On May 30, 2025, Vietnam National Gas Corporation (GAS) held its 2025 Annual General Meeting of Shareholders.

According to an update report from VietCap Securities, one of the issues raised during the meeting was the potential risk of delisting the company’s stock.

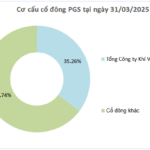

Under the amended Securities Law, GAS is at risk of being delisted as it fails to meet the requirement of having at least 10% of voting shares held by a minimum of 100 retail investors, while the Vietnam National Oil and Gas Group (PVN) currently owns 95.8% of GAS’s shares.

However, at the 2025 AGM, the Chairman of the Board of Directors assured that the expected upcoming Law on State Capital Management will grant an exemption to state-owned enterprises undergoing capital restructuring from the delisting regulation during the transition period.

As of May 30, 2025, PV GAS ranked 12th in market capitalization, with over VND 152,200 billion (equivalent to over USD 5.8 billion).

GAS stock price movement over the past year

GAS announced its preliminary business results for the first five months of 2025, with a commercial gas output of 2.6 billion cubic meters, revenue of VND 46,500 billion, and after-tax profit of VND 5,900 billion.

The management attributed the positive profit to (1) the recognition of provision reversals and (2) favorable international business operations (possibly from the LPG business segment).

These two factors offset the decrease in fuel oil prices compared to the previous year.

The meeting approved a cash dividend payout of VND 2,100 per share for the fiscal year 2024.

GAS announced a significant capital investment plan of VND 65,000 billion for the period of 2026-2030, which is likely to be allocated towards (1) upstream investment in gas fields, (2) midstream investment in LNG terminals (including four LNG centers in Vietnam: Thi Vai, Son My, Central, and Northern) and new gas pipeline projects (such as Lot B and White Tiger Phase 2B), and (3) downstream investment in gas-fired/LNG power plants.

This capital expenditure is equivalent to 95% of GAS’s current total assets and 52% of its market capitalization, indicating a potential need for future equity fundraising.

Strategic investments in LNG infrastructure to maintain its leading position as Vietnam’s top LNG supplier include:

– FSRU Leasing: GAS will lease floating storage and regasification units (FSRUs) to meet short-term LNG demand and expand LNG supply capacity.

– Thi Vai LNG Phase 2 Project: This project aims to increase capacity from 1 million tons/year to 3 million tons/year and is expected to be operational by 2028.

– Nationwide LNG Terminal Network: GAS plans to operate four LNG centers across Vietnam: Northern (Hai Phong), Central, South-Central (Son My – investment preparation completed), and Southern (Thi Vai).

With this extensive network, GAS targets to supply gas to most of the approved LNG-fired power projects in the Power Development Plan VIII.

– LNG imports from the US will be based on economic competitiveness and the goal of reducing the bilateral trade deficit. However, according to the management, price remains a key factor to ensure profitability for GAS.

“PCG Plunges to Historic Lows as Investors Bail Out Ahead of Delisting”

In the month leading up to its forced delisting, PCG’s stock price plummeted, hitting rock bottom at 2,200 VND per share – the lowest since its IPO. The company is mired in crisis with its financial statements rejected by auditors, obscure transactions, and consistent losses over the past three years.