According to data from VietstockFinance, 42 water enterprises (listed on HOSE, HNX, and UPCoM) recorded a total revenue of nearly VND 7,760 billion, up 7.2% over the same period. However, net profit increased slightly by only 2.6%, reaching VND 811 billion.

The main reason lies in the disparity in pricing policies between localities and the uneven ability to control costs.

Benefiting from the adjusted water price increase

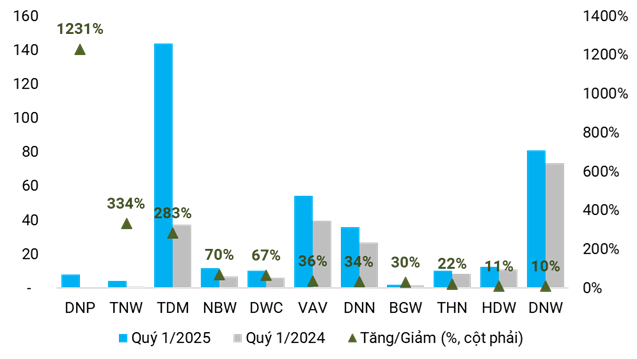

Many units improved their business results thanks to higher selling prices and volumes. Thai Nguyen Water Supply JSC (UPCoM: TNW) increased its profit by over 333%, to VND 4.4 billion, thanks to increased volume and reduced financial costs.

Dak Lak Water Supply JSC (UPCoM: DWC) recorded revenue of nearly VND 78 billion, up 15%, the highest in history. Profit also increased by 67%, reaching nearly VND 10.5 billion, thanks to the increase in water prices since the beginning of the year and higher demand, bringing the gross profit margin to a record 61.9%.

The higher average selling price also contributed to the profit increase of Danang Water Supply JSC (UPCoM: DNN) and Nha Be Water Supply JSC (HNX: NBW) by 34% and 70%, respectively, to VND 36 billion and VND 12 billion.

Thanh Hoa Water Supply JSC (UPCoM: THN) and Bac Giang Clean Water JSC (UPCoM: BGW) showed positive signs with reduced losses, expanded distribution systems, and modest revenue growth.

Profit surged thanks to financial flows

The most notable performance was from Thu Dau Mot Water JSC (HOSE: TDM), which recorded a 283% surge in profit to VND 144 billion, while revenue decreased. The main driver was not from water sales but a dividend of over VND 107 billion from the industry giant, BWE.

DNP Holding (HNX: DNP) also surprised the market with a 13-fold increase in profit to over VND 8 billion, thanks to growth in its three main segments: clean water, tiles, and household appliances. The difference from the previous year was the consolidation of Saigon – An Khe Water this quarter.

Despite lower revenue, Ba Ria-Vung Tau Water Supply JSC (UPCoM: BWS) maintained its profit at over VND 66 billion thanks to dividend income.

|

Many enterprises reported double-digit profit growth (in VND billion)

Source: Author’s compilation

|

Operating costs eroded business efficiency

Despite positive revenue, many businesses struggled as input costs increased faster.

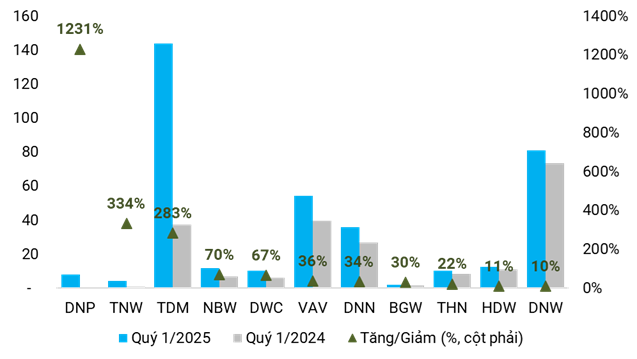

Binh Duong Water – Environment Corporation (HOSE: BWE) achieved revenue of nearly VND 924 billion, up 17%, but profit dropped to VND 148 billion, a 17% decrease from the previous year. The main reason was the loss from exchange rate differences, which increased financial expenses by 45%, along with higher operating costs. However, the gross profit margin remained the highest in the last four quarters at 46.6%.

In the group of smaller-scale enterprises, Phu Yen Water Supply and Drainage JSC (UPCoM: PWS) suffered a nearly 37% drop in profit due to connection costs in the last quarter of 2024, which continued to be allocated in this period. Similarly, the results of Quang Tri Clean Water JSC (UPCoM: NQT) also decreased by 35% due to higher costs of goods sold compared to revenue growth.

While Ca Mau Water Supply JSC (UPCoM: CMW) achieved record-high revenue and gross profit margin, at nearly VND 38 billion and 43%, respectively, its profit declined due to increased expenses for customer expansion, system repair, and loss reduction.

Adverse weather conditions

Some businesses were affected by less harsh climate conditions compared to the previous year, which led to a decrease in the demand for clean water.

Ben Tre Water Supply and Drainage JSC (UPCoM: NBT) reported that the intrusion of saltwater and hot weather were less severe than last year, resulting in a decrease in consumption of over 122,000m³. At the same time, operating expenses increased, causing net profit to fall by over 12% to VND 13 billion.

Due to prolonged heavy rains and low temperatures, Binh Dinh Water Supply and Drainage JSC (UPCoM: BDW) recorded the lowest revenue in two years at VND 64 billion. Profit also decreased by 34% to VND 5.4 billion.

For similar weather-related reasons, Quang Binh Water Supply JSC (UPCoM: NQB) experienced stagnant revenue and a series of rising costs, leading to a 27% drop in profit to VND 2.3 billion.

Decline in consumption volume in Ho Chi Minh City

In the Ho Chi Minh City region, except for Nha Be Water Supply JSC (HNX: NBW), which reported a 70% profit growth, the rest witnessed declining performance due to a decrease in consumption volume, despite an increase in the average selling price.

Cho Lon Water Supply JSC (HOSE: CLW) experienced the most significant drop in volume, with a decrease of more than 1.2 million m³, equivalent to a 4.6% decline. Its average selling price also slightly dropped, while the wholesale price increased, resulting in a 44% decrease in profit to VND 12 billion.

The consumption volume of Gia Dinh Water Supply JSC (HNX: GDW) decreased by more than 297,000m³, and higher operating costs caused a nearly 89% drop in profit, resulting in a meager VND 700 million.

Ben Thanh Water Supply JSC (HNX: BTW) experienced a decrease of over 415,000m³ in volume, while the average selling price slightly increased. Higher costs led to a nearly 21% drop in net profit to VND 19 billion. Thu Duc Water Supply JSC (HOSE: TDW) was similarly affected by higher wholesale prices, resulting in increased costs and a nearly 19% decrease in profit to VND 11.4 billion.

|

Many enterprises reported a sharp decline in profit (in VND billion)

Source: Author’s compilation

|

Losses due to heavy financial burdens

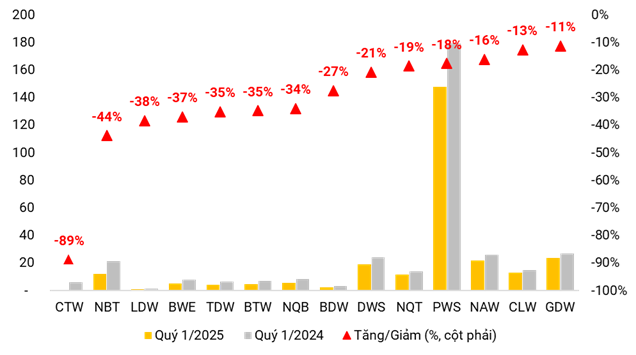

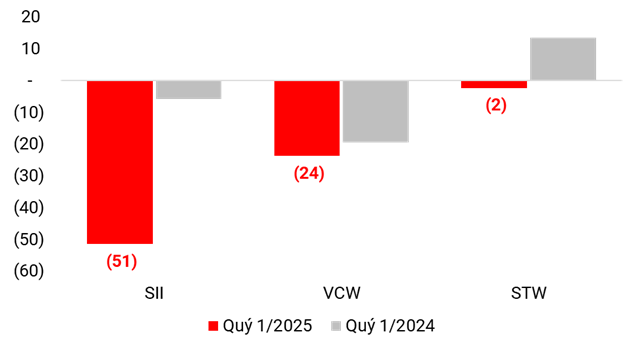

Some enterprises started the year 2025 with negative results, mainly due to significant financial costs and abnormal expenses.

The heaviest loss in the industry was reported by Saigon Water Infrastructure JSC (UPCoM: SII), with a loss of VND 51.4 billion. The consolidation of Saigon – An Khe Water was said to reduce gross profit, while the company also incurred financial expenses of over VND 40 billion.

Clean Water Investment JSC (UPCoM: VCW) continued its losing streak with a loss of nearly VND 24 billion due to interest expenses of VND 39.3 billion, while gross profit was only VND 26.6 billion.

Uniquely, Soc Trang Water Supply JSC (UPCoM: STW) turned from profit to a loss of over VND 2.3 billion due to increased repair expenses and administrative penalties related to the environment, taxes, and business registration, totaling VND 12 billion.

|

Three enterprises reported losses in the 1st quarter of 2025 (in VND billion)

Source: Author’s compilation

|

– 13:00 05/28/2025

“HPP Announces Final Dividend for 2024 with a 20% Payout Ratio”

The Hai Phong Paint Joint Stock Company (UPCoM: HPP) announces the record date for shareholders to receive the remaining 2024 cash dividends. The ex-dividend date is set as June 4th, 2025.

“A Mining Company Plans an Ambitious Five-Fold IPO”

The Industrial Mineral Company of Quang Nam JSC (Minco) has an exciting announcement for its shareholders. At the recent 2025 Annual General Meeting, a resolution was passed to offer an impressive 581% stock dividend to existing shareholders. This means that shareholders will receive five times the number of shares they currently own, a truly remarkable offering.

Foreign Block Remains Net Sellers Despite Market’s Spectacular Recovery, Dumping Nearly $100 Million Worth of Stocks

“VHM witnessed a robust buying trend in the market, with a total net purchase value of VND 148 billion, standing out as the most actively traded stock for the day.”