Illustrative image

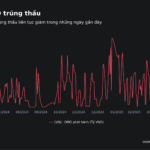

The State Treasury has recently announced its intention to purchase foreign currency from commercial banks, with a maximum volume of 200 million USD. This foreign currency will be bought on a spot basis on June 10th, with the settlement date expected to be June 12th.

This is the second time in less than a month that the State Treasury has made such an announcement. On May 20th, a similar notice was released, stating their intent to purchase up to 100 million USD from commercial banks. So far this year, there have been 10 such auctions, totaling approximately 1.8 billion USD.

These foreign currency purchases by the State Treasury come at a time when the USD/VND exchange rate has consistently remained at high levels. The large volume of USD being bought by the State Treasury is adding further pressure on the exchange rate, which has already hit historical highs. Previously, the State Bank of Vietnam attributed the pressure on the exchange rate in 2024 partly to the need to balance a significant amount of foreign currency for the Ministry of Finance’s external debt payments.

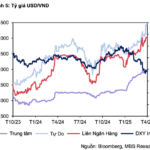

Currently, the central exchange rate set by the State Bank of Vietnam stands at 24,985 VND per USD, reflecting an increase of over 2.6% since the beginning of the year. Notably, on June 4th, the central rate surpassed the 25,000 VND mark for the first time.

In the interbank and retail market, the USD is being traded at commercial banks at around 26,200 VND for selling and 25,800 VND for buying, representing a more than 2.5% increase since the start of 2025.

Interestingly, the VND continues to depreciate against the USD, despite the greenback hitting a three-year low against other major currencies. The DXY index, which tracks the USD’s performance against a basket of currencies, has fallen by 9% since the beginning of 2025.

Fiin Ratings also attributed the high USD/VND exchange rate to the strong domestic demand for USD from businesses and the State Treasury, which has constrained the supply. Meanwhile, the State Bank of Vietnam has been proactively adjusting the central exchange rate to record highs, providing the market with more room for self-regulation.

The Ultimate Guide to Mastering the Art of Currency Trading: Fiin Ratings’ Fresh Forecast on USD/VND Exchange Rates Unveiled

“The US dollar is predicted to weaken further, according to Fiin Ratings, easing exchange rate pressures in the coming months. This forecast bodes well for those with investments tied to the dollar, as a softer greenback could bring some much-needed relief.”

The Ultimate Guide to Investing: Navigating the Financial Markets with Confidence

The Vietnamese Dong (VND) continues its decline against the US Dollar (USD), with a 2.7% loss despite the greenback hitting a three-year low against other major currencies. The DXY index, which tracks the USD’s performance, has fallen by 9% since the start of 2025, yet the VND struggles to gain traction.

The Vietnamese Dong’s Turbulent Times: A Brighter Future Ahead

The forex market has been under significant pressure since the US announced countervailing duties in early April, despite a global easing of the US dollar’s strength. Nonetheless, experts assess that the Vietnamese Dong will show positive signs by year-end, with a ‘not-so-bad’ trade deal on the table.

Interbank Overnight Interest Rates Remain at a One-Year Low

“Liquidity in the banking system remained relatively stable during the week of April 28 to May 5. The overnight interbank interest rates persisted at low levels ahead of the extended holiday weekend.”

Why is the US Dollar Weakening Globally Yet Appreciating Against the VND?

According to MBS, the increase in foreign currency purchases by the State Treasury, coupled with heightened foreign currency demands from businesses amid global trade uncertainties and a significant negative shift in VND-USD interest rate differentials, contributed to the appreciation of the USD/VND exchange rate in April, despite the greenback’s weakness in the international market.