On June 5, 2025, KDC Corporation (stock code KDC) held its 2025 Annual General Meeting of Shareholders, approving a target of 13,000 billion VND in revenue, a 56% increase, and 800 billion VND in pre-tax profit, a significant 662% surge compared to 2024’s performance.

In 2024, KDC recorded a 3.7% decrease in revenue, amounting to 8,331 billion VND, while post-tax profit dropped by 50% to 67 billion VND compared to 2023. The main reason for this decline was the significant decrease in financial revenue as the company did not record over a thousand billion VND from liquidation as in 2023.

Looking ahead to 2025, KDC anticipates ongoing challenges in the global economy, despite a reduction in the severity of the recession. Geopolitical factors such as the Russia-Ukraine conflict, instability in the Middle East, and the impact of US politics will continue to cause economic fluctuations. Notably, Vietnam’s major trading partners, including the US, Europe, and China, are expected to face negative consequences from the unstable global environment and reduced demand.

However, KDC remains optimistic about Vietnam’s economic growth prospects for 2025. Currently, KDC operates in various sectors: (i) edible oil industry, (ii) butter industry, (iii) spice industry (with holdings in Tuong An, Vocarimex, and KIDO Nha Be), (iv) bakery industry (including fresh, dry, and mooncakes), and (v) steamed bun & frozen dim sum industry (with the acquisition of Tho Phat).

At the meeting, KDC announced its leading market share in the edible oil and butter industries. The company has also recently expanded into the spice market. In late May 2025, Tuong An launched two new product lines: Tuong An Unicook soy sauce and chili sauce.

“After two years of restructuring, KDC has essentially completed its transformation,” said Mr. Tran Le Nguyen. He added, “In the fresh bakery sector, our monthly sales have reached 50-60 billion VND, and our products have been well-received since KDC’s return to the market. As for the dry bakery business, it took time to collaborate and develop after acquiring Tho Phat, but our steamed bun business has started contributing effectively to the corporation.”

Introducing real estate project ideas: Whale Bay, KDC Central Tower…

At the AGM, KDC submitted a proposal to authorize the Board of Directors to proactively seek cooperation opportunities with other entities to develop the existing land fund within the ecosystem.

The management team shared that alongside executing strategies for core businesses (edible oil, butter, spices, bakery, and e-commerce), the corporation will seek potential partners to attract investment in constructing commercial retail projects, shopping complexes, offices, apartments, etc., from the existing land fund to create a synergy in revenue and profits.

Upcoming real estate project ideas by KDC include Whale Bay, expected to be a tourist attraction; KDC Central Tower, located in a prime area; and KDC Residence.

Mr. Nguyen further shared that KDC’s land plots are gradually resolving legal issues to restart the projects. He emphasized that many of these projects hold significant value, and their successful development could substantially enhance the corporation’s current stock value.

Regarding the 8-12 Le Duan project, KDC representatives shared a positive update after the government issued Decree 68 and Decree 171. KDC is now approaching and fulfilling legal procedures to implement the project, and the state agency is processing KDC’s dossier.

In Q4 2023, KDC provisioned 753 billion VND for the Lavenue project at 8-12 Le Duan. In 2010, KDC acquired Lavenue’s shares, and by 2024, after a long period of legal procedures, project investments, and emerging issues affecting KDC’s separate and consolidated financial statements for multiple periods and years, the management team decided to provision for this investment.

Bringing Hung Vuong Plaza and Van Hanh Mall under the Corporation

Mr. Tran Le Nguyen – CEO of KDC.

In the commercial center segment, KDC plans to bring projects under the corporation’s umbrella.

In 2024, KDC successfully brought Hung Vuong Plaza into the fold by investing in and holding a controlling stake of 75.39%, expanding the corporation’s retail ecosystem and adding a modern commercial center to its investment portfolio.

“Previously, when Hung Vuong Plaza was self-operated, it achieved over 90% capacity, and since KDC took over, it has consistently maintained near-full capacity, providing a stable cash flow for the corporate ecosystem,” shared a representative.

KDC also plans to bring Van Hanh Mall under the corporation soon. Additionally, KDC revealed that they possess attractive land plots for mega projects, which could attract significant investment and commercial value.

Continuing to present shareholder opinions on the percentage of shares held in KDF and issues related to the KIDO brand

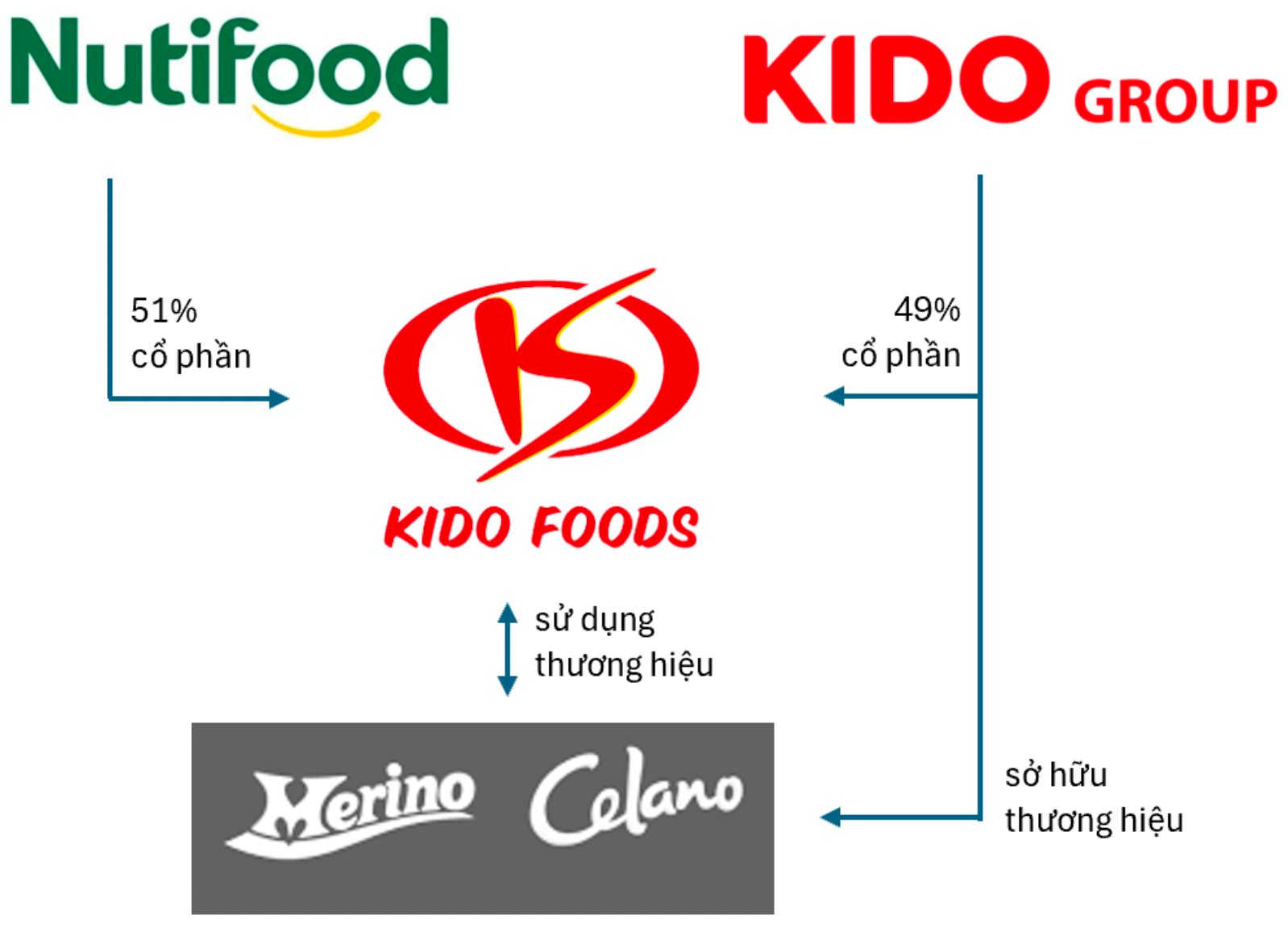

Addressing the dispute with Nutifood over the transfer of 24% capital in KIDO Foods (KDF), Mr. Nguyen shared that six months after KDC’s Extraordinary General Meeting unanimously decided against transferring to a partner, Nutifood has not provided any response.

Nonetheless, Mr. Nguyen confirmed that KDC still owns KDF.

Recalling the events, in 2023, KDC resolved to transfer 24.03% of KDF’s capital, reducing its ownership to 49% and relinquishing control of the enterprise. However, in September 2024, Nutifood announced it had become the parent company of Kido Foods (KDF) after completing the purchase of 51% of the capital from multiple sellers.

KDF is a company that manufactures and distributes the two largest ice cream brands in Vietnam, Merino and Celano. Although KDC no longer holds a controlling stake in the ice cream business, it asserts that Merino and Celano remain brands owned by the corporation.

Notably, since the beginning of 2022, KDC has been undertaking legal procedures to transfer all brand ownership from its subsidiaries to the corporation, including Vocarimex, Tuong An Oil, KIDO Foods, and KIDO Nha Be.

Specifically, KDF transferred the intellectual property rights of 34 brands, including Celano and Merino. The transaction between the two parties was signed in June 2022, confirmed by the National Office of Intellectual Property in August 2022, and amended in December 2023.

KDC also held an Extraordinary General Meeting on January 24, 2025, where shareholders voted on four critical issues:

+ Disapproval of the transaction to sell 24.03% of KDF shares

+ Disapproval of the transfer of the Celano trademark

+ Disapproval of the transfer of the Merino trademark

+ Disapproval of the transfer of the KIDO trademark

The voting results showed that all four items were approved. Specifically, the item “Disapproval of the transaction to sell 24.03% of KDF shares” received a 91.3% approval rate. The remaining three items, including the disapproval of transferring the Celano, Merino, and KIDO trademarks, were approved with a rate of over 99.1%.

At this AGM, KDC once again submitted a proposal for shareholders’ opinions on the 49% stake in KDF and issues related to the KIDO, Celano, and Merino trademarks. KDC requested the AGM’s consideration and approval to authorize the Board of Directors to decide on all matters related to the 49% stake in KDF and all issues related to the Merino and Celano trademarks, as these matters lack clear regulations.

The Real Estate Industry’s Struggle with a Mountain of Project Red Tape

“The implementation of the trio of new real estate laws has had a muted impact on the industry over the past ten months. Businesses have expressed that the laws have not significantly affected various segments of the market. The journey of a project from conception to completion remains a tedious one, fraught with a maze of procedures and a hundred bureaucratic hoops to jump through, each demanding their pound of red tape and seals of approval.”

The Average Vietnamese Income Script Achieves $28,370 Annually

According to experts, for Vietnam to join the ranks of high-income countries, there needs to be a period where its GDP growth reaches double digits (over 10%). This is an unprecedented threshold, an ambitious goal, yet not an impossible one. An ambitious scenario targets an 11-12% annual GDP growth rate during the 2025-2035 period, elevating per capita income to $28,370 by 2045.