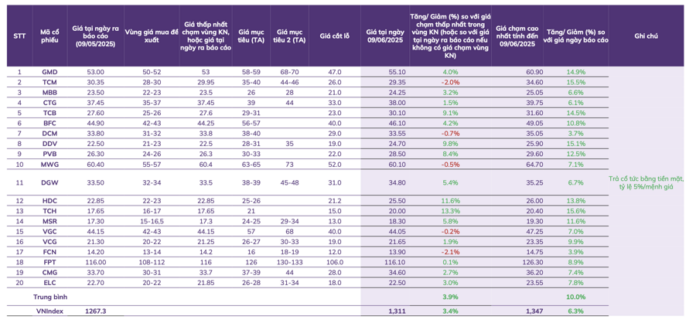

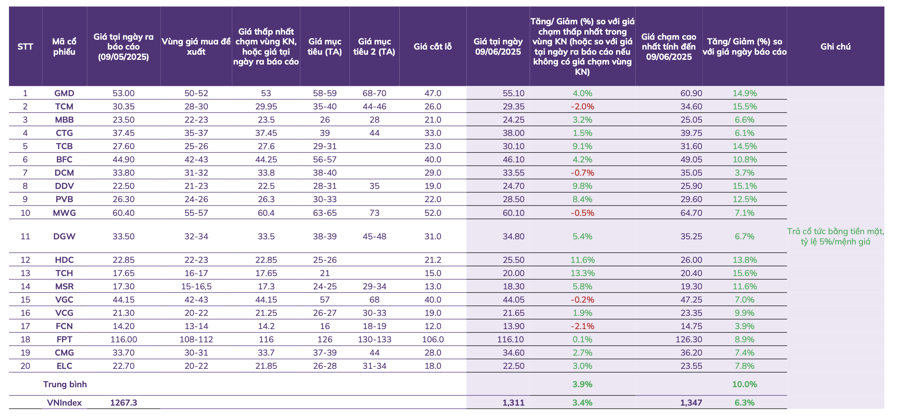

In a recent market outlook assessment, ABS Securities suggested that the short-term trend of the VN-Index is likely to weaken in early June, potentially trading sideways with suggested support levels at 1310-1293 and 1260-1283 points before rebounding to target the 1400 level.

ABS has identified a list of stocks with potential upside of up to 35%. This list includes:

MPC with a 35% upside potential: The company’s net profit after tax reached VND 17.7 billion, a 145.6% increase year-on-year. MPC’s growth drivers stem from its focus on developing high-quality breeding sources, increasing self-sufficiency in shrimp materials, and expanding export markets.

SAB with a potential upside of 33%: Low-alcohol beer is gaining popularity, and SAB has launched low-alcohol beer products to stay on top of this trend. The increase in SAB’s ownership stake in SABIBECO to 65% by the end of 2024 has improved profit margins and operational efficiency, and this positive impact is expected to continue into 2025.

VPB (26%): ABS forecasts VPB’s credit growth in 2025 to exceed 20%, supported by economic recovery and the benefits of integrating GPBank. NIM is expected to recover in the second half of 2025 due to improved lending rates, a high proportion of retail loans, and positive contributions to profit margins from FE Credit after the restructuring process.

BVH (23.9%): Business performance in 2025 is expected to remain positive, with slight growth in revenue thanks to recovering customer confidence, Circular No. 34/2024/TT-NHNN allowing commercial banks to sell insurance, and an improving economy driving demand for life and non-life insurance products.

Financial income is gradually improving, with investments mainly in certificates of deposit benefiting from the upward trend in deposit interest rates. The claims ratio and reserve ratio are expected to continue decreasing in the following quarters.

PVD (21.6%): PVD’s rigs are fully booked. PVD currently owns four jack-up rigs, one semi-submersible rig, and one land rig. All offshore rigs are fully booked in the international market until the end of 2025, with some contracts secured until 2028. These contracts do not include extension options, which could extend the duration by two to three years. Investing in new rigs contributes to PVD’s revenue and profit growth in the new cycle.

CNG (21.2%): Healthy financial position with a substantial cash balance of VND 346 billion in cash and bank deposits (accounting for 27.2% of total assets as of March 31, 2025) and a low leverage ratio (D/E of around 0.11 times). The company also has a history of consistent cash dividend payouts, averaging 12% per year.

As the leading distributor of compressed natural gas (CNG) in Vietnam, with a market share of over 70% nationwide, CNG’s revenue is predominantly derived from CNG sales, accounting for 89.2%. Additionally, CNG benefits from a stable gas supply from the Thai Binh field, which has maintained high production since Q3 2024, boosting CNG consumption in the North.

POW (20%): The main driver is the Nhon Trach 3&4 power plants, which are expected to become operational in 2025. These are POW’s key projects and the first gas-fired power projects using LNG. With a combined capacity of 1,500 MW, these plants are expected to increase POW’s capacity by 36%. However, they are projected to incur losses in the first two years of operation due to depreciation and interest expenses but are anticipated to turn profitable from 2027 onwards.

Long-term prospects are bolstered by POW’s pipeline projects, including the Quynh Lap Power Plant (Nghe An), Vung Ang 3 Power Plant (Ha Tinh), Ca Mau Power Plant Expansion (Ca Mau), and the mixed-fuel turbine project in Quang Ninh. Additionally, the electric vehicle charging station segment is expected to contribute significantly to POW’s future revenue.

PAN (21.2%): In the seafood segment, ABT benefits from not exporting to the US and thus avoids direct exposure to US tariff policies. FMC has prepared to target non-US markets and views the US as a low-profit market, so reducing its focus on this market won’t significantly impact its profits. For the packaged food segment, namely biscuits, potential export markets will drive growth for Bibica and Lafooco.

ANV (22.6%): A high proportion of non-US markets is a significant advantage for Anvifish at a time of high risk related to US tariff policies. Nam Viet is actively diversifying its markets, cutting unnecessary costs to minimize production costs, and automating production processes while maintaining 100% self-sufficiency in raw fish material, ensuring a stable supply for its production orders despite the industry-wide shortage.

DRC (23.2%): The company’s performance is expected to improve in the coming quarters due to lower raw material prices, which support profit margins, and a strategy focused on domestic consumption, given the positive outlook for tire demand in the domestic market.

Establishing International Financial Centers in Ho Chi Minh City and Da Nang: A Proposal

With our headquarters strategically based in Ho Chi Minh City, we are poised to revolutionize the financial landscape by offering an extensive range of services, including asset and fund management, insurance, and a diverse portfolio of equity and bond products.

The Stock Market’s Hidden Gems: Unveiling June’s Top Growth Stocks

The An Binh Securities (ABS) team believes that the market is currently presented with a medium-term growth opportunity, attributed to positive developments in trade negotiations and the government’s proactive efforts.