Deposit interest rates stable at low levels

After several consecutive months of banks cutting deposit interest rates to promote cheap capital within the banking system, the trend seems to have cooled down in May. The market no longer witnessed simultaneous adjustments as before, but rather a cautious and clear differentiation among banks, with only a few units continuing to lower interest rates.

According to statistics from the State Bank of Vietnam, as of the end of May, 30 credit institutions had reduced deposit interest rates, with an adjustment margin of 0-1.05%/year.

However, in May, only four banks, including VPBank, MB, Eximbank, and GPBank, adjusted their deposit interest rates downward. Similarly, in April, only nine units made such a move, indicating that the downward trend in interest rates is slowing down and is no longer rampant as it was at the beginning of the year.

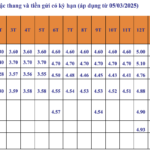

By the beginning of June, only three banks publicly offered deposit interest rates above 6%/year. These included Bac A Bank, HDBank, and the digital bank Vikki Bank, a subsidiary of the HDBank ecosystem.

Specifically, at Bac A Bank, the highest interest rate of 6.2%/year is applied to deposits of one billion VND or more, with a term of 18-36 months. In addition, customers who deposit one billion VND for 13-15 months also enjoy a rate of 6%/year, while those with smaller amounts for the same term receive 5.9-6%/year.

Deposit interest rates remain low (Photo: Nhu Y)

At HDBank, the interest rate of 6%/year is applied to a 15-month term, while the highest rate of 6.1%/year is offered for an 18-month term.

Vikki Bank offers an interest rate of 6%/year for terms of 13 months or longer. Online savings rates at this bank range from 4.15%/year (one-month term) to 5.95%/year (12-month term), indicating a significant difference between short and long-term rates.

In contrast, the group of state-owned banks (Agribank, Vietcombank, VietinBank, and BIDV) continues to maintain their role in stabilizing interest rates at low levels. Currently, the highest interest rate in this group is only 5%/year, while the lowest is around 1.6%/year – and in some cases, the rate is as low as 1.59%/year…

These developments indicate that deposit interest rates are stabilizing at low levels.

Will interest rates continue to fall?

According to some experts, the deposit interest rates of banks in Vietnam are currently at their lowest levels in the last two years. This occurs as the State Bank of Vietnam remains committed to stabilizing interest rates and supporting credit growth.

According to statistics from BSC Research and KBSV Research, the average deposit interest rate at banks has decreased by 6-7% compared to the peak in 2023.

In their latest interest rate outlook, ABS Research expects interest rates to remain low or slightly decrease in the coming period, given the stable banking system liquidity and manageable inflation pressure. However, interest rates also face pressure from improving credit demand, while capital mobilization faces strong competition from alternative investment channels such as real estate and securities.

Previously, analysts predicted that deposit interest rates would increase slightly but only towards the end of the year. Specifically, KBSV Research forecasted that deposit interest rates are likely to increase by 1-2% in the new cycle, starting from the fourth quarter of this year.

Mirae Asset Securities believes that banks will no longer have much room to flexibly regulate liquidity as before. The pressure to balance capital sources will force banks to narrow the gap between credit and mobilization, even through less popular tools such as deposit certificates due to their high costs.

Latest HDBank Interest Rates for June 2025: Which Term Deposit Offers the Best Returns?

As of early June 2025, HDBank offers a maximum interest rate of 6.1% per annum for regular deposits. This competitive rate positions HDBank as a leading player in the industry, providing customers with an attractive option for their savings and investments. With this offering, HDBank demonstrates its commitment to delivering value and helping its customers grow their wealth.

“Bank Interest Rates on May 28: Unveiling the Top-Tier Institutions with the Highest Yields”

With a substantial deposit to invest, ranging from hundreds of billions to trillions of VND, customers can now take advantage of an attractive interest rate of 7.5%-9.65%. This opportunity is presented by four prominent banks: ABBank, PVcomBank, HDBank, and Vikki Bank. It’s time to make your money work harder for you!

Latest SHB Bank Interest Rates for May 2025: Which Term Deposit Offers the Best Rates?

“In May 2025, SHB offered its highest interest rates to individual customers who deposited their money online for 36 months or more.”