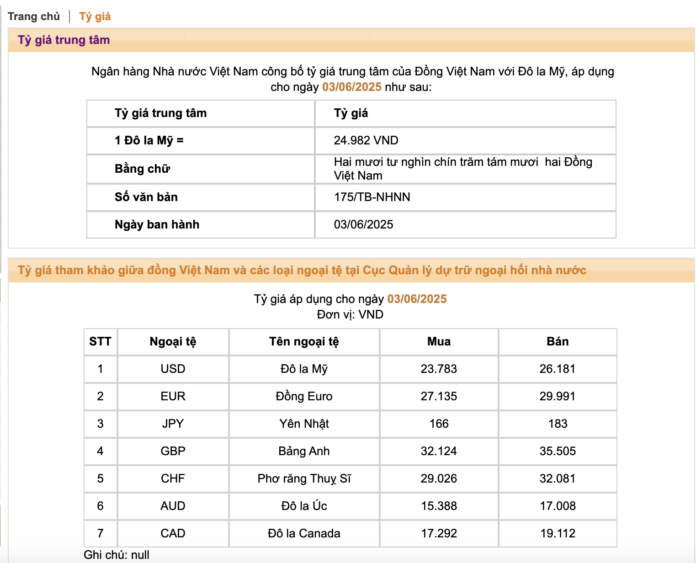

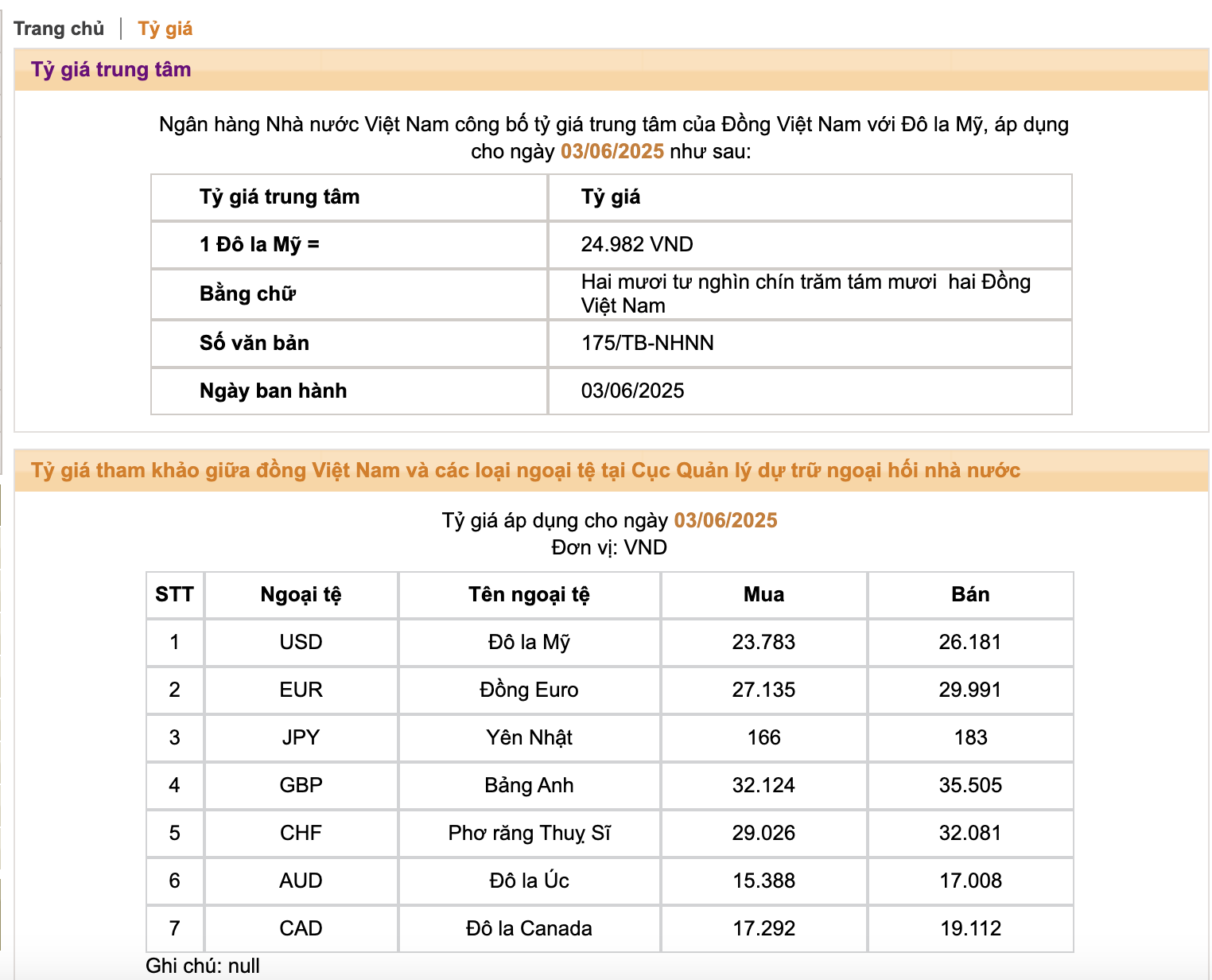

The State Bank of Vietnam has announced the USD/VND central exchange rate for today (June 3rd) at 24,982 VND/USD, a 12-fold increase compared to yesterday’s session. This is also the highest level in history since this mechanism was applied at the beginning of 2016.

With a 5% margin, the current allowable trading range for commercial banks is from 23,733 to 26,231 VND/USD.

The State Bank of Vietnam’s Trading Center also adjusted the reference buying and selling rates accordingly, to the range of 23,783 – 26,181 VND/USD.

This morning, USD exchange rates at banks continued to set new records.

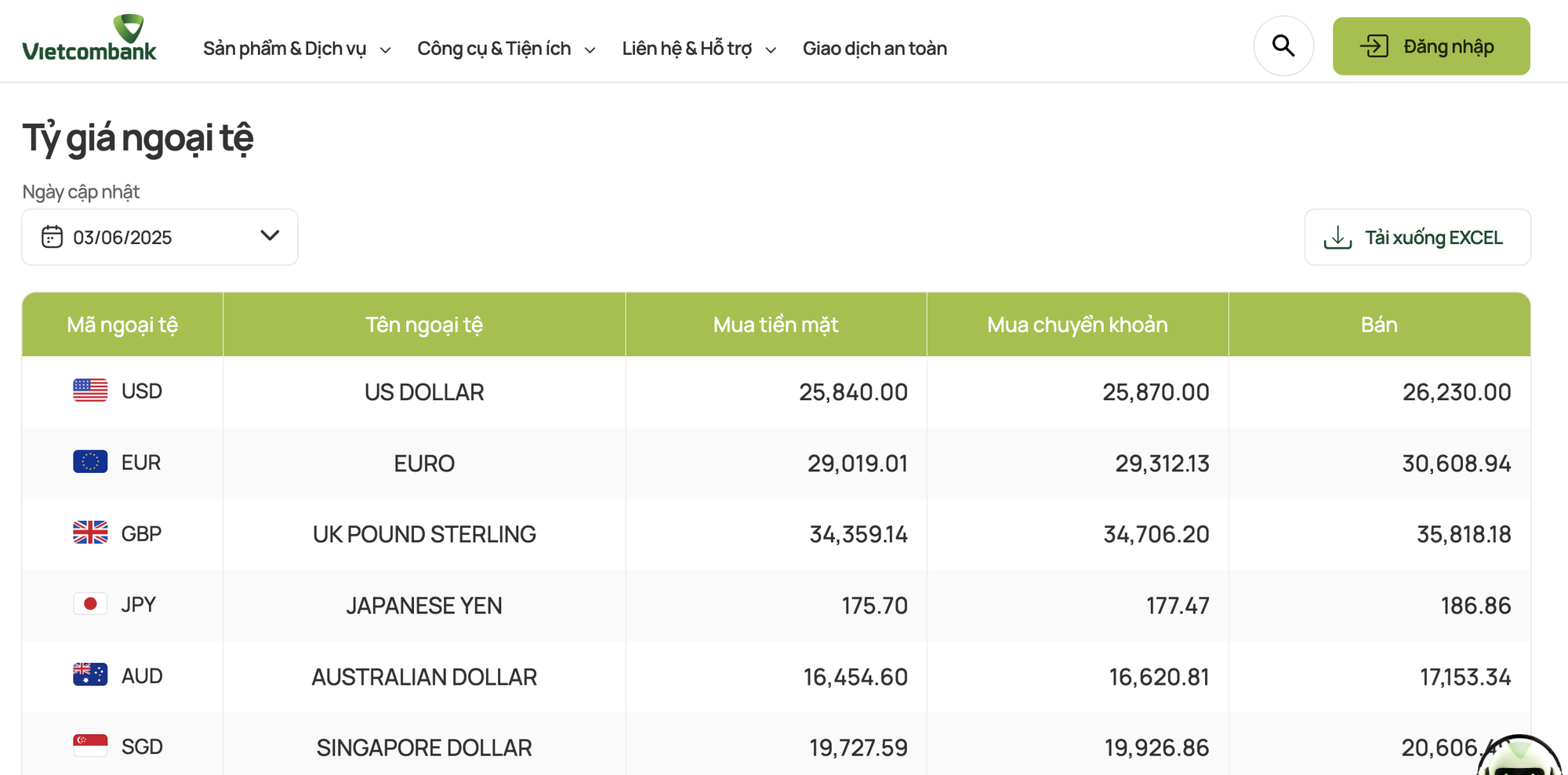

At 10:00 am, Vietcombank, the bank with the largest foreign exchange transaction volume in the system, listed the USD buying and selling rates at 25,840 – 26,230 VND/USD, an increase of 20 VND in both directions compared to yesterday morning, just one step away from the allowable trading ceiling. BIDV also increased by 8 VND in both directions, buying and selling at 25,858 – 26,218 VND/USD. Meanwhile, VietinBank increased the buying price by 24 VND and the selling price by 19 VND, trading at the ceiling price of 25,876 – 26,231 VND/USD.

In the group of private banks, Techcombank and Eximbank also raised their selling price to the ceiling of 26,231 VND/USD.

In the interbank market, the exchange rate ended on June 2nd at 26,030 VND/USD, a decrease of 05 VND compared to May 30th.

In the self-traded market, the US dollar also showed a downward trend. A survey at 10:00 am this morning showed that the US dollar is currently traded at 26,230 – 26,330 VND/USD, with both buying and selling prices decreasing by 50 VND compared to yesterday.

The USD/VND exchange rate in banks hits the ceiling and reaches an all-time high, while the US dollar slightly recovers in the international market, although it remains at a three-year low. The US Dollar Index (DXY), which measures the strength of the greenback against other major currencies, currently hovers around 98.9 points.

The US dollar has fallen for the fifth consecutive month against other major currencies as traders brace for new turmoil in trade and US fiscal health. Currently, the US dollar is 4.5% lower than its April 2nd level when President Donald Trump began announcing tariffs, causing foreign investors to flee the US stock and bond markets.

According to MBS Securities, the USD/VND exchange rate rises despite the weakness of the US dollar in the international market, partly due to the State Treasury’s continued purchase of USD from commercial banks, limiting foreign currency supply. In addition, the demand for foreign currency from businesses increases amid global trade instability.

Moreover, the deep decline in VND interbank interest rates has caused the VND-USD interest rate differential to reverse sharply, putting additional pressure on the exchange rate.

MBS experts forecast that the USD/VND exchange rate will fluctuate within the range of 25,500 – 26,000 VND/USD in 2025, as the US dollar recovers from expansionary fiscal policies, high-interest rates, and US trade protectionism, which are expected to support the appreciation of the US dollar this year.

In addition, the unpredictable tariff policies from the US are expected to create challenges for Vietnam’s exports and FDI attraction in the coming time and may put pressure on foreign reserves – which are already modest after selling more than $9 billion last year.

Nevertheless, positive macroeconomic factors such as trade surplus ($3.79 billion), FDI disbursement ($6.74 billion), and strong international visitor growth (up 23.8% over the same period) are expected to continue supporting the VND.

“June 2nd: VietinBank and Sacombank Push USD Rates Higher, Setting a New Peak for Dollar Value”

This morning, the USD exchange rate at banks continued its upward trajectory, reaching new highs despite the State Bank’s decision to lower the central exchange rate.

“Dollar and Yuan Dance to Different Tunes: A Tale of Contrasting Fortunes.”

“As of 8:30 a.m. on June 2nd, the USD exchange rate at Vietcombank and BIDV was set at 23,850-23,210 VND/USD for buying and selling, respectively. This marks an increase of 20 VND in both buying and selling rates compared to the morning of May 30th, indicating a slight strengthening of the USD against the VND in the interbank market.”

“Dollar and Yuan Rise Against the Tide: A Commercial Bank Perspective.”

As of 8:30 a.m. on May 29, the USD exchange rate at Vietcombank was set at 23.780-23.140.00 VND/USD (buy-sell), witnessing a rise of 40 VND in both buying and selling rates compared to the previous day, May 28.