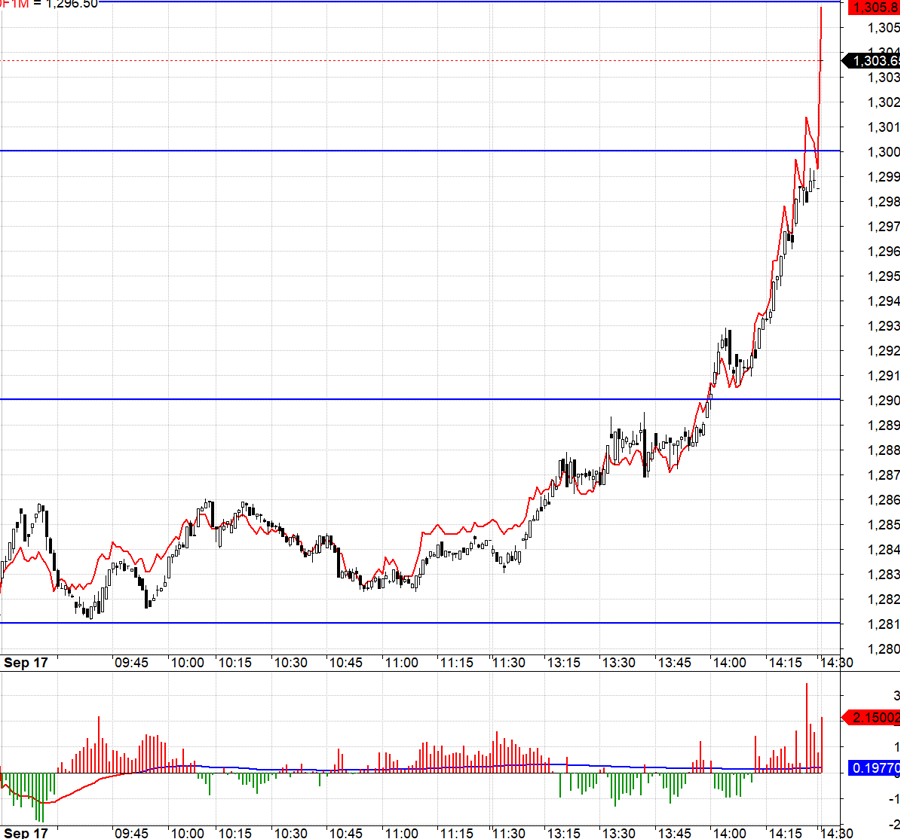

The matching auction transactions of the two listed exchanges this afternoon were about 16% lower than in the morning, but that doesn’t mean the selling pressure decreased. The buyers withdrew, weakening the demand and creating conditions for a deeper price drop. VN-Index continues to plummet to the lowest level at the close, losing 15.34 points, equivalent to -1.3%, with nearly 4 times more declining stocks than rising stocks.

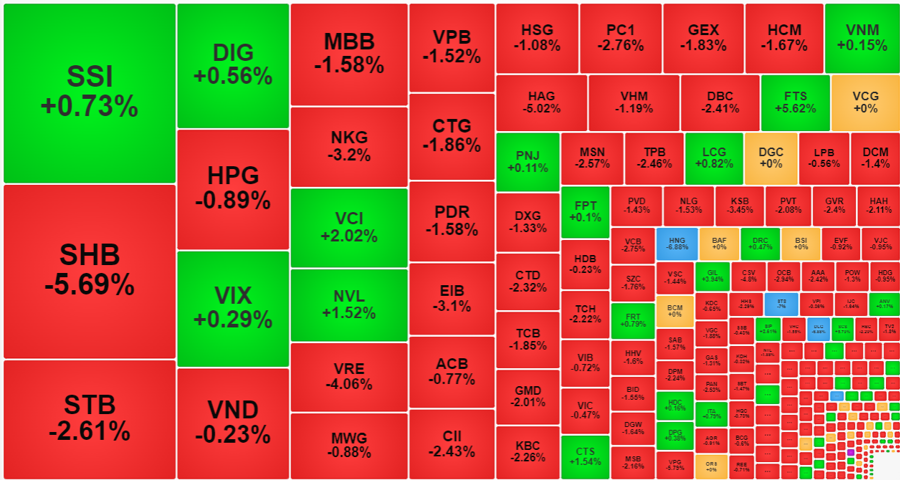

The “culprit” of the index is obviously still the banking group, with VCB even expected to hit the floor price at the close. VCB is not the weakest stock in this group, but the 2.75% decline, coupled with the largest market capitalization, has a serious impact. This stock alone has caused VN-Index to lose more than 2.6 points. Banks continue to account for 6 out of 10 stocks that declined the most.

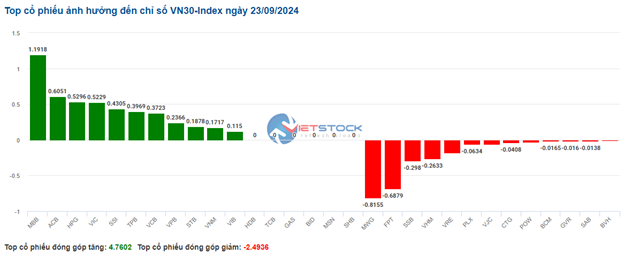

In the morning session, the banking group accounted for 8 out of 10 stocks. This confirms that there are more pillars that fell sharply compared to the morning session. Specifically, MSN decreased by 2.57%, GAS decreased by 1.31%, VHM decreased by 1.19%, GVR decreased by 2.4%… VN30 basket closed down 1.3%, with only 3 stocks rising but 26 stocks declining. There are 7 stocks in the red group that decreased by more than 2%, and another 10 stocks decreased from 1% to 2%. The rising stocks include SSI increased by 0.73%, FPT increased by 0.1%, and VNM increased by 0.15%.

The selling pressure can be clearly seen, especially in the excellent stocks in the morning session such as securities. At the close of the morning session, this group had 6 declining stocks out of 21, in which 17 stocks increased by more than 1%. At the end of the afternoon session, there were still 12 stocks rising, but only 7 stocks rose by more than 1%.

The matched trading volume of the two listed exchanges this afternoon reached 10,533 billion VND, a decrease of 16% compared to the morning session. HoSE decreased by 15% with 9,785 billion VND. Although trading volume decreased, the reason was that the buyers withdrew more orders. Evidence for this is that although the breadth is not much different from the morning session (106 rising stocks/346 declining stocks and 101 rising stocks/393 declining stocks), in the morning session, there were only 116 stocks that dropped by more than 1% in VN-Index, while in the afternoon, there were 160 stocks.

Banks, steel, and real estate stocks are experiencing strong selling pressure. SHB and STB even traded at 1,509.7 billion VND and 1,037.3 billion VND, respectively, corresponding to decreases of -5.69% and -2.61%. SHB also had an unusually high liquidity session of 1,129 billion VND on January 10, but today’s closing price was even lower. Steel stocks like NKG and HSG had strong trading sessions last week but declined significantly today with very high liquidity. Real estate stocks still have some stocks maintaining the green color, such as DIG increasing by 0.56%, NVL increasing by 1.52%, but there are also many stocks with significant decrease.

Among the 101 stocks on HoSE that reversed, 36 stocks are still increasing by more than 1%, but most of them have very low liquidity. The prominent representatives are SCS increasing by 5.79% with 29.3 billion VND traded, FTS increasing by 5.62% with 201.8 billion VND traded, RDP increasing by 4.25% with 10.1 billion VND traded, GIL increasing by 3.94% with 55 billion VND traded, DHC increasing by 3.93% with 26.1 billion VND traded, SIP increasing by 2.51% with 33 billion VND traded, VCI increasing by 2.02% with 474.3 billion VND traded, MSH increasing by 1.56% with 12.8 billion VND traded, CTS increasing by 1.54% with 112 billion VND traded.

Foreign investors had balanced trading this afternoon, with a slight net buying of 24.4 billion VND on HoSE, and the total net buying for the day was 121.4 billion VND. The stocks that were still well bought were SSI with a net buying of 194.9 billion VND, HPG with a net buying of 113.2 billion VND, AAA with a net buying of 94.9 billion VND, VIX with a net buying of 79.5 billion VND, HSG with a net buying of 57.4 billion VND, VCI with a net buying of 56.3 billion VND, VPB with a net buying of 43.5 billion VND, VCB with a net buying of 43.4 billion VND, FTS with a net buying of 40.4 billion VND. The net selling side includes VRE with a net selling of 184.5 billion VND, VNM with a net selling of 93.4 billion VND, VND with a net selling of 69.9 billion VND, VCB with a net selling of 49.7 billion VND, VIC with a net selling of 37.5 billion VND, GEX with a net selling of 22.5 billion VND, GMD with a net selling of 22.4 billion VND, HAG with a net selling of 20.8 billion VND…

The sharp decline of banking stocks, which is a major force affecting the entire market, is not surprising. This group has reduced the price momentum significantly in the past two weeks, along with weakened liquidity. However, a simultaneous and significant reversal has not occurred yet. Today is a very negative day, making the opportunity for VN-Index to surpass the previous week’s high seem distant.