In his second letter, billionaire Tran Ba Duong, Chairman of THACO, shared the results and profit plans of THACO and its member groups from 2024 to 2027 regarding their investment in the North-South High-Speed Rail Project.

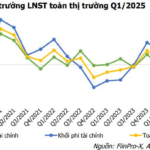

According to the letter, in 2024, THACO recorded a consolidated after-tax profit of VND 3,228 billion, with the majority of the profit coming from Thaco Auto, which posted a consolidated pre-adjustment after-tax profit of VND 4,410 billion. This was followed by Thaco Industries, Thilogi, and Thadico – DQM with profits of VND 312 billion, VND 251 billion, and VND 242 billion, respectively. Thisco and Thaco Agri had profits of VND 76 billion and VND 3 billion, respectively.

THACO’s after-tax profit in 2024 saw an 18% increase compared to 2023, which stood at VND 2,734 billion. Prior to this, THACO’s profit in 2023 had witnessed a significant drop of 63%, reaching its lowest point in nine years.

THACO experienced rapid growth between 2013 and 2016. In 2013, its after-tax profit surged by 357% to VND 1,121 billion, and it has maintained profits above VND 1,000 billion since then. The group peaked in 2016, recording an after-tax profit of VND 7,993 billion.

As of the end of 2023, THACO’s total assets exceeded VND 170,500 billion, with liabilities totaling over VND 118,000 billion.

The company has set ambitious profit plans for the upcoming years, with an after-tax profit target of VND 6,021 billion for 2025, representing an 87% increase compared to the same period. For 2026, the target is set at VND 11,230 billion, an 87% jump from the 2025 plan, and by 2027, the profit is projected to reach VND 16,089 billion, a 43% increase over the 2026 plan. Simultaneously, the company anticipates that from 2027 onwards, the average after-tax profit will be maintained at a minimum of VND 15,000 billion per year.

THACO was established in 1997 in Dong Nai by Mr. Tran Ba Duong, who also serves as its Chairman. Starting as a company specializing in importing used cars and providing auto parts and repair services, THACO has diversified into six member groups: Thaco Auto (automotive), Thaco Industries (mechanics and supporting industries), Thaco Agri (agriculture), Thadico (investment and construction), Thisco (trade and services), and Thilogi (logistics).

Mr. Duong’s letter mentioned that for Thaco Auto, the market underwent a significant correction in 2023, following a high in 2022, and despite intense competition, necessary changes have been made to ensure high revenue and stable profit growth in 2024 and subsequent years.

Regarding Thadico (Dai Quang Minh), on April 24, 2025, the government issued Decree No. 91/2025/ND-CP, which resolved all obstacles that had persisted for seven years. As a result, the Sala Urban Area project can resume sales and construction this year, leading to positive profit growth plans for 2025 and beyond.

In 2018, THACO invested in and provided financial support to HAGL for their transition from rubber and oil trees to fruit trees. By 2021, THACO had taken over more than 85,000 hectares of land and nearly USD 2 billion in debt. They have since systematically replaced old gardens, invested in technical infrastructure, planted new fruit trees, and started to see a significant and stable increase in profits this year.

The other member groups are also performing efficiently, contributing stable profits, and are expected to demonstrate strong growth in the coming years.