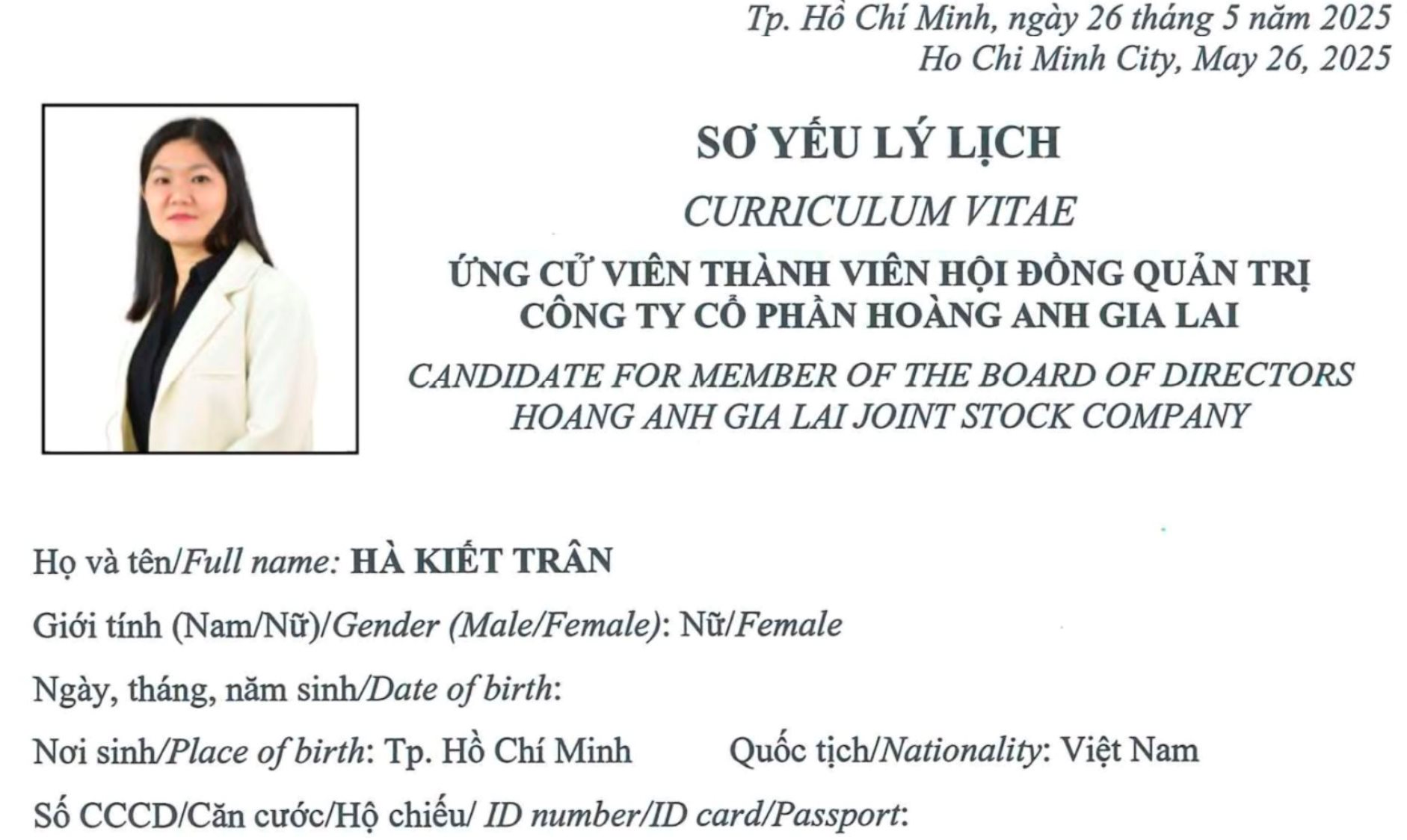

Mr. Ha, a prominent Vietnamese businessman and the Chairman of Hoang Anh Gia Lai Group, announces the nomination of Ms. Ha Kiet Tran as an independent member of the Board of Management for the 2025-2030 term.

On May 27th, Hoang Anh Gia Lai Joint Stock Company (HAGL), listed on the Ho Chi Minh Stock Exchange under the ticker HAG, released an updated list of nominees for their upcoming 2025 Annual General Meeting of Shareholders, scheduled for June 6th.

Among the nominees for the Board of Management for the 2025-2030 term, Ms. Ha Kiet Tran stands out as the sole independent member endorsed by Mr. Ha. This marks a significant addition to the company’s leadership roster.

Ms. Tran brings a wealth of experience to the table, boasting a Master’s degree in Finance. Her impressive resume includes stints at DongA Bank (2012-2014), Dong A Securities, and OCB (2015-2017). She also served as the Chief Financial Officer of Ofood Joint Stock Company from 2017 to 2021.

Ms. Ha Kiet Tran, the newly nominated independent member of HAGL’s Board of Management, brings a wealth of financial expertise and industry experience to the company.

Currently, Ms. Tran serves as the Capital Investment Director at Huong Viet Investment Joint Stock Company (appointed in 2021) and is a member of the Supervisory Board of Century Fiber Joint Stock Company. Huong Viet Investment is the largest shareholder of OCBS Securities Joint Stock Company, formerly known as VIS Securities.

Huong Viet Investment is evolving into a holding company, with notable investments such as a stake of over 20% in Century Fiber, as well as shares in Quoc Loc Phat – the developer of The Metropole Thu Thiem, and Prodezi Long An – the company behind La Home.

Additionally, OCBS Securities holds nearly 5 million HAG shares as of March 2025. The Chairman of OCBS, Mr. Vo Quang Long, concurrently serves as the General Director of Huong Viet Investment. The recent appointment of Mr. Nguyen Duc Quan Tung as the CEO of OCBS further strengthens the connection, as he previously served as the CEO of LPBank Securities.

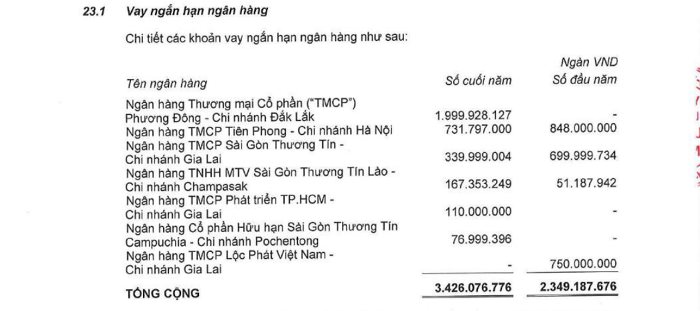

OCB, a prominent Vietnamese bank, has been increasingly involved with HAGL, providing significant loans and demonstrating their confidence in the company’s prospects.

OCB, a prominent Vietnamese bank, has been actively engaging with HAGL in recent times. In the fourth quarter of 2024, OCB extended a loan of nearly VND 2,000 billion to HAGL, which increased to VND 2,213 billion in the first quarter of 2025. These short-term loans carry an interest rate of 8.75% per annum.

The loans are secured by 195 million shares of HAGL’s subsidiary, Livestock Gia Lai, as well as assets related to a fruit tree and livestock project, over 127 million HAG shares owned by Mr. Ha, and more than 345 million shares of Le Me Company.

“OCB and OCBS Sign Comprehensive Strategic Partnership Agreement”

On May 28, 2025, Orient Commercial Joint Stock Bank (HOSE: OCB) and OCBS Securities Joint Stock Company (OCBS) solidified their partnership by signing a comprehensive strategic cooperation agreement. This momentous occasion marked a significant step forward in their journey to enhance customer benefits and experiences.

“OCB to Issue 197.2 Million Bonus Shares to Boost Chartered Capital”

OCB is set to issue a bonus share dividend, offering 197.2 million new shares to its shareholders. This move will increase the bank’s charter capital from VND 24,657.8 billion to VND 26,630.5 billion.

The Heiress of Hoang Anh Gia Lai Fails to Acquire 4 Million Shares Due to Lack of Funds

“Despite her best efforts, Ms. Doan Hoang Anh, daughter of businessman Doan Nguyen Duc, was unable to purchase any of the 4 million HAG shares she had registered for, due to personal financial constraints. This setback did not deter her spirit, and she remains resolute in her pursuit of future opportunities.”

“Core Business Activities of OCB Maintain Strong Growth Momentum in Q1 2025”

Oriental Commercial Joint Stock Bank (HOSE: OCB) has announced its Q1 2025 financial report, boasting impressive results with a remarkable pre-tax profit of VND 893 billion, showcasing a strong and consistent growth in its core operations.