According to preliminary statistics from the General Department of Vietnam Customs, Vietnam’s textile and apparel exports in April 2025 reached $3.64 billion, a 15% increase compared to the same period last year. In the first four months of 2025, this sector brought in over $13.9 billion, an 11% rise year-on-year.

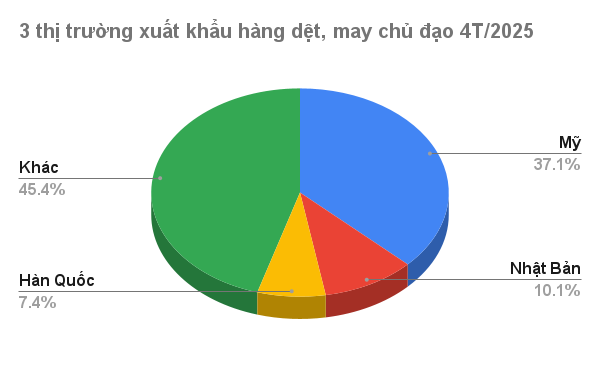

The United States remained Vietnam’s largest export market in Q4 2025, with a trade value of over $5.1 billion, marking a 17.12% growth rate compared to 2024. Free trade agreements and the global supply chain shift have solidified Vietnam’s position in this market. However, with potential new tariff policies from the US, Vietnam needs to diversify its markets to mitigate risks and sustain long-term growth.

Japan, the second-largest export market, recorded a trade value of over $1.4 billion as of April, reflecting an 11.87% increase year-on-year. This growth indicates a consistent demand for Vietnamese textiles and apparel. To meet Japan’s stringent quality standards, Vietnam must continuously enhance its product quality. Leveraging agreements like the CPTPP will enable Vietnam to expand its market share in Japan.

South Korea, the third-largest market for textile and apparel exports, witnessed a trade value of over $1.02 billion in the first four months of 2025, a 1.46% rise compared to the same period in 2024.

In 2024, the textile and apparel industry achieved $44 billion in exports, an 11.26% increase from 2023. Vietnamese textile and apparel products reached over 100 countries and territories, and this year, the industry aims to expand its reach to 104 markets.

For 2025, the industry sets an export target of $47-48 billion (a $3-4 billion increase from 2024). To attain this goal, businesses are investing in green production, adopting AI in manufacturing processes, enhancing competitiveness, meeting international market demands, and expanding market share.

Regarding future market prospects, businesses anticipate a de-escalation in US-China trade tensions, a positive VND/USD exchange rate, and extremely low physical inventory levels in the US, with many brands having only enough stock for the next 6-8 weeks and facing shortages for the back-to-school and holiday seasons. However, businesses are confronted with rising input costs due to the recent electricity price hike, while export unit prices are challenging to increase.

Overall, most exporters have secured orders for Q2 and nearly all of Q3 2025, demonstrating their agility in production coordination to meet delivery deadlines. To ensure sustainable exports and mitigate trade remedy-related risks associated with origin, businesses are making utmost efforts in input material arrangements and transparent origin certification, especially for orders utilizing imported raw materials and accessories.

The Trade Tension Tango: How the US-China Standoff Impacts Vietnam’s FDI Flow

Instead of basing investment decisions on the short-term perspective of a 4-year US presidential term, foreign direct investment (FDI) should be driven by the long-term strategic vision and core values of the investor, as well as the fundamental strengths and potential of the recipient nation.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)