After five consecutive weeks of gains, pushing the VN-Index to the 1,340-1,350 point range, the highest since March 2025, the index faced corrective pressures in the first week of June. Selling pressure intensified in the latter part of the week, with three consecutive sessions of losses. The VN-Index ended the week down -0.20% at 1,329.89 points.

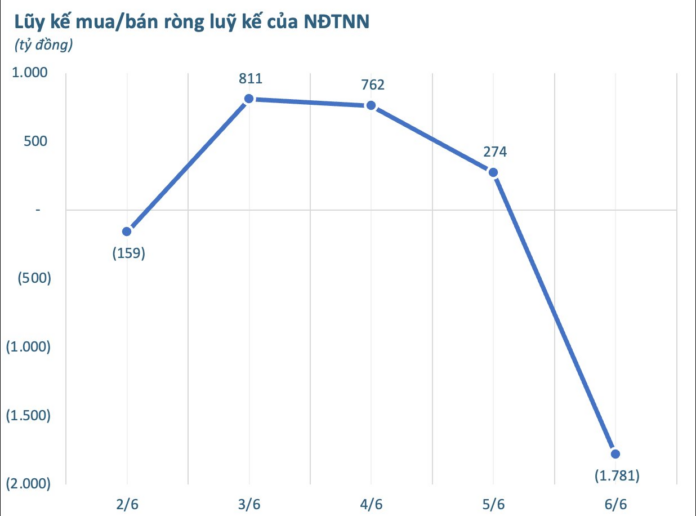

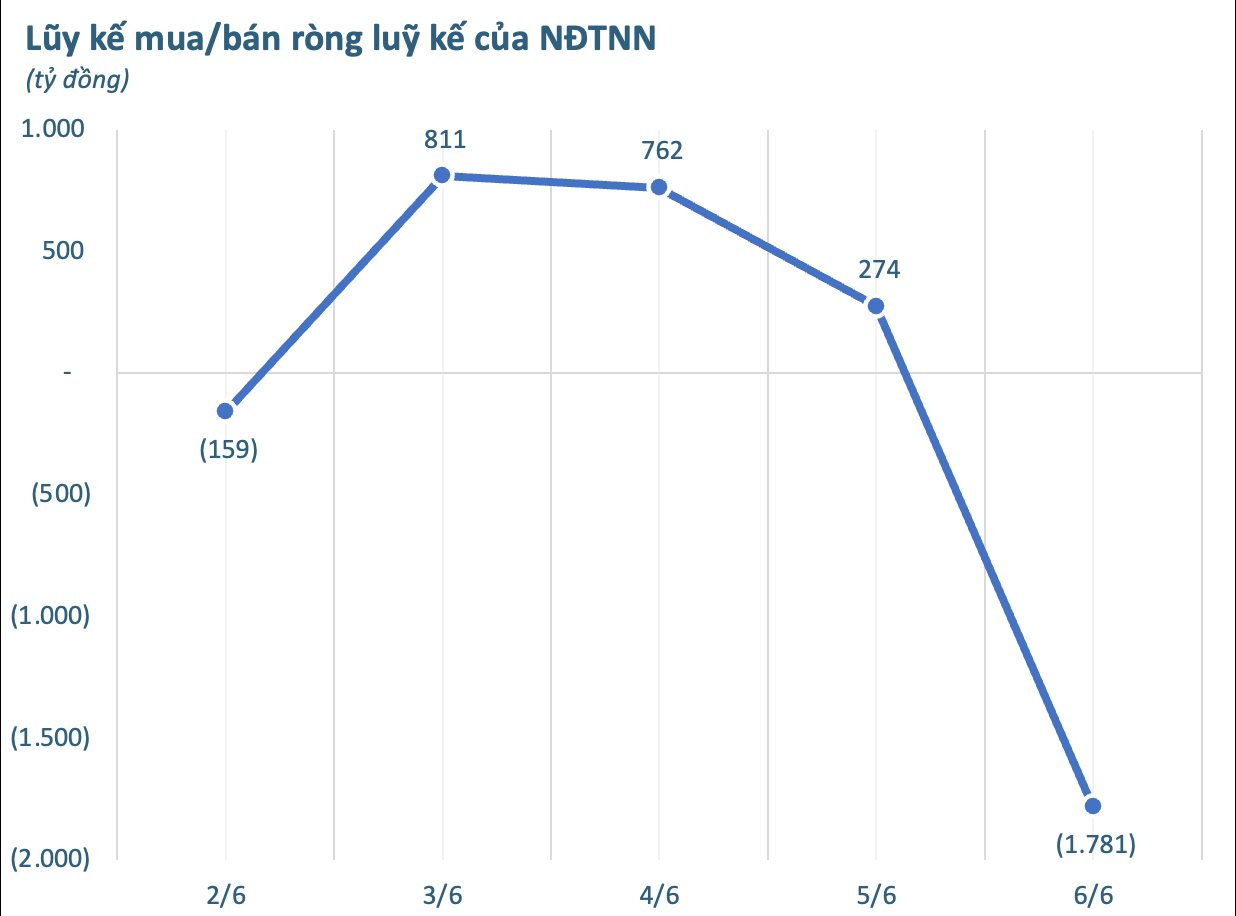

A notable negative during the week was foreign investor activity, with strong net selling, particularly in the final session. Overall, foreign investors sold a net amount of VND 1,781 billion on the market in five sessions.

On a per-exchange basis, foreign investors sold a net amount of VND 2,755 billion on the HoSE, VND 46 billion on the HNX, and VND 116 billion on the UPCoM.

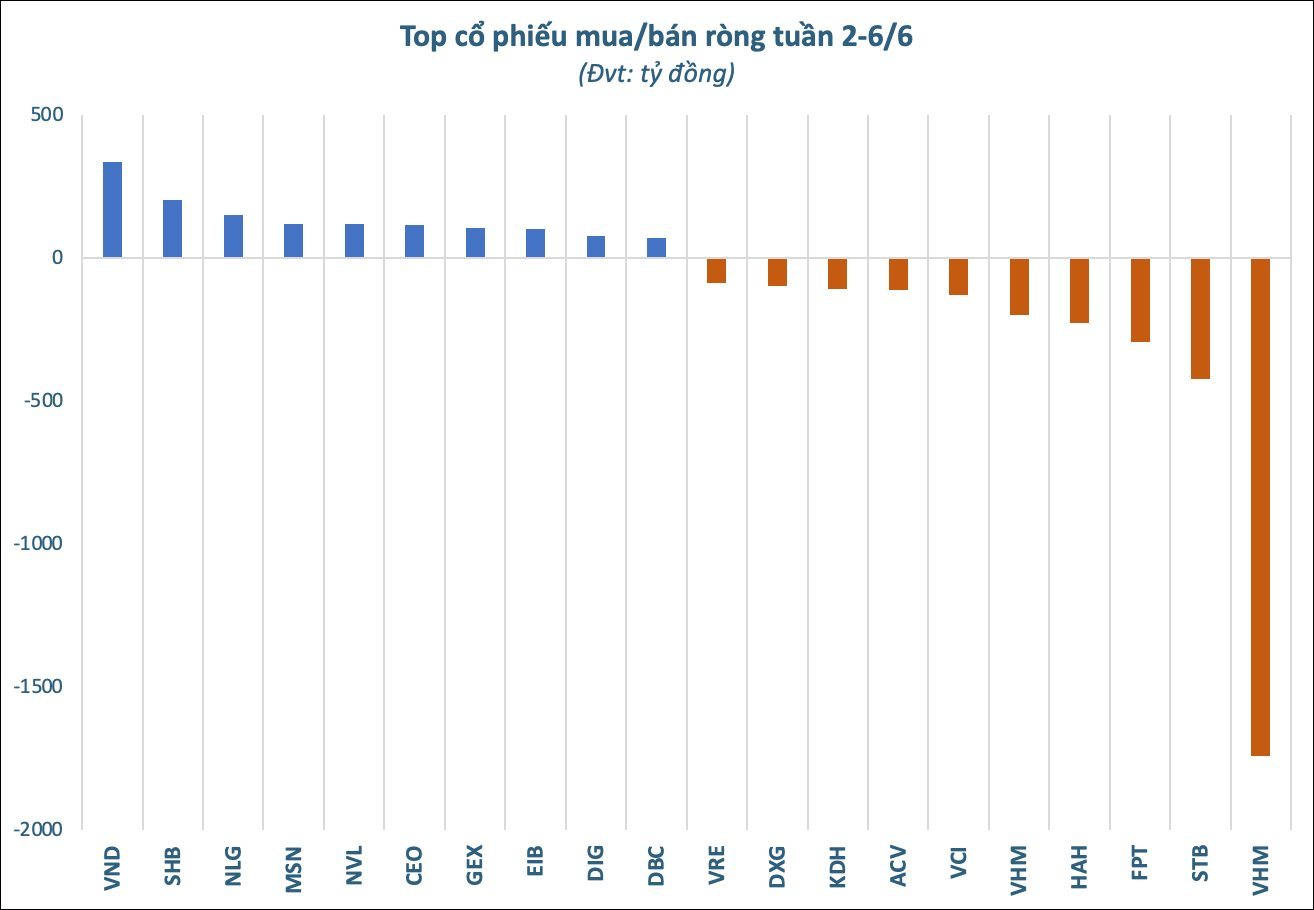

Focusing on individual stocks, VHM witnessed the highest net selling at VND 1,741 billion, with a sudden spike in net selling of over VND 1,500 billion in the last session on June 6. FPT and HAH also faced net selling of VND 292 billion and VND 224 billion, respectively. VHM was further sold down by foreign investors, with a net sell figure of VND 197 billion. The week’s net sell list also included VCI, ACV, KDH, DXG, VRE, HCM, VCB, and HDB, each recording net selling in the tens to hundreds of billions of VND.

On the buying side, VND emerged as the top pick for foreign investors, with net buying of VND 338 billion. SHB and NLG also attracted foreign capital, with net buying of VND 205 billion and VND 152 billion, respectively, over the week. Other stocks that witnessed net buying during the week included MSN, NVL, CEO, GEX, EIB, DIG, DBC, DGW, and VNM…

The Stock Market Shake-Up: Time for Investors to “Separate the Wheat from the Chaff” Ahead of the Next Wave

The stock market experts advise against short-term trading or ‘surfing’ during this period. With the potential for high losses and difficulty in repurchasing at a favorable price, investors are warned to proceed with caution.

The Power of Persuasive Writing: Crafting Compelling Headlines

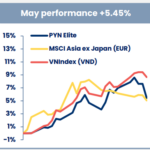

Unleashing PYN Elite’s “Slow-Paced” Performance to Reach a 16-Month High

Despite lagging behind the robust growth of the VN-Index in May, PYN Elite Fund’s investment performance delivered the highest returns in 16 months since January 2024.