According to data from the Vietnam Steel Association (VSA), in Q1/2025, crude steel output reached 5.81 million tons, up 9.1%; finished steel reached 7.464 million tons, up 5.7% over the same period last year. Total steel sales in the Q1/2025 market reached 7.501 million tons, up a strong 12.2% over the same period.

Commenting on this result, VSA attributed the main driver of domestic consumption to the disbursement of public investment in projects such as the North-South Expressway Phase 2, Long Thanh Airport, and Hanoi and Ho Chi Minh City belt roads.

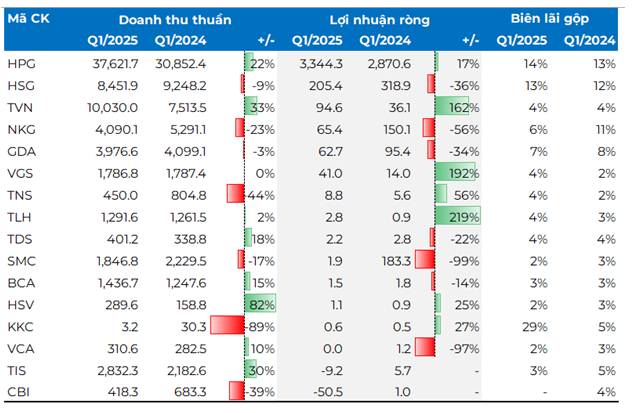

Hoa Phat remains unwavering

Hoa Phat continues to affirm its leading position with impressive growth, with revenue reaching VND 37,900 billion and after-tax profit of VND 3,300 billion, up 22% and 17%, respectively. This positive result came from the fact that the new plant in Dung Quat officially went into operation, helping Hoa Phat significantly increase its production capacity and supply capacity, especially for HRC steel products. In addition, it also came partly from the supply of steel for public investment projects.

Another giant, Vietnam Steel Corporation (TVN), also recorded positive results with revenue of VND 10,030 billion, up 33% over the same period. Especially, after-tax profit surged 162% to VND 94.6 billion.

Business results of steel companies in Q1/2025

Unit: Billion VND

Source: VietstockFinance

|

Coated sheet group struggles with challenges

While growth stories are present in the construction steel segment, coating sheet businesses are facing a completely different harsh reality.

Hoa Sen and Nam Kim – two familiar names in the field of coated sheets – are going through the most difficult days in many years.

Nam Kim suffered the heaviest blow as net profit plummeted by 56%, to VND 65 billion. Hoa Sen was not much better, with net profit down 36% to VND 205 billion, while financial and management expenses soared by 50% to 60%.

The difficulties of coating sheet enterprises are further exacerbated by the rising wave of trade protectionism globally. The US has just imposed temporary anti-dumping duties on Vietnam’s coated sheet products, with Hoa Sen facing the highest tax rate of up to 59%, Nam Kim 49.42%, and Dong A Steel 39.84%. Many other countries have also started to erect barriers to Vietnamese steel. In fact, coating sheet manufacturers such as Nam Kim and Hoa Sen have temporarily stopped exporting to the US since September 2024.

The group of commercial and distribution enterprises – the important “link” in the steel supply chain – is also facing many difficulties. SMC, one of the big names in this field, recorded a revenue of nearly VND 1,850 billion, and net profit almost “evaporated”, reaching only nearly VND 2 billion, down 17% and 99%, respectively, over the same period last year.

This dismal performance was mainly due to the decline in core activities (gross profit down 37%) and no longer profit from the sale of NKG shares as in the same period last year (when financial revenue reached nearly VND 330 billion). Notably, if it had not recorded other income of nearly VND 17 billion, SMC would have fallen into a loss-making state.

The positive thing is that the company has started to recover debts by taking real estate – this is also the main factor helping SMC not to lose in 2024.

Tien Len Steel shows signs of recovery with profit up 219%, although the absolute figure is still modest at VND 2.8 billion.

The battle to protect the “home field”

Amid the wave of global trade protectionism, Vietnam is also taking measures to protect the domestic steel industry. The Ministry of Industry and Trade has issued a decision to impose temporary anti-dumping duties on imported HRC steel from China, with tax rates ranging from 19.4% to 27.8%. At the same time, Vietnam has also decided to impose anti-dumping duties of up to 37% on coated sheets imported from China and South Korea.

These moves can help domestic businesses compete better in the domestic market, but they also create cost pressures for units that use HRC steel as input materials.

However, the reality also shows that Chinese goods are still finding ways to circumvent these anti-dumping duty decisions by selling HRC steel with a width larger than 1,880mm, while Vietnam only imposes taxes on HRC steel with a width below 1,880mm.

According to the Customs Department, in the first four months of the year, the volume of hot-rolled coil (HRC) imported into Vietnam was more than 3.1 million tons, down 15% over the same period last year. HRC steel imports from China alone accounted for 62% with 1.9 million tons.

The Honda Special Edition with Impressive Fuel Economy is Coming to Vietnam in June: Free Accessories Worth Millions and Attractive Pricing.

With its unique style and ABS brakes, this Honda model stands out from the crowd. Its distinctive design and advanced safety features make it a head-turner on the road. The sleek and modern aesthetic of this Honda is sure to catch the eye of anyone who sees it. Coupled with its advanced braking system, this car offers both style and substance, providing a safe and enjoyable driving experience.

KBSV and PVCB Capital: A Strategic Alliance, Expanding the Financial Ecosystem

Recognizing the untapped potential in the field of investment and asset management, particularly in catering to the needs of the younger generation seeking financial freedom, KBSV and PVCB Capital have joined forces. Together, they aim to introduce exceptional services that comprehensively address the needs of investors.

Streamlining the Social Housing Process: A 350-Day Reduction – Can We Make It a Reality?

Resolution 201/2025/QH15 slashes 350 days off social housing procedures, aiming for 1 million apartments by 2030. This ambitious goal requires a synchronized and aggressive approach from ministries, sectors, localities, and businesses.