The annual event, organized by the State Bank, was graced by the presence of the Prime Minister, senior leaders from the banking industry, and representatives of financial organizations.

Contactless Payments: A Convenient, Innovative, and Modern Trend

At the event, Mr. Phung Duy Khuong, Vice Chairman and Executive Vice President of VPBank, shared that one of the most convenient, innovative, and modern lifestyle trends is contactless payments.

Citing data from Mastercard, Mr. Khuong highlighted that Vietnam is among the fastest-growing countries in the region for cashless transactions. While cashless payments are often associated with transfers or card swiping on bulky POS devices, the digital transformation has led to evolving customer expectations towards simplicity and security.

Specifically, customers now demand that all transactions be integrated into their smartphones or smartwatches, enabling them to make payments anywhere globally without carrying cash or even a physical card. This is where the Tap & Pay solution comes into play.

With Tap & Pay, users only need to integrate their cards and accounts into their smartphones or smartwatches, secured by Tokenization technology. They can then make payments by simply tapping their devices on the payment terminal and authenticating with facial recognition, eliminating the need for physical cards.

As of Q4 2024, with the introduction of Tap & Pay and the inclusion of Apple Pay, 60% of transactions are contactless, marking a significant step forward in digital payment behavior and global trends.

VPBank has offered a comprehensive Tap & Pay solution across all mobile operating systems: Samsung Pay, Google Pay, Apple Pay, Garmin Pay, and VPBank Wallet. The bank has witnessed a 70% increase in contactless credit card transactions.

Moreover, Tap & Pay technology now enables customers to integrate their payment accounts directly into their smartphones or wallets, further enhancing convenience.

Mr. Phung Duy Khuong, Vice Chairman and Executive Vice President of VPBank, presents at the event

Mr. Khuong added that VPBank is proud to be the first bank in the Asia-Pacific region to launch ‘Pay by Account’ with Mastercard, a groundbreaking solution that enables direct payments from customers’ accounts through their phones without the need for a physical card. ‘Pay by Account’ expands financial access to millions of Vietnamese.

Besides serving individual customers, VPBank also caters to businesses and households. Businesses and merchants no longer need to invest in costly POS machines (10 million VND per device). Instead, they can accept payments directly on their smartphones or their employees’ phones. Electronic invoices will be sent to the customers’ emails. VPBank’s ‘Tap to Phone’ solution is not just a payment tool but a mobile financial platform for small and medium-sized enterprises, merchants, and retailers.

These contactless payment solutions reflect VPBank’s commitment to the government, the State Bank, and its customers. The bank will continue to invest in and expand its modern cashless payment ecosystem, contributing to the development of a digital economy, a cashless society, and a modern, transparent, safe, and sustainable lifestyle.

While contactless payments have made transactions faster and more convenient, personalizing the experience further requires harnessing the power of data and building a human- and enterprise-centric financial ecosystem.

VPBank representatives introduce their cutting-edge technologies to the Prime Minister

“Paste to Pay”: TPBank’s Impressive Innovation

Among the various technologies showcased at the Banking Industry Digital Transformation Day 2025 on May 29, TPBank’s “Paste to Pay” stood out as a testament to the bank’s unique approach to product development: continuously refreshing old methods with cutting-edge technology and an exceptional understanding of, and anticipation of, customer needs.

“Paste to Pay” is the next evolution of ChatPay, which allows users to transfer money as effortlessly as sending a chat message, simplifying transactions and integrating banking into everyday life.

By leveraging Generative AI and advanced OCR (optical character recognition), TPBank has developed “Paste to Pay” to address a common pain point: the manual process of obtaining account information from messages. With “Paste to Pay,” users can simply copy transaction information from messaging apps like Zalo, Viber, or Messenger and paste it into the TPBank app. The system automatically recognizes details such as account number, amount, and transaction description, completing the transaction in seconds accurately.

Behind this seamless experience is the powerful combination of Generative AI and advanced OCR, enabling TPBank to process even unstructured messages, which is a challenge for most traditional systems. This technology is designed to integrate seamlessly into users’ lives and bear their unique mark.

The Prime Minister visits TPBank’s exhibition booth

Mr. Nguyen Hung, CEO of TPBank, shared, “We believe that technology proves its worth when it seamlessly integrates into users’ lives. ‘Paste to Pay’ is our way of bringing the bank into every chat, every story, and every financial need, no matter how small.”

This innovation aligns with TPBank’s long-standing strategy of personalizing digital financial experiences. From the 24/7 LiveBank to the TPBank app and the integrated financial ecosystem with mini-apps, e-commerce platforms, insurance, and education, TPBank brings the bank to customers instead of waiting for them to come to the bank, meeting their needs precisely when and where they expect it.

With over 98% of transactions now digital, TPBank is not just a technology leader but also a model for merging technology and life. Their digital journey is not about following trends but about understanding and empathizing with user behavior. “Paste to Pay” is the latest testament to this effort, where every technological detail is tailored for the customer experience, and every solution aims for a distinctive digital financial life—unique to TPBank.

Event Highlights

Prime Minister visits HDBank’s digital transformation exhibition – Photo: VGP/Nhat Bac

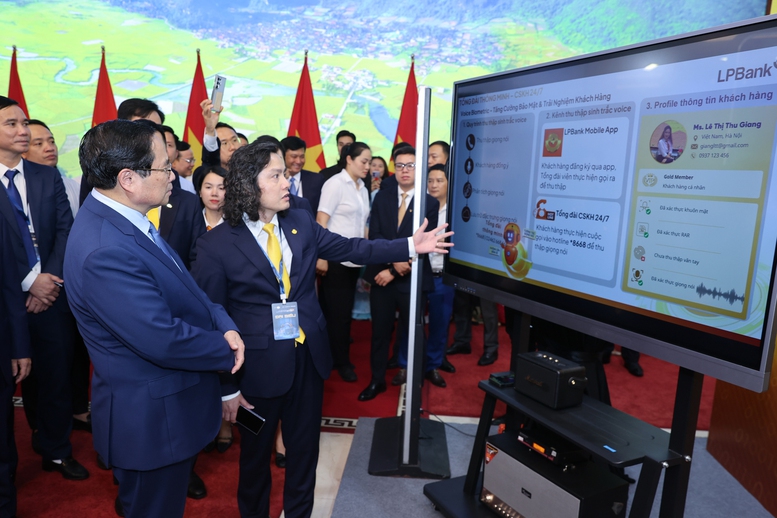

Prime Minister visits LPBank’s digital transformation exhibition – Photo: VGP/Nhat Bac

Prime Minister visits KienlongBank’s digital transformation exhibition – Photo: VGP/Nhat Bac

“MSB Unveils Cutting-Edge Marketing Tech at the 2025 Banking Digital Transformation Event”

Attending the Digital Transformation in Banking 2025 event, the Vietnam Maritime Commercial Joint Stock Bank (MSB) unveiled a host of tech-based financial solutions. These offerings are designed to provide customers with a comprehensive, seamless, and deeply personalized experience.

Unlocking Financial Support: Prime Minister Encourages Banks to Lower Interest Rates for the 500,000 Billion Package

“Speaking at the event, “Digital Transformation Day of the Banking Industry in 2025”, the Prime Minister urged banks to further reduce costs and be “a little more open-hearted” to reduce the interest rate of the VND 500,000 billion credit program for science, technology, innovation, digital transformation, and strategic infrastructure by at least 1.5% compared to medium- and long-term interest rates.”

Unleashing the Power of Digital Transformation: Techcombank Introduces Revolutionary Solutions at the 2025 Banking Industry Digital Transformation Event.

“At the 2025 Banking Digital Transformation event, themed ‘Smart Digital Ecosystem in the New Era’, Techcombank reaffirmed its pioneering position by offering comprehensive digital solutions for corporate customers through its digital banking application. By accelerating its digital transformation and maintaining its market leadership, the bank demonstrated its strong commitment to accompanying the nation in its journey towards a new era of prosperity.”

“Digital Transformation: Empowering Banks to Better Serve Customers and Stay Market-Relevant”

Prime Minister Pham Minh Chinh has outlined key areas where banks need to accelerate their efforts and embrace digitalization to better serve the people and understand the market.