On May 19, Saigon Water Infrastructure Joint Stock Company (UPCoM: SII) held an extraordinary general meeting to elect one additional board member and replace the entire Supervisory Board. As a result, Mr. Trinh Duc Hoang, nominated by DNP Water (DPWC), was elected to the board with 51.05% of the votes. Prior to this, on February 13, the SII board appointed Mr. Hoang as Deputy General Director, effective February 14.

The SII Supervisory Board has been entirely replaced, with Mr. Aldrin Dano Nool, nominated by Manila Water South Asia Holdings, winning the election with the highest percentage of votes at 114.1%. The other two candidates nominated by DNP Water, Ms. Giang Thi Ngoc Bich and Ms. Pham Thi Loan, were also elected with 76.58% of the votes. However, Ms. Huynh Thi Bao Tram, a former Supervisory Board member and nominee of Viac (No.1) Limited Partnership, received only 33.74% of the votes and was not elected to the new term.

At this extraordinary meeting, SII also added three additional agenda items for shareholder approval: (1) consideration and handling of violations by Supervisory Board members (as proposed in Resolution No. 12 of the Board dated May 19, 2025); (2) approval of the report explaining the inspection, supervision, and issuance of the report dated January 25, 2025, by the Supervisory Board; and (3) approval of the report of the SII Supervisory Board dated April 11, 2025.

The voting results for item (1) were 51.05% in favor and 48.95% against; for items (2) and (3), the results were 48.95% in favor and 51.05% against.

The violations in question were committed by two former Supervisory Board members, Ms. Azerina Macalinga Bundoc and Ms. Huynh Thi Bao Tram, who misused their positions and instructed the company to stop payments without proper authorization from the Supervisory Board, violating the principle of collective decision-making.

|

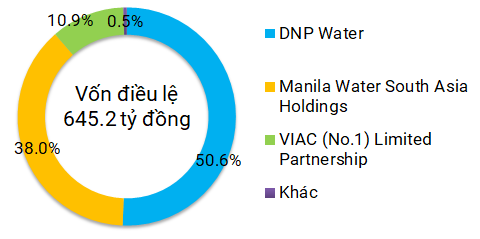

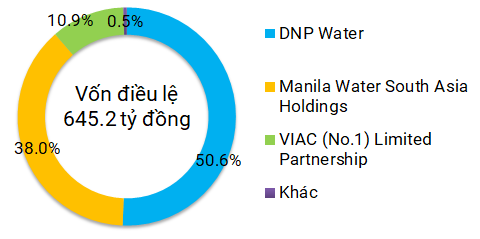

SII currently has three major shareholders holding 99.5% of its charter capital

|

The nature of long-term payables to two foreign shareholders

Manila Water and VIAC have been involved with SII since before 2015, holding a significant 49% stake and previously holding four out of seven seats on the board. Manila Water is a longstanding company from the Philippines with international experience and access to capital from banks. VIAC, on the other hand, is an investment fund owned by the Oman National Investment Committee.

In 2015, SII established a subsidiary, Cu Chi Water Supply Joint Stock Company (with a charter capital of 99.98%), to invest in the Cu Chi Water Plant project. Subsequently, SII transferred 49% of its stake in Cu Chi to Manila Water and VIAC, reducing its own holdings to 50.98%.

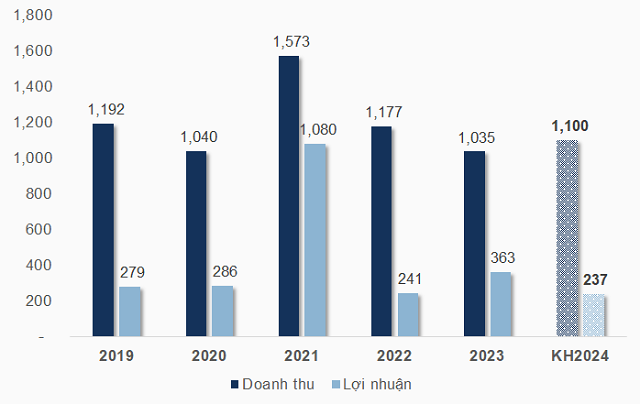

The Cu Chi project was highly anticipated at its inception, with a planned investment of VND 2,662 billion. However, the project has consistently incurred losses since 2015, forcing SII to redirect investments from other profitable ventures like Tan Hiep to support Cu Chi.

During 2022-2023, DNP Water began its involvement with SII by acquiring shares from Ho Chi Minh City Technical Infrastructure Investment Joint Stock Company (HOSE: CII). In reality, DNP Water’s relationship with SII dates back to 2017 when the company spent over VND 120 billion to purchase Can Tho Water Supply Joint Stock Company from SII.

In 2023, DNP Water provided a long-term loan of nearly VND 340 billion to SII to supplement its working capital. The loan had a term of 12 months, maturing on January 25, 2025, with a fixed interest rate of 11.5% per annum and no collateral.

In January 2024, DNP Water completed the acquisition of a 50.6% stake in SII.

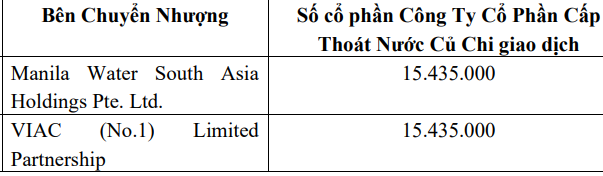

Meanwhile, SII‘s other two shareholders, Manila Water and VIAC, are also direct investors in the Cu Chi Water Plant project since 2015. They sought to convert their investment in the unlisted Cu Chi company into an investment in the listed SII. In November 2023, an extraordinary general meeting of SII shareholders passed Resolution 02/2023/SGW/DHCD-NQ, which included a provision for the conversion of debt into new shares of SII, to be implemented by February 1, 2025, and the acquisition of Cu Chi Water Supply Joint Stock Company shares from the two foreign shareholders.

Source: 2023 Extraordinary General Meeting Resolution

|

The 2023 audited financial statements of SII recorded long-term “payables to sellers” of VND 154.4 billion each for Manila Water and VIAC. These payables are related to the contract for the acquisition of Cu Chi Water Supply Joint Stock Company shares.

As of the issuance of the 2024 audited financial statements on March 28, 2025, the parties were still discussing the issuance of new SII shares. As of the end of March 2025, the value of the payables to the two foreign shareholders remained unchanged. These “payables” can be considered assets awaiting conversion.

Divestment from Tan Hiep and investment plans

Returning to the Tan Hiep Water Plant, this wholesale water plant has been operational since 2005, with no new investments, no growth, but stable dividend payments. According to SII, the divestment from Tan Hiep aims to prepare capital for the company’s development investment plans and repay a portion of its debts.

At the time of the divestment decision, Tan Hiep was the most profitable asset as the Cu Chi plant was still incurring losses and there were no resources for new investments.

DNP Water, the parent company of SII, also stated that this divestment is part of their overall strategy to focus on subsidiaries where they have controlling interests and divest from associated investments that have performed well. The resources freed up from this divestment will be prioritized for larger projects that the company is pursuing, such as the Region 1 project with a capacity of 600,000 cubic meters/day, providing water infrastructure for three provinces: Tien Giang, Ben Tre, and Long An; and a 600,000 cubic meter/day water plant for the Ca Mau peninsula, covering the provinces of Ca Mau, Bac Lieu, and Soc Trang. According to DNP Water, these two projects aim to address the fundamental issues of excessive groundwater use, land subsidence, and saltwater intrusion in the water supply areas.

Additionally, the company plans to commence construction of a water plant in Trang Bang this year, with a total investment of VND 400 billion, to address groundwater and surface water issues in the region.

|

According to our understanding, regarding the An Khe water plant put up for debt sale by BIDV, in mid-2016, SII established Saigon Water – An Khe Joint Stock Company (SAW) to implement the An Khe water plant project in An Khe town and its vicinity in Gia Lai province. With an initial charter capital of VND 40 billion, SII held a 51% stake. In mid-2017, BIDV provided a loan of VND 119 billion to SII for a term of 10 years. In July 2018, the An Khe plant officially commenced operations. In March 2020, SII reduced its ownership in SAW to 49%. Due to the pressure of the loan, BIDV requested the founding shareholders to increase SAW’s capital. By the end of 2024, SII owned 77.33% of SAW after purchasing an additional 5 million new shares. SII acknowledged the challenges of this project but remained committed to providing support due to its social responsibility. |

SII Post-Takeover (Part 1): Selling Good Assets and Lending Money

SII Post-Takeover (Part 2): Lending Money and Investing in a Debt-Ridden Company

– 11:15 28/05/2025