The VN-Index has witnessed a growth of over 9.4% since the beginning of May, with bank stocks making a significant contribution, according to data from the Ho Chi Minh City Stock Exchange (HOSE). Private bank stocks from the large VN30 group have seen strong price increases: TCB (+16%), VPB (+12%), and SHB (+9.5%), to name a few. Similarly, state-owned bank stocks have also performed well, with notable gains for MBB (+4.5%), BID (+5.6%), and CTG (+6%).

It is worth mentioning that the majority of bank stocks on the UPCoM market also experienced impressive growth in May: KLB (+41%), VAB (+25.5%), VBB (+19%), ABB (+11%), and BVB (+10%).

Not only have bank stocks shown strong price performance, but they have also maintained high liquidity in May, despite a slight cooldown compared to the strong bottom-fishing trend in April.

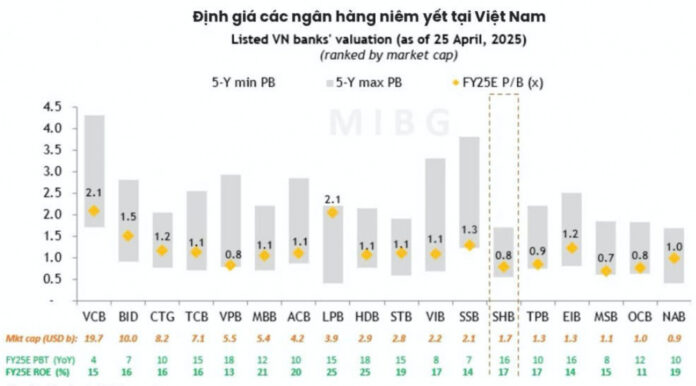

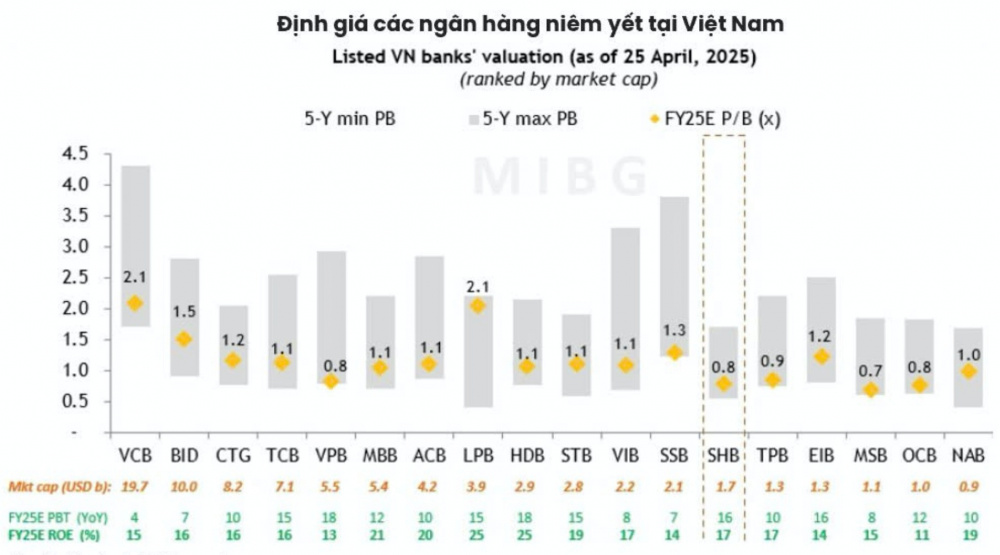

Analysts attribute the attraction of bank stocks to their low valuations and expected future growth, drawing investments from both institutional and individual investors. Some stocks also have unique stories that boost their appeal. The sharp adjustment at the beginning of April 2025 due to trade war concerns, coupled with stable profit growth in Q1, pushed the P/E ratio to its lowest level in years.

According to FiinTrade data, since 2019, there have been only two occasions when the P/B ratio for the banking sector reached similar valuation levels: the onset of the COVID-19 pandemic and the Van Thinh Phat incident.

Mr. Tran Hoang Son, Market Strategy Director at VPBank Securities, shared his view that, in the medium and long term, bank stocks remain attractively valued. The appealing factors include high credit growth, improved growth prospects as the economy recovers, and the current trend of sharing profits and responsibilities through offering reasonable interest rate loan packages.

“If trade negotiations go smoothly and Vietnam’s economy weathers the storm, bank stocks will continue to be a destination for investment flows,” Mr. Son assessed.

Among the bank stocks, SHB stands out not only for its position among the top gainers in May but also for consistently leading the entire market in terms of direct matched trading volume. Its liquidity has consistently ranged from 50 to 100 million units per session, peaking at 168 million units on May 15th.

The appeal of SHB stock has also drawn foreign investors, with net purchases by foreign entities reaching tens of millions of units since the beginning of the year. By mid-May, SHB’s market capitalization surpassed $2 billion. With a charter capital of VND 40,658 billion, SHB solidifies its position as one of the Top 5 largest private banks in Vietnam.

In a recently published report, “ETF Restructuring Projection for Q2 2025,” Yuanta Securities forecast that SHB is one of the three stocks that two ETFs will adjust significantly in their portfolios during the Q2 2025 restructuring. Specifically, Yuanta estimates that the FTSE ETF will purchase an additional 17.7 million SHB shares, while the VNM ETF will buy approximately 4 million shares of this bank.

According to Maybank Securities, SHB is one of the few stocks trading at a low valuation, with a P/E of only 5.28 and a P/B of 0.9. In 2024, the bank achieved a return on equity (ROE) of 21.4%, one of the highest in the industry, while its net interest margin (NIM) stood at 3.26%, and its cost-to-income ratio (CIR) was 24.5%, one of the lowest in the industry, which it has maintained for many years.

Maybank Securities assesses that with its current asset scale and loan balance, SHB has significant room to improve its profit margin if it continues to strengthen its retail lending business.

According to Maybank Securities, based on observations over the past 12 months and a meeting with the bank in April 2025, SHB is undergoing a series of notable internal transformations.

Currently, SHB is implementing a comprehensive transformation strategy with the support of domestic and international experts and leading technology partners such as SAP Fiooner and Amazon. The bank has established transformation teams in each department to drive change and has initiated initiatives to improve corporate governance, including investor relations…

Maybank Securities evaluates that these transformations have yielded positive results, clearly reflected in SHB’s operational indicators.

Market Beat: Stocks End Higher, Energy Sector Soars

The market ended the session on a positive note, with the VN-Index climbing 2.06 points (+0.15%) to reach 1,341.87, while the HNX-Index gained 1.77 points (+0.8%), closing at 223.56. The market breadth tilted in favor of gainers, with 388 advancing stocks against 360 declining ones. However, the large-cap VN30 index painted a mixed picture, as 15 stocks declined, 10 advanced, and 5 remained unchanged.

Market Beat: Vingroup Leads the VN-Index’s Green Charge

The market remained in the green throughout the morning session. By the mid-session break, the VN-Index had gained over 6 points (+0.45%), climbing to 1,345.86; while the HNX-Index rose nearly 1%, reaching 223.97. Market breadth was positive, with 415 advancers, 250 decliners, and 919 stocks trading unchanged.

The Stock Market: A Fresh Breeze of Opportunities

With a bright outlook for upgrades, positive Q2 earnings forecasts, and low-interest rates, the stock market is poised for a vibrant performance.