|

Source: VietstockFinance, BVSC 2025 Annual General Meeting Documents

|

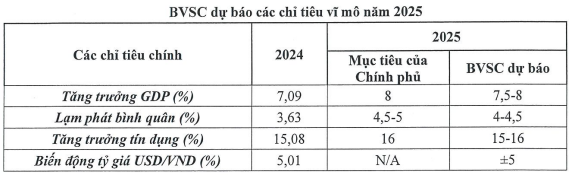

In its 2025 economic outlook, BVSC identifies several positive factors that could contribute to GDP growth: (1) an enhanced public investment plan serving as a key growth driver, (2) the passage and upcoming enforcement of amended laws, (3) continued success in FDI attraction, and (4) the government’s consideration to extend the 2% VAT reduction through the end of 2026.

However, GDP growth also faces risks from potential changes in tariffs by the US, Vietnam’s largest export partner.

BVSC forecasts inflation to remain manageable, with persistent pressure on exchange rates. The monetary policy is expected to maintain its accommodative stance, keeping interest rates low to support economic growth.

|

Source: BVSC 2025 Annual General Meeting Documents

|

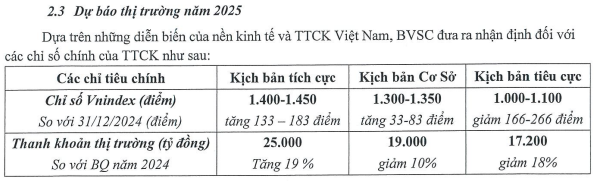

For the 2025 stock market, BVSC presents three scenarios. The positive scenario projects the VN-Index to close the year at 1,400 – 1,450 points with an average liquidity of VND 25,000 billion. The base case scenario targets 1,300 – 1,350 points and VND 19,000 billion in liquidity, while the negative scenario foresees a decline to 1,000 – 1,100 points with VND 17,200 billion in liquidity.

|

Source: BVSC 2025 Annual General Meeting Documents

|

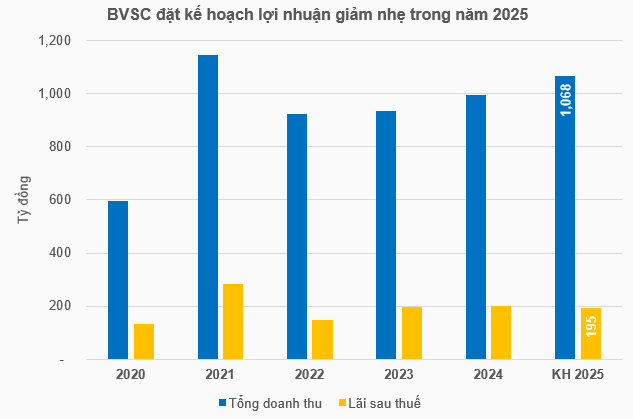

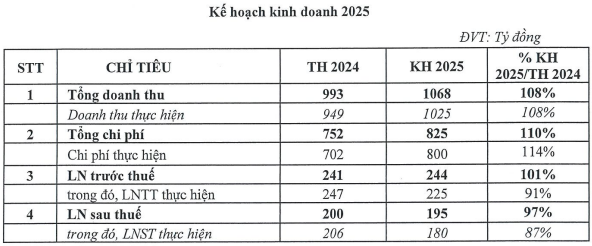

Based on the positive scenario, BVSC’s Board of Directors proposes a 2025 business plan with a total revenue of VND 1,068 billion, an 8% increase from the previous year. This growth is primarily driven by an 8% increase in operating revenue to VND 1,025 billion, focusing on core activities such as brokerage (+1.3%), margin lending and interest income (+10%), and proprietary trading (+14%).

However, total expenses are also projected to rise by 10% to VND 825 billion due to a 14% increase in operating expenses to VND 800 billion. Borrowing costs are expected to increase as the company plans to borrow from commercial banks and/or issue bonds to fund business activities such as margin lending, customer advances, and proprietary trading, given the constraints on equity capital.

Additionally, technology investment expenses are estimated to surge by 220% as BVSC embarks on upgrading its information technology systems. Depreciation costs and allocation for refurbishment and maintenance of transaction offices will also increase.

Lastly, net profit after tax is expected to decrease slightly by 3% to VND 195 billion, comprising of realized profit of VND 180 billion, a 13% decline. However, BVSC notes that the comparative base for net profit after tax in the previous year included a reversal of provision expenses of VND 44 billion. Excluding this, the actual profit for the previous year was VND 171 billion, indicating a 25% growth in the 2025 plan.

|

Source: BVSC 2025 Annual General Meeting Documents

|

In the first quarter of 2025, BVSC reported a net profit after tax of over VND 41 billion, a 25% decrease from the same period last year, achieving 21% of its annual plan. The realized profit exceeded VND 42 billion, a 14% decrease, meeting 24% of the annual target.

BVSC’s Board of Directors will propose to the shareholders a cash dividend payout ratio of 8% (VND 800 per share), consistent with the previous year’s payout. With over 72.2 million shares in circulation, the estimated scale of this dividend is approximately VND 57.8 billion.

– 6:19 PM, June 8, 2025

The Average Vietnamese Income Script Achieves $28,370 Per Annum

According to experts, for Vietnam to join the ranks of high-income countries, there needs to be a period where its GDP growth reaches double digits (over 10%). This is an unprecedented threshold, an ambitious goal, yet not an impossible one. An ambitious scenario targets an 11-12% annual GDP growth rate during the period of 2025-2035, elevating the per capita income to $28,370 by 2045.

The Average Vietnamese Income Script Achieves $28,370 Annually

According to experts, for Vietnam to join the ranks of high-income countries, there needs to be a period where its GDP growth reaches double digits (over 10%). This is an unprecedented threshold, an ambitious goal, yet not an impossible one. An ambitious scenario targets an 11-12% annual GDP growth rate during the 2025-2035 period, elevating per capita income to $28,370 by 2045.

The Capital Ha Noi: Shining Bright as the Country’s Top Revenue Generator, Poised to Become a ‘Superstar’ Post-Merger

In the nationwide ranking of budget revenues for the first four months of this year, Hanoi took the top spot with over VND 310 trillion. Ho Chi Minh City followed with more than VND 200 trillion, and Haiphong came in third with nearly VND 58 trillion. According to the list of 34 provinces and cities after the merger, some localities will see significant changes.