As of April 2025, the total value of corporate bonds in circulation reached nearly VND 1,270 trillion, up 2.3% from the previous month and 6.1% from the same period in 2024, after four consecutive months of decline.

This rebound was mainly due to more vibrant new bond issuance activities, with a total value of VND 46.9 trillion, 2.7 times higher than in March 2024, while the volume of matured corporate bonds decreased sharply (-56% MoM and -76% YoY).

According to FiinGroup data, April 2025 was the first month after four consecutive months of growth in the value of circulating bonds.

Source: FiinGroup

The repurchase of corporate bonds before maturity continued to increase by 41.6% compared to March 2025. In terms of issuance type, the value of privately placed bonds in circulation rebounded, reaching more than VND 1,110 trillion at the end of April 2025, up 2.2% from the end of March 2025, and continued to account for an overwhelming 87.6% of the market.

Meanwhile, despite accounting for only 12.4% of the total circulation value, equivalent to VND 156.6 trillion, publicly issued bonds still recorded a significant increase of 3.2% from the previous month and 25% from the previous year. The main growth driver came from the expansion of public corporate bond issuance in the first four months of 2025.

Repurchases were mainly focused on banks and real estate. Specifically, the repurchase value of real estate was three times higher than the previous month. In the first four months of the year, the total repurchase value before maturity of the whole market decreased by 17% YoY, mainly in banks.

In terms of secondary market transactions, corporate bond trading in April 2025 slightly decreased by 13% from the previous month (MoM) but maintained a high growth rate compared to the same period (+41.4% YoY). Banks and real estate accounted for 78% of the trading value, while financial services recorded remarkable growth with VND 4.5 trillion, up 95.2% MoM and 232% YoY.

In terms of cash flow payments, bond issuers are estimated to have paid VND 42.2 trillion in principal and interest on corporate bonds since the beginning of 2025. The estimated cash flow payment for the second quarter of 2025 is about VND 47.5 trillion, and the market did not record any new cases of late payment in April.

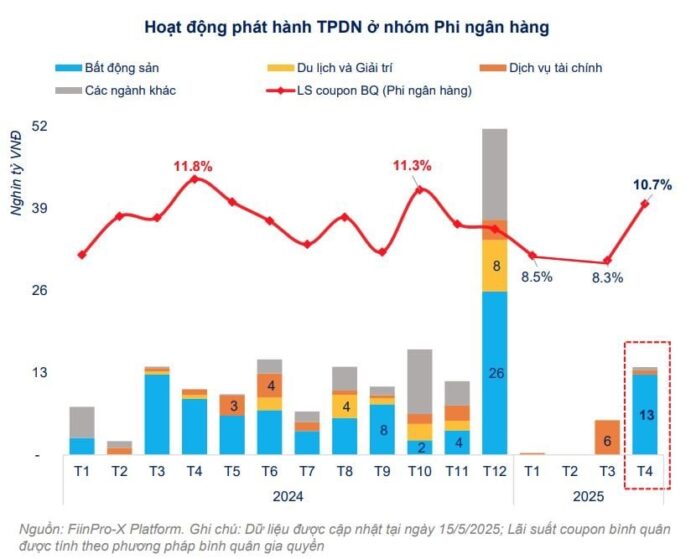

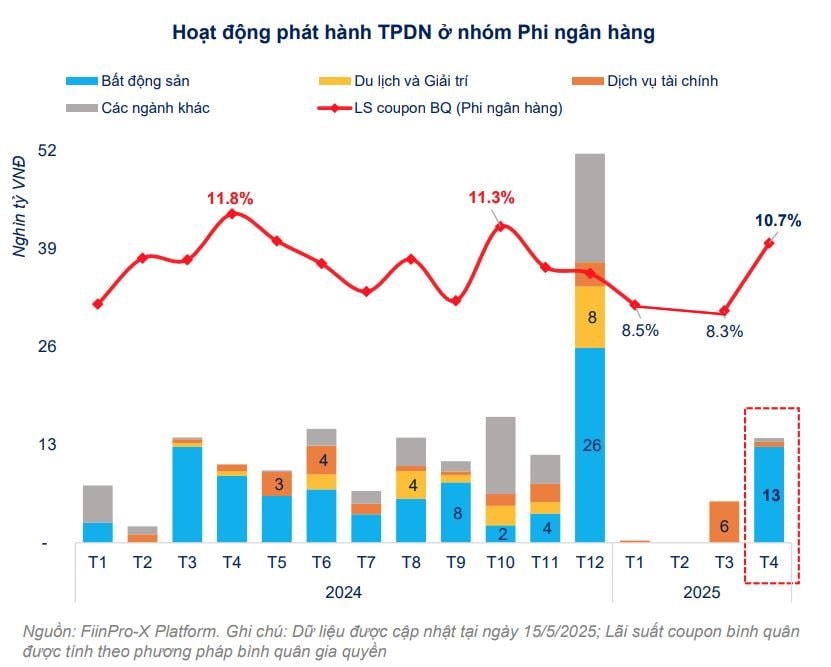

Real estate, led by Vingroup, leads the non-bank group

In April 2025, the value of corporate bond issuance by the non-bank group reached VND 13.9 trillion, surging 152.7% from March 2025 and 33.7% YoY. Despite a noticeable recovery in the month, the cumulative four-month figure shows that the non-bank group has only mobilized a total of VND 19.7 trillion through bonds, down 42% from the same period in 2024. The main reason for this decrease is the stricter regulations in the amended Securities Law 2024 (effective from January 1, 2025) and Circular 76/2024/TT-BTC (effective from December 25, 2024).

According to FiinGroup, an interesting point in April 2025 was the return of the real estate group to the corporate bond market after three months of absence.

The total issuance value of the industry in the month reached VND 12.7 trillion, up 43% from the same period, and accounted for 91.7% of the total issuance volume of the non-bank group in the month. The average coupon interest rate of the real estate group increased to 10.7%/year, significantly higher than the 8.3%/year in the previous month.

The main contributor was Vingroup (VIC), with a total issuance value of VND 9 trillion, marking the first time the enterprise returned to the corporate bond market after a 10-month hiatus.

VIC’s bond tenors averaged 2.5 years, with coupon rates ranging from 12% to 12.5%/year, equivalent to the coupon rate in the 2023-2024 period.

Notably, according to FiinGroup’s observations, in April 2025, some issuers started to implement the stricter requirements of the amended Securities Law regarding corporate bond issuance.

Accordingly, out of the 10 non-bank corporate bond codes issued in April, 2 codes were voluntarily rated by the issuers (including Real Estate Company TCO and Business Company F88). In addition, the market recorded 3 codes with collateral and 2 codes with payment guarantees.

The Gió Riverside Apartments: Prestigious River View Residences in the Heart of the East

The apartments in the Dong Gio tower at The Gio Riverside boast stunning views of the Dong Nai River and the future administrative center, “Bien Hoa Dong Pho”. With premium amenities and an enviable location in the eastern part of Ho Chi Minh City, these residences embody an upscale lifestyle.

Can Surplus Office Spaces Post-Merger be Transformed into Social Housing?

Amid challenges in developing social housing across the country, the Land Management Authority has proposed an innovative solution. They suggest repurposing surplus government offices, resulting from mergers, into social housing. This proposal offers a potential win-win situation by addressing the need for social housing while making efficient use of existing resources.

“A Province’s Ambitious $300 Million Project: A Secluded Island Retreat Spanning 118 Acres on the Embracing Dong Nai River”

The Kim Quy Island project is an impressive development, spanning over 48 hectares of land with a total investment of 7.2 trillion VND. This ambitious project comprises 571 units of detached and semi-detached villas and townhouses, offering a luxurious and exclusive lifestyle to its residents. With a vast array of amenities and a prime location, Kim Quy Island is set to become a prestigious and highly desirable address.