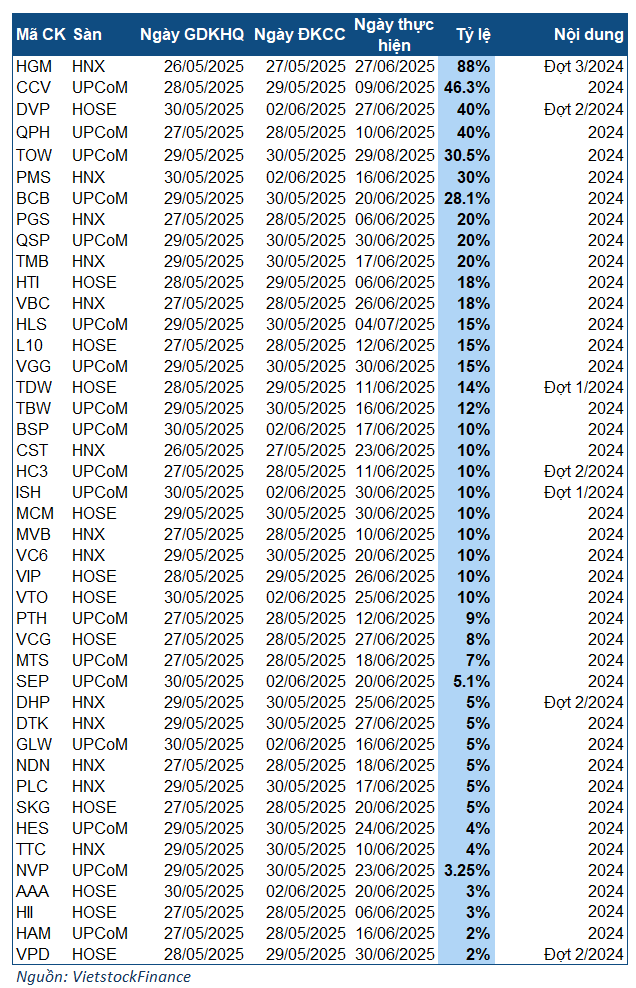

Companies finalising dividend payments in the week of 26-30/05/2025

|

The most notable name in the upcoming week is HGM, finalising an 88% dividend payout. With 12.6 million shares outstanding, the company is expected to distribute nearly VND 111 billion. The ex-dividend date is 26/05, and payment is expected on 27/06/2025.

Previously, HGM had paid interim dividends in two instalments totalling 50%. Thus, the 2024 cash dividend reaches 138% (VND 13,800/share) – the highest in the company’s history, surpassing the previous peak of VND 12,000/share in 2012. In the 2021-2022 period, HGM’s dividend was VND 4,000/share, increasing to VND 4,500/share in 2023.

HGM is also one of the few stocks with a three-digit market price, currently trading around VND 304,000/share, up over 500% year-on-year. However, actual liquidity is relatively low, with an average daily trading volume of just over 5,400 shares.

The next prominent name is CCV, with a payout ratio of 46.3% (VND 4,630/share), also a record high for the company. The ex-dividend date is 28/05, and payment is expected on 09/06. With 1.8 million shares outstanding, CCV is estimated to distribute over VND 8.3 billion.

The record business results in 2024 were the main reason for the high dividend. Historical revenue reached VND 208 billion, and net profit was nearly VND 14 billion, up 27% and 56%, respectively, compared to 2023.

Following are two other companies, DVP and QPH, finalising dividend payments with a ratio of 40% (VND 4,000/share). DVP is paying the second instalment for 2024, distributing VND 160 billion with 40 million shares outstanding. The ex-dividend date is 30/05, and payment is expected on 27/06. Previously, DVP paid an interim dividend of 30%, bringing the total dividend ratio for 2024 to date to 70%. Notably, according to the plan approved by the 2025 AGM on 18/04, the company will distribute an 80% dividend for 2024 (a record high since listing), with the remaining 10% expected in September 2025.

The 40% ratio is also the highest QPH has ever paid, doubling the usual rate maintained over the past eight years (20%). The ex-dividend date is 27/05. With nearly 18.9 million shares outstanding, QPH is expected to distribute over VND 75 billion, almost entirely from the profit after tax available for distribution in 2024. Payments will commence from 10/06.

Additionally, several other notable companies will finalise dividend payments next week, including TOW (30.5%), PMS (30%), BCB (28.1%), PGS, QSP, and TMP (20% each).

Regarding stock dividends, five companies will finalise them next week: VC6 (12%), DIG (6%), NHA (10%), BCF (12%), and VSM (33.33%).

– 13:58 25/05/2025

“Bank Dividend Policies: Striking a Balance Between Shareholder Rewards and Fortifying Financial Position?”

“To cash dividend or to retain earnings, that is the question on the minds of bank executives as they gear up for the 2025 annual general meetings. With a volatile macroeconomic climate, striking a balance between keeping shareholders happy and fortifying the financial foundation of the bank is a delicate matter.”

The Initiative of Top Business Leaders

Mr. Le Van Tan, Chairman of Lam Son Sugar Joint Stock Company, purchased 500,000 shares, while Mr. Le Hai Doan, Chairman of HIPT Group, registered to buy 1 million shares. Additionally, Mr. Nguyen Thanh Phong, a member of the Board of Management of Thu Dau Mot Water Joint Stock Company, registered to purchase 1 million shares as well.