**Becamex IDC to Raise Capital and Seek Shareholder Approval**

Becamex IDC, one of the leading industrial development corporations in Vietnam, has announced that June 19th will be the record date for seeking shareholder approval through a written resolution. The company plans to propose a public offering of additional shares to increase its charter capital and will seek approval within July 2025.

Prior to this announcement, Becamex IDC had planned to auction 300 million shares at a starting price of VND 69,600 per share on April 28th at the Ho Chi Minh City Stock Exchange. A successful auction could have brought in a minimum of VND 20,880 billion.

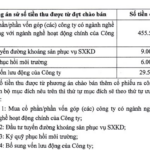

The proceeds from the public offering were intended to be allocated towards expanding the Cay Truong and Bau Bang industrial parks and investing in the Vietnam-Singapore Industrial Park (VSIP) joint venture. Additionally, the company aimed to use nearly VND 4,300 billion to repay short-term loans to BIDV and Vietinbank, as per their financial reports.

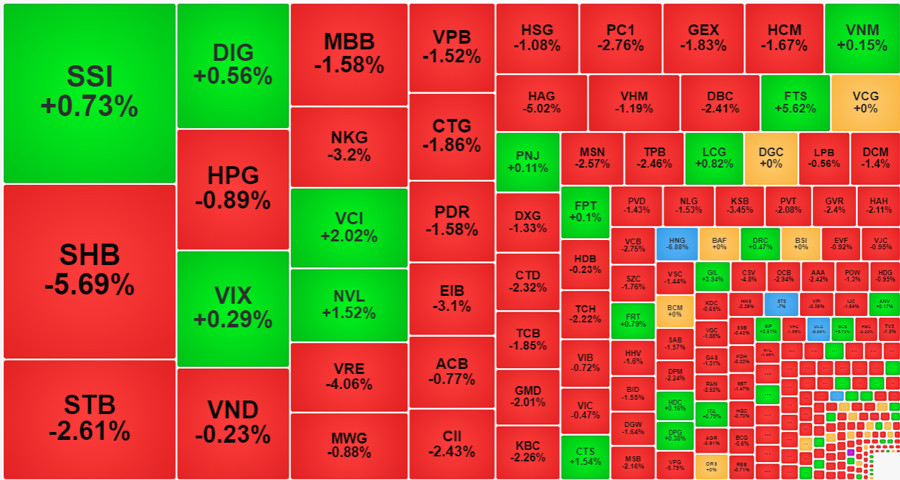

However, amidst a market downturn in early April due to tax policy changes affecting industrial real estate, Becamex IDC decided to postpone the public offering of shares.

Illustrative image

In Q1 of 2025, Becamex IDC reported impressive financial results with a revenue of nearly VND 1,843 billion, more than doubling their revenue from the previous year. While gross profit increased by 23% to VND 704 billion, net profit after tax reached over VND 358 billion, triple the amount from the same period last year.

For the full year of 2025, the company has set ambitious targets, aiming for a consolidated revenue of VND 9,500 billion, a 29% increase from 2024, and a net profit after tax of VND 2,470 billion, a 3% rise from the previous year.

Regarding dividend distribution, Becamex IDC proposed an 11% dividend payout for 2024, amounting to VND 1,138.5 billion, to be paid in 2025. For 2025, the company plans to distribute a 10% dividend, totaling VND 1,148.8 billion.

Vinhomes Unveils Plans for Two Industrial Parks in Hai Phong with a Massive Investment of nearly $430 Million

Let me know if you would like me to provide any additional revisions or if you have another writing task for me!

The Ngu Phuc Industrial Park (Phase 1), spanning over 238 hectares in Ngu Phuc and Kien Quoc communes (Kien Thuy district), and the Tan Trao Industrial Park (Phase 1), covering more than 226 hectares in Tan Trao and Kien Quoc communes, are set to be the newest and most promising industrial hubs in the region.

The Mineral Company’s Ambitious Plans: Offering Shares to Acquire Large Reserves with a 581% Upsurge

“Following the distribution of dividends in 2024, Minco will offer a rights issue, providing existing shareholders with the opportunity to purchase additional shares. Specifically, for every 100 shares owned, shareholders will be entitled to buy 581 new shares, representing a substantial increase of up to 581%.”

Financial Synergies, Economic Connections: Who’s Your Strategic Financial Partner?

Industrial parks and the real estate sector may experience short-term impacts due to changing tariff policies. However, the recent resolution to merge 34 provinces and cities into mega industrial powerhouses will create a significant boost to the economy. This strategic move will foster long-term economic growth and continue to attract foreign investment, creating a vibrant and prosperous future.