Southern Battery Joint Stock Company (Pinaco, code: PAC) recently announced that it will finalize its shareholder list on June 24 to implement the second round of 2024 dividend payments in cash and issue bonus shares to increase charter capital from owner’s equity.

Regarding dividends, the company will make cash payments at a rate of 10% (VND 1,000 per share), equivalent to over VND 46 billion in value. The expected payment date is July 15.

Currently, the Vietnam Chemical Group remains the parent company, controlling over 51.4% of PAC’s capital and is expected to receive VND 16.7 billion. Foreign shareholder Furukawa Battery, with a 10.54% stake, will receive VND 3.4 billion, while Saigon 3 Jean, with a 6.46% stake, will receive VND 2.1 billion.

As for the bonus issue, the company plans to implement it at a ratio of 50% (shareholders owning 2 shares will receive 1 new share), corresponding to the issuance of 23.3 million new shares. The issuance source will be from the investment development fund in the 2024 audited report (actual balance of VND 232 billion). If successful, Pinaco’s charter capital after the bonus issue will increase to VND 697 billion.

It is known that PAC was formerly known as Southern Battery Company, established by the General Department of Chemicals (now Vietnam Chemical Group) in 1976. In 1993, the Ministry of Heavy Industry (now the Ministry of Industry and Trade) officially decided to re-establish Southern Battery Joint Stock Company (Pinaco) under the Vietnam Chemical Corporation.

Its flagship brands include Pin Con Ó and Dong Nai Battery, which are well-known for their automotive parts and accessories. Pinaco’s clients include prominent names such as Ford Vietnam, Thaco, Vinfast, Vietnam Suzuki, Honda, Piaggio, Yamaha, Mercedes-Benz Vietnam, and Hyundai Thanh Cong.

Notably, Pinaco has successfully manufactured lead-acid batteries for electric bicycles and motorcycles and has already introduced them to the market. PAC’s management emphasizes that each electric car uses a lead-acid battery, and Pinaco currently supplies 100% of lead-acid batteries for VinFast’s electric vehicle line.

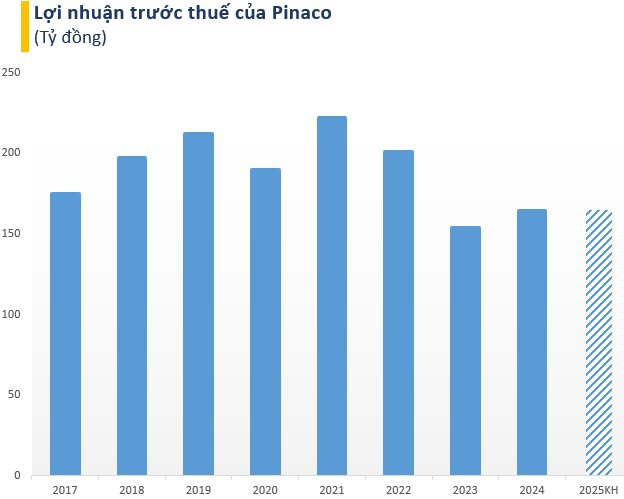

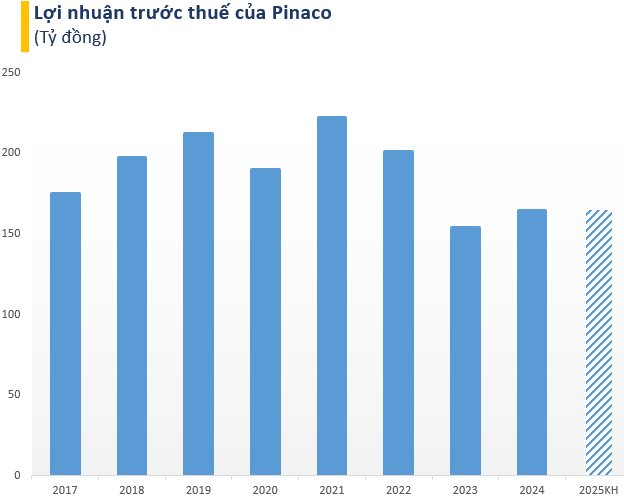

In 2024, Pinaco recorded revenue of VND 3,205 billion, almost unchanged from the previous year. Its pre-tax profit reached VND 164 billion, up 6% from 2023 and 3% higher than the plan.

With these results, shareholders agreed to a 15% dividend payout for 2024 in cash, of which the company has already advanced the first tranche with a rate of 5% on January 20.

In 2025, the Annual General Meeting of Shareholders approved a target of VND 4,000 billion in total revenue. The profit-before-tax target was slightly increased to VND 165 billion. The expected dividend rate is 10%.

The management stated that the 2025 plan was formulated based on market conditions, production capacity, and domestic and global situations, resulting in a VND 4,000 billion target. However, as the government has requested state-owned enterprises to increase by 8%, the company has reassessed its internal strengths, market trends, and readjusted its plan accordingly.

Regarding shareholders’ interest in VinFast, Pinaco’s representative shared that the company is currently the exclusive supplier of control system batteries for VinFast, with revenues exceeding VND 100 billion, doubling the figure from 2024.

For the first quarter of 2025, the company recorded net revenue of nearly VND 862 billion and pre-tax profit of over VND 41 billion, an increase of 8% and 1%, respectively, compared to the same period last year. These figures represent 22% of the revenue target and 25% of the profit plan for the year.

Unlocking Shareholder Value: FPT Approves Cash Dividend and Plans to Issue 222 Million New Shares

With 1.47 billion shares outstanding, FPT Corporation has announced a dividend payout of VND 1,500 billion for this distribution.

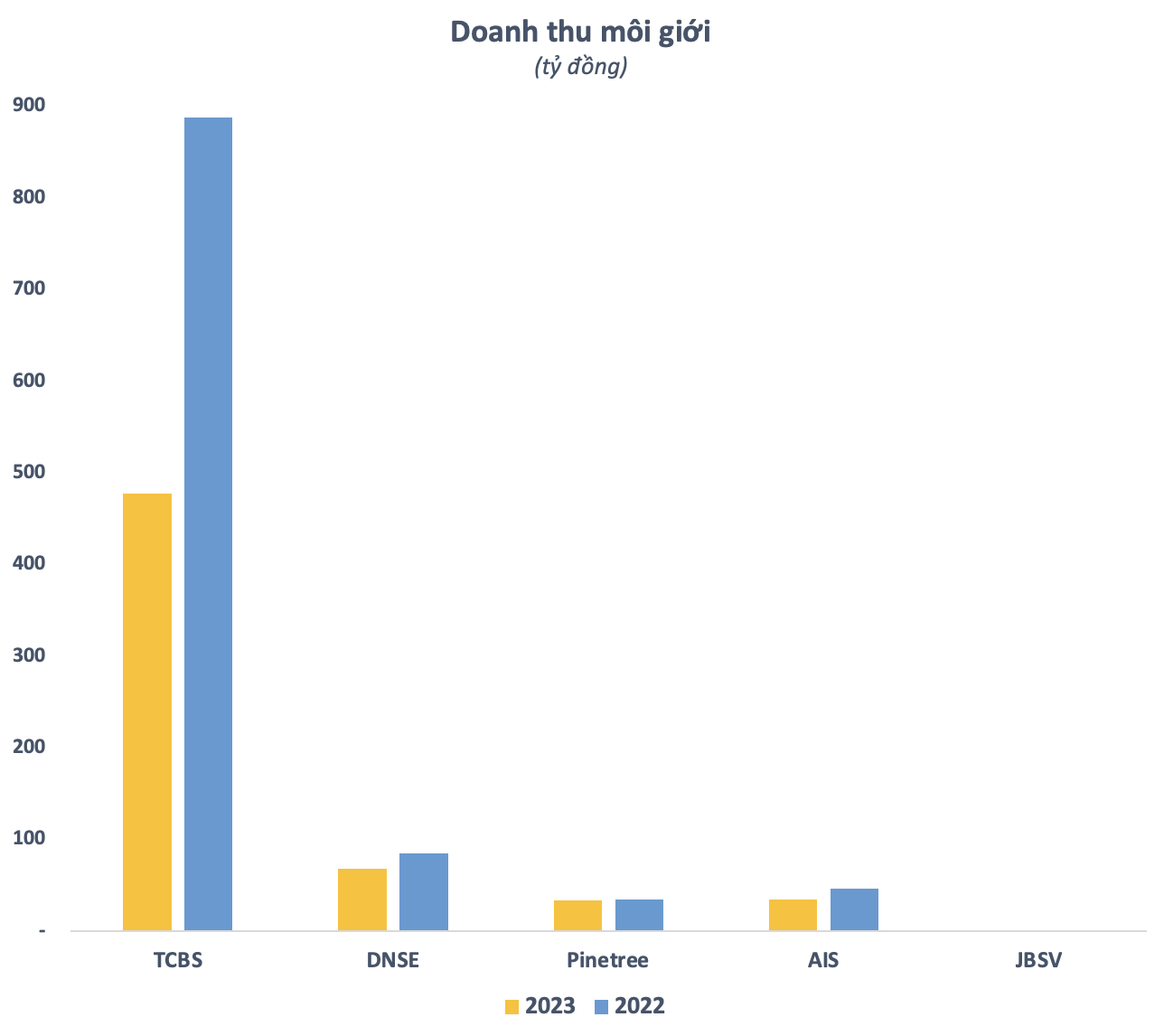

How Did the Fund Management Industry Perform in the First Quarter?

The statistics from 43 active fund management companies in the Vietnamese stock market paint an interesting picture. With a focus on revenue and net profit growth, the numbers reveal a thriving industry. However, a deeper dive into the figures uncovers a notable decline in net profit margins, leaving room for further analysis and exploration.

The Long Chau Chain Accelerates with a “Breath-Taking” Pace: Averaging One New Store Opening Per Day Since the Start of the Year

As of the end of 2024, Long Chau’s network of pharmacies and vaccination centers boasted an impressive 2,069 stores. Fast forward to the present, and that number has skyrocketed to an astonishing 2,251, reflecting a substantial expansion of 182 additional stores.