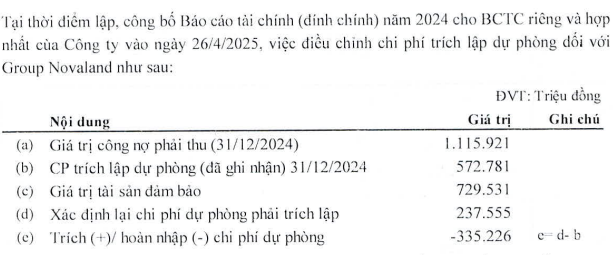

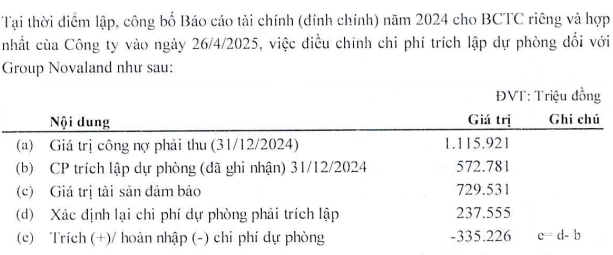

Regarding the highlighted opinion related to receivables from JSC NOVAGROUP and its member companies (Novaland Group), SMC stated that on December 20, 2024, the company and Novaland Group signed a debt confirmation and repayment commitment. However, due to the early Lunar New Year, there was insufficient time to complete all the necessary documents and paperwork. As a result, the company was unable to collect all the relevant documents to reverse the allowance for doubtful accounts at the time of reporting.

By April 26, 2025 – the date of preparation and publication of the adjusted 2024 financial statements, all relevant documents and records had been collected, including the debt confirmation and repayment commitment; sale and purchase agreements, settlement agreements; valuation reports; booking agreements; and the proposal to the Board of Directors regarding the adjustment of the allowance for doubtful accounts for the Novaland Group in the 2024 financial statements (post-year-end).

Source: SMC

|

According to SMC, the reversal of a portion of the allowance for doubtful accounts has led to a significant change in the profit for the year 2024. While this adjustment is appropriate from an accounting perspective, it had a material impact on the financial results, leading the auditor to include an emphasis of matter paragraph in the audit report.

Regarding the emphasis of matter on going concern, with accumulated losses of nearly VND 140 billion, negative cash flow from operating activities of over VND 508 billion, and current liabilities exceeding current assets by nearly VND 623 billion, SMC affirmed that the financial statements for the financial year ended December 31, 2024, were prepared on a going concern basis, which is appropriate.

The reason given by SMC is that the company has been and is implementing various measures to improve its financial and cash flow position. At the same time, measures are being taken to streamline, cut back, and dispose of unprofitable assets and activities, while increasing the efficiency of core operations to improve cash flow and performance in 2025.

Regarding the recovery from losses in two consecutive years, 2022 and 2023, with a net profit of over VND 29 billion in 2024, SMC attributed this to the reversal of the allowance for doubtful accounts of the Novaland Group, as well as the disposal of investments and fixed assets.

| SMC ends two consecutive years of losses |

In the first quarter of 2025, the steel trading company recorded net revenue of nearly VND 1,850 billion and a net profit of almost VND 2 billion, a decrease of 17% and 99%, respectively, compared to the same period last year.

The lackluster performance was mainly due to the decline in core business profitability (gross profit decreased by 37%) and the absence of profit from the sale of NKG shares (in the same period last year, financial income was nearly VND 330 billion). Excluding the other income of nearly VND 17 billion, SMC would have been in a loss position.

SMC‘s business operations are facing challenges due to weak demand, declining steel prices, domestic oversupply, and protectionist trends globally. In addition, capital recovery has been difficult as the company’s partners, mostly from the real estate industry, have not yet recovered. At the end of the first quarter of 2025, SMC slightly increased its allowance for doubtful accounts receivable to VND 365 billion.

The balance sheet also reveals SMC‘s precarious financial position. As of the first quarter of 2025, the company’s short-term debt was nearly VND 3,820 billion, including short-term borrowings of over VND 2,150 billion, while current assets held were just over VND 2,960 billion, including cash and short-term financial investments of nearly VND 660 billion.

In 2025, SMC plans to improve its business operations with a focus on three core segments: trading, processing, and manufacturing. The company also aims to stabilize cash flow and concentrate resources on the two core segments with quick and efficient capital turnover, namely trading and processing, while scaling back manufacturing due to its longer capital turnover cycle.

The company is also optimizing its working capital, controlling costs, and improving production efficiency, including the disposal of a series of land-based assets, a portion of the production line, and redundant personnel at the Sendo Steel Pipe Factory, as well as the liquidation of a galvanizing line at the SMC Phu My Steel Plant in the first four months of 2025. Financial restructuring is also underway, notably the resolution of long-outstanding debts from the Novaland Group.

– 10:58 28/05/2025

“Searefico Plans to Sell Nearly 2 Million Treasury Shares to Boost Capital”

Searefico plans to sell 1.78 million treasury shares at a price no lower than VND 13,000 per share, expecting to raise a minimum of VND 23.14 billion. The sale is scheduled to take place in the fourth quarter of 2025.

“Thuduc House Faces Tax Enforcement of Over 88.9 Billion VND”

Thuduc House, a prominent real estate company, faced consequences for delinquent tax payments. With taxes overdue by more than 90 days past the deadline, the company was subject to enforcement measures. The authorities imposed a halt on their usage of invoices, with the enforced tax amount totaling over 88.9 billion VND.

The Rise of a Financial Empire: Unveiling the Secrets Behind the Success of HCMC’s Wealth-Creating Powerhouse

In 2025, the company aims for a revenue target of 13.167 trillion VND, averaging a remarkable 36 billion VND per day.