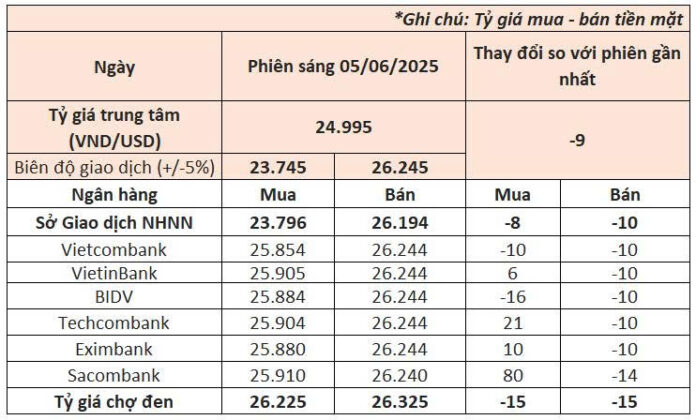

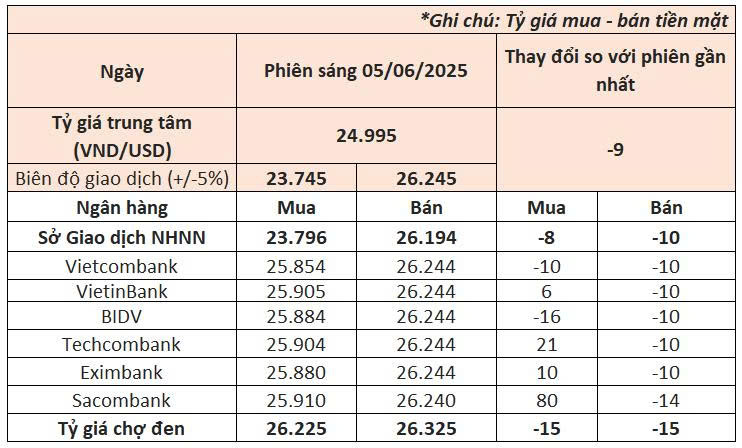

The State Bank of Vietnam has announced the central exchange rate for USD on June 5th as 24.995 VND/USD, a decrease of 9 VND from the previous day’s rate. With a 5% fluctuation band, the permitted trading range for commercial banks is now between 23.745 – 26.245 VND/USD.

The State Bank of Vietnam’s Trading Centre has also made corresponding reductions to the buying and selling rates, which now stand at 23.796 – 26.194 VND/USD.

This morning, banks unanimously lowered their selling rates in line with the central rate, but remained close to the permitted trading ceiling. Buying rates, however, showed mixed movements.

As of 10:00 am, Vietcombank, the system’s largest foreign currency trader, posted a buying and selling rate of 25.854 – 26.244 VND/USD, a decrease of 10 VND from the previous day for both rates.

VietinBank increased its buying rate by 6 VND but decreased its selling rate by 10 VND. BIDV reduced its buying and selling rates by 16 VND and 10 VND, respectively.

In the private sector, banks unanimously raised their buying rates and lowered their selling rates. Specifically, Techcombank and Eximbank increased their buying rates by 21 VND and 10 VND, respectively, while both reduced their selling rates by 10 VND. Sacombank significantly raised its buying rate by 80 VND and lowered its selling rate by 14 VND.

In the interbank market, the exchange rate closed at 26.089 VND/USD on June 4th, a significant increase of 36 VND from the previous day’s rate.

In the black market, the USD showed a downward trend. As of 10:00 am today, the USD was traded at 26.225 – 26.325 VND/USD, with both buying and selling rates decreasing by 15 VND compared to the previous day’s rates.

Internationally, the US Dollar Index (DXY), which measures the strength of the greenback against a basket of major currencies, hovered around 98.8 points. The US dollar weakened on Wednesday as optimism about global trade waned and US economic data disappointed.

The Institute for Supply Management (ISM) reported a services PMI of 49.9% for May, down from 51.6% in April and contrary to expectations of a slight increase to 52.0%. This is the lowest services PMI in 11 months and the first time it has indicated contraction (PMI below 50%) during this period.

In the labor market, ADP’s survey showed that the US economy added only 37,000 new jobs in May, lower than the 62,000 jobs added in the previous month and well below expectations of 111,000. This is the lowest figure the US has recorded since February 2022.

The USD/VND exchange rate remains under pressure despite the US dollar falling to a three-year low against other major currencies, as there is still no final decision on US tariff actions against Vietnam.

Previously, the USD/VND exchange rate had continuously increased after President Donald Trump announced a 10% tariff on all goods from all countries, effective April 5, 2025. In addition, the US will impose countervailing duties, effective April 9, on goods from countries with which the US has a trade deficit, ranging from 10-50%. Vietnam is among the group of countries facing the highest rate of 46%. On April 9, President Donald Trump announced a 90-day suspension of plans to impose countervailing duties on all trading partners who do not retaliate against the US.

Analysts believe that concerns about tariff risks could slow down foreign investment registration and disbursement. In addition, export activities, especially to the US market, may slow down or even suffer losses. Meanwhile, Vietnam’s foreign exchange reserves are currently quite limited, putting pressure on the exchange rate.

According to Dragon Capital Securities (VDSC), there are three major trends shaping the global monetary environment: growing concerns about debt and budget deficits, especially after Moody’s downgraded the US credit rating; the potential for foreign exchange market intervention agreements related to trade negotiations; and the trend towards diversifying foreign exchange reserves and reducing dependence on the US dollar.

VDSC believes that these changes will shape the outlook for a weaker US dollar in the medium and long term, which is generally favorable for maintaining the stability of the Vietnamese dong.

In fact, the USD/VND exchange rate remained stable in the past month while most other currencies appreciated against the US dollar, reflecting the fact that the depreciation pressure on the dong remains anchored by the uncertain tariff policy outlook.

“A favorable negotiation outcome will help curb the dong’s depreciation. We maintain our view that the dong could depreciate by 3-5% in 2025,” VDSC said.

“June 3rd: State Bank Raises USD Exchange Rate to a New High, Bank Dollar Price Soars”

This morning, the USD exchange rate at banks surged to a new high as the State Bank of Vietnam increased the daily reference exchange rate by 12 VND.