In this context, the role of financial institutions, especially banks like ACB, is crucial: becoming a partner accompanying businesses in the process of restructuring and expanding production.

Multiple Factors Driving the Development of Industrial Parks

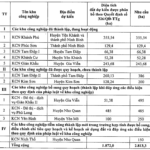

Resolution 60-NQ/TW dated April 12, 2025, of the 11th Conference of the 13th Central Executive Committee passed a plan to merge provinces and cities, resulting in 34 new administrative units. This rearrangement of administrative boundaries has led to the formation of super industrial hubs in Vietnam, notably Bac Ninh (the merger of Bac Ninh and Bac Giang) and Ho Chi Minh City (the merger of Ho Chi Minh City, Binh Duong, and Ba Ria-Vung Tau). With their large scale, high concentration, and supportive policies, these hubs present a significant opportunity for Vietnam’s long-term economic growth.

According to analysts, industrial real estate may experience short-term impacts due to tariff policies. However, this is an opportunity for Vietnam to upgrade its infrastructure connectivity and improve its investment policies and environment over the long term. Particularly, in a scenario of positive negotiations between the Vietnamese and American governments resulting in more reasonable tariffs, Vietnam will likely maintain its attractiveness to foreign investors.

In recent years, the development of the economy in industrial parks and export processing zones has also received special attention from the government. Since the beginning of 2025, the government has approved numerous large-scale industrial park projects covering thousands of hectares and involving investments of tens of thousands of billion VND. Additionally, the development of green industrial parks that focus on infrastructure connectivity and ecological industrialization is becoming a dominant trend. Along with this, credit support for investors and local governments to develop green industrial parks is expanding with the accompaniment of credit institutions, especially dynamic private banks.

As one of the pioneering banks in developing ESG criteria linked to business operations, in addition to offering preferential interest rates, ACB has been promoting its “Green Credit” and “Super Solutions for Specialized Financing for Enterprises in Industrial Parks” programs, demonstrating its determination to accompany businesses with a sustainable development orientation and promote economic growth in general.

Super Solutions for Enterprise Financing in Industrial Parks

Mr. Ngo Tan Long, Deputy General Director of ACB Bank, shared that since 2023, industrial parks have been clearly positioned in ACB’s business growth strategy. This is why the bank has developed the “Super Solutions for Enterprise Financing in Industrial Parks” with abundant capital to serve the needs of leasing/purchasing land and constructing factories, investing in machinery and equipment, and production lines for businesses to expand their production. “We aim to facilitate businesses’ access to capital so that they don’t miss any growth opportunities. Moreover, ACB’s comprehensive ecosystem of financial services will help businesses hedge risks against economic fluctuations,” emphasized Mr. Long.

Accordingly, this specialized super solution has been and is being deployed across various types of industrial parks nationwide, especially meeting the needs of businesses for land acquisition and factory construction within industrial parks. It offers exceptionally competitive medium and long-term loan interest rates, with loan terms of up to 20 years. This solution also flexibly accepts mortgages on specific assets of enterprises operating in industrial parks, particularly accepting the “right to arise from the annual land lease contract formed from the loan capital.” Furthermore, ACB also finances the maximum medium and long-term capital needs of enterprises with a ratio of up to 85% of the total investment capital of the project. This means that enterprises only need to contribute a minimum of 15% of the capital, and ACB will finance the rest.

Meanwhile, for enterprises with specific production activities that regularly invest in new and replacement specialized, complex, or high-tech machinery and equipment, ACBL (ACB Leasing – Asia Commercial Bank Financial Leasing Company Limited) serves as an extended arm supported by 100% direct capital from ACB, providing additional flexible and comprehensive financial leasing solutions. With over 16 years of experience and financial leasing interest rates equivalent to ACB’s medium and long-term preferential interest rates, the ratio of financed assets at ACBL is always competitive in the market.

By leveraging the “synergistic power” of ACB and ACBL, along with the quick online disbursement through ACB ONE BIZ, enterprises can maximize time and cost savings and automatically monitor their loan portfolio. Moreover, instant payment and revenue management solutions are directly connected to the enterprise’s business management system through API technical connections, salary payments to employees, guarantee services, deposits, and international payments at ACB have advantages in synchronization, competitive interest rates, service fees, and technology.

For more information about the financing solutions, please visit the website acb.com.vn, contact the Contact Center at 1900 54 54 86 – (028) 38 247 247, or visit the nearest branch/transaction office for consultation and support.

Exclusive Privileges Offered by the Super Solutions for Enterprises in Industrial Parks:

- Specialized financing for enterprises to purchase land and construct factories in industrial parks, with mortgages accepted on the real estate formed from the loan capital;

- Access to diverse types of industrial parks/export processing zones/industrial clusters/high-tech parks;

- Flexibility in accepting mortgages on specific assets of enterprises operating in industrial parks, including factories, offices, and operating machinery and equipment. Acceptance of the right to arise from the annual land lease contract within the industrial park as collateral;

- Project loan terms of up to 20 years, with a mechanism for grace periods on principal and interest based on the project’s cash flow;

- Special preferential interest rates for loans exclusively offered to enterprises in industrial parks.

The Ultimate Coastal City: Discover the Vision for Quang Ngai’s New Mega Project

On May 28, 2025, the Quang Ngai Provincial Department of Finance, via the National Bidding Network System, invited interested parties to bid on the An Phu New Urban Area project (known as the ‘Gem Island’), located in the wards of Nghia Chanh and Truong Quang Trong, and the commune of Tinh An, in the city of Quang Ngai.

Ninh Binh Expands Tam Diep II Industrial Park

On May 19, the People’s Committee of Ninh Binh province approved the adjusted master plan for the construction of Tam Diep II Industrial Park. The total planned area has been increased from over 363 hectares to 386 hectares, with an additional 23 hectares allocated for the expansion of clean, high-tech, and innovative industrial development.

“Sustainable Ocean Economy: Nurturing Marine Life for a Prosperous Future”

The recently approved marine spatial plan by the National Assembly has created an overarching spatial framework. The merger of provinces has also opened up a broader spatial landscape, an expansive ecosystem, and shaped a biological corridor to holistically approach and learn from the experiences of other countries worldwide.

“VNC Group’s Powerhouse: Trí Việt Investcons’ Asserted Ascendancy”

For almost two decades, VNC Group, a diversified investment enterprise, has been striving to establish its position as a pioneer in innovation and sustainable development. With a steadfast commitment to bringing tangible value to its customers, partners, and the community, VNC Group is dedicated to forging ahead and making a lasting impact.