“Zero Fee” is a familiar term in the securities industry. However, the extent of this trend in Vietnam is still relatively limited. At present, the number of lifetime fee-free securities companies for new investors can be counted on one hand, including TCBS, DNSE, Pinetree, JBSV, AIS, and the latest addition, MBS.

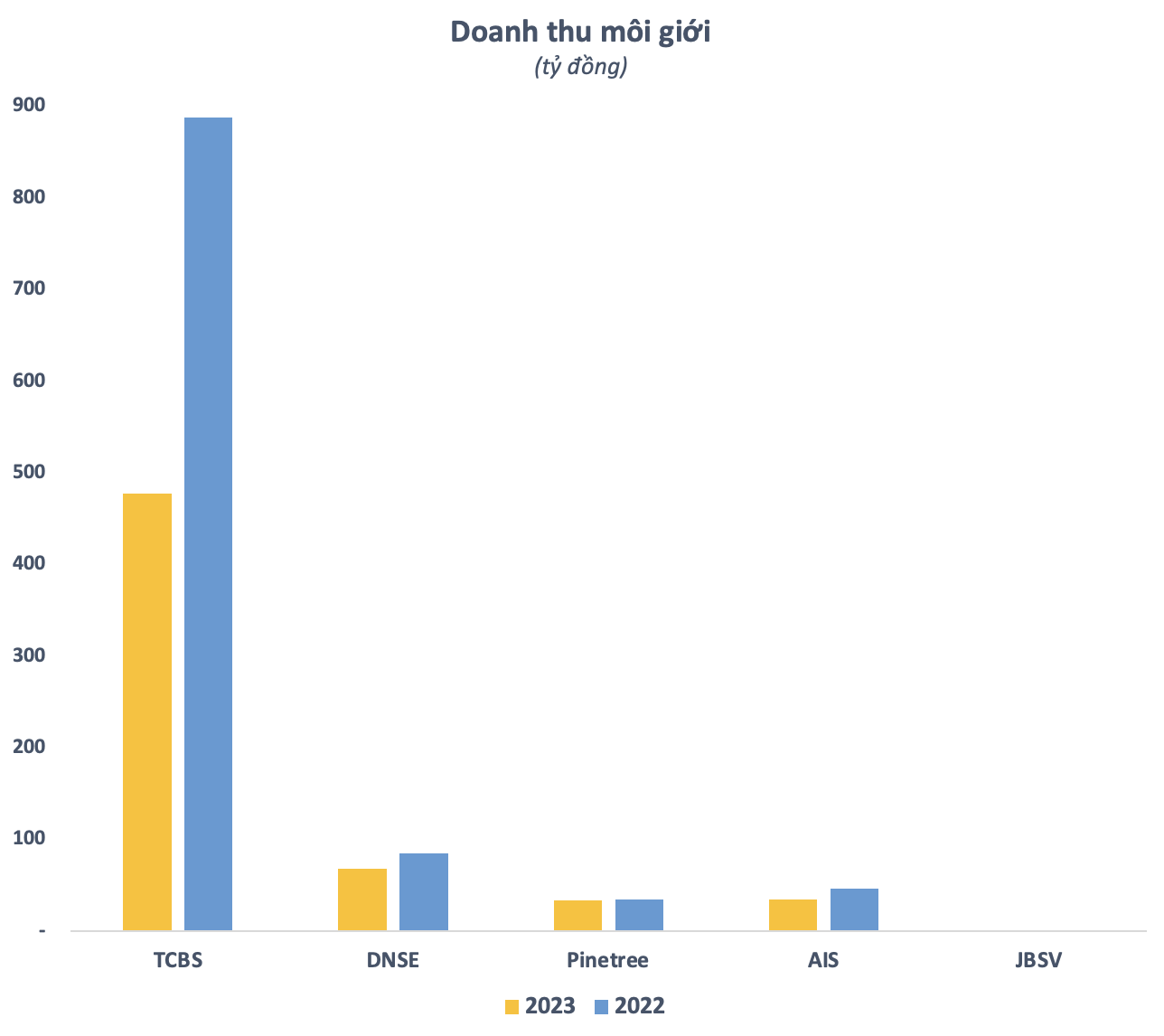

Pursuing the Zero Fee model significantly narrows the brokerage revenue of securities companies. For example, TCBS’s brokerage revenue in 2023 decreased by more than 46% while the associated costs increased by nearly 19% compared to the previous year. Gross profit margin decreased from 82.6% to 61.5%, resulting in a 60% decrease in gross profit compared to 2022.

DNSE and Pinetree both experienced a decline in brokerage revenue in 2023 and suffered losses in this area. Meanwhile, the brokerage revenue of JBSV was negligible as it is a relatively new player in the market. AIS didn’t experience losses in the brokerage segment, but its brokerage revenue in 2023 decreased by nearly 27%, resulting in a 79% decrease in gross profit compared to 2022.

In reality, brokerage fees are still a significant source of revenue, contributing a large portion to the total revenue of securities companies. Therefore, the Zero Fee model has not been widely adopted. However, it should be noted that low brokerage revenue due to the impact of Zero Fee does not signify a lack of customers.

On the contrary, Zero Fee is one of the strategic tactics that helps securities companies compete with industry leaders. For example, DNSE had 560,000 accounts by the end of 2023, with an average of 1,500 new accounts opened daily, accounting for 26.5% of the new market share.

Increasing Proportions of Interest Income

With the customer base attracted by Zero Fee, securities companies can diversify their product offerings and cross-sell additional services to compensate for the decline in brokerage revenue. One of the rapidly growing segments is lending.

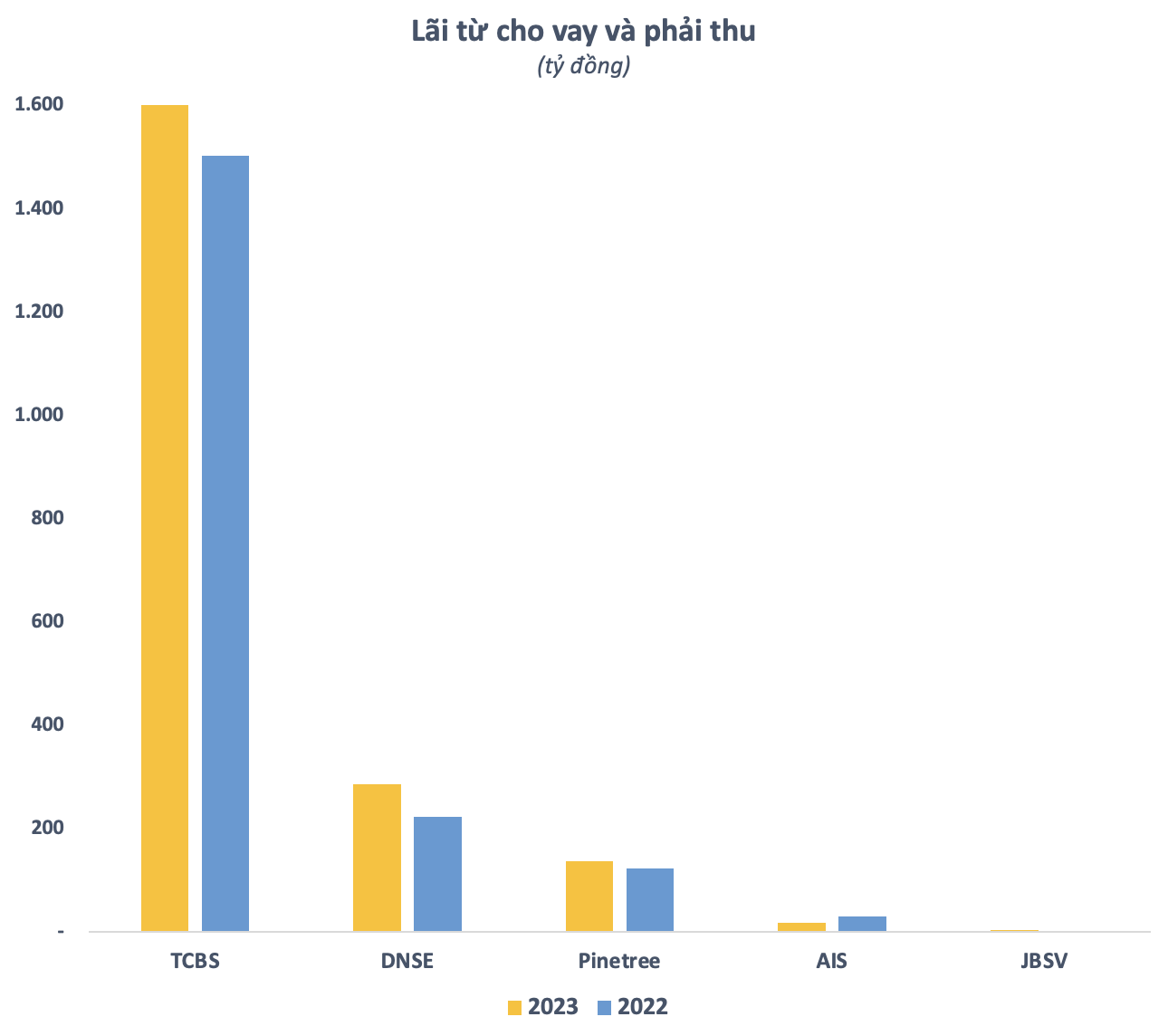

Except for AIS, securities companies pursuing Zero Fee recorded an increase in interest income and accounts receivable in 2023 compared to the previous year, especially DNSE with a growth rate of over 28%. It should be emphasized that the interest rates for margin lending in 2023 at securities companies were much lower than in 2022.

Looking at the structure, interest income and accounts receivable are increasingly representing a large proportion of the total operating revenue for securities companies pursuing Zero Fee. TCBS, for instance, received more than 1,600 billion VND from lending and accounts receivable in 2023, the highest in the securities industry. This segment accounted for approximately 30% of the company’s total operating revenue, almost equal to proprietary trading.

Similarly, for DNSE, interest income and accounts receivable are the largest revenue source, accounting for 40% of total operating revenue. Pinetree also heavily relies on lending, with interest income and accounts receivable contributing more than 55% of its revenue. These figures are expected to continue to increase in the future as the lending potential at securities companies is still significant.

Although TCBS had the largest lending amount by the end of 2023, the margin/cash ratio was relatively low at less than 70%. DNSE and Pinetree had ratios below 80%. Additionally, DNSE is currently in the process of conducting an initial public offering (IPO) to raise its capital to 3,300 billion VND. It is estimated that the company will have around 5,000 billion VND available to lend to investors after a successful IPO.

Zero Fee Trend and Decreasing Transaction Costs

In general, transaction fees are moving toward zero, and it would not be surprising to see more securities companies adopting the Zero Fee model in the future. In the early days of 2024, MBS joined this race. Many securities companies have already reduced fees, bringing transaction fees below 0.1% (including fees returned to the Stock Exchange). Furthermore, many other securities companies such as FPTS and Yuanta have also significantly reduced transaction fees for investors.

Regarding this trend, a recent report from DSC Securities suggests that sacrificing part of the brokerage profit will continue in 2024. Securities companies will have to compete by providing better services, training self-directed investors… focusing on non-transaction fee revenues. In the past five years, profit from margin activities has always contributed 35-45% to securities companies’ gross profit. Therefore, DSC expects this segment to continue driving profit growth for the securities group.

In addition to lending, advisory services are also expected to flourish as the quality of customer portfolios improves and the range of goods in the market becomes more diverse. The demand for advisory services will undoubtedly increase as investors seek alternative income-generating channels, rather than getting caught up in the risky market “trading”.

Currently, the majority of securities companies still rely on a large team of traditional brokers to gain market share. On the other hand, except for MBS joining the race in early 2024, securities companies pursuing Zero Fee do not employ brokers. If Zero Fee becomes widespread, it will undoubtedly lead to a personnel shift in the securities industry.

To stay ahead of this trend, brokers themselves must enhance their knowledge and invest more intellect into advisory activities. They need a deep understanding of macroeconomics, market volatility, and various investment assets. The broker team will focus on improving the quality of advice and accompanying investors, which will drive the sustainable development of the securities market.