The VN-Index ended May 2025 at 1332.60 points, surging 8.67%. The market performance exceeded expectations due to positive factors such as tax deferment and trade negotiations. Additionally, the Vietnamese economy and businesses maintained growth in Q1 2025, while interest rates remained low. There are hopes for new growth drivers from Resolution 68-NQ/TW 2025 and attractive valuations after a significant decline.

In their latest strategy report, SHS Research assessed that after a strong recovery in May, the market entered June with a cautious sentiment. According to their analysis, June is an unpredictable month as we approach the final stages of trade negotiations and the end of the tax deferment period. A notable deadline is July 9, when the tax deferment expires. Any unfavorable information could put pressure on the market and sectors closely linked to exports.

Moreover, the impact of tariffs may gradually reflect on businesses’ financial performance. The VN-Index is likely to face corrective pressure, testing the support level around 1,300 points, and investors need to pay attention to portfolio management.

Short-term capital tends to shift towards defensive sectors such as electricity, water, and residential real estate. Currently, SHS believes that many stocks still offer reasonable valuations relative to their fundamentals. However, the market needs time to establish a new equilibrium for sectors affected by tariffs as their fundamentals are changing and weakening. Capital may flow towards sectors with less tariff pressure, including residential real estate, construction, financial services, and utilities. Securities and investment stocks are also bright spots that can provide attractive investment returns for investors in the coming month of June.

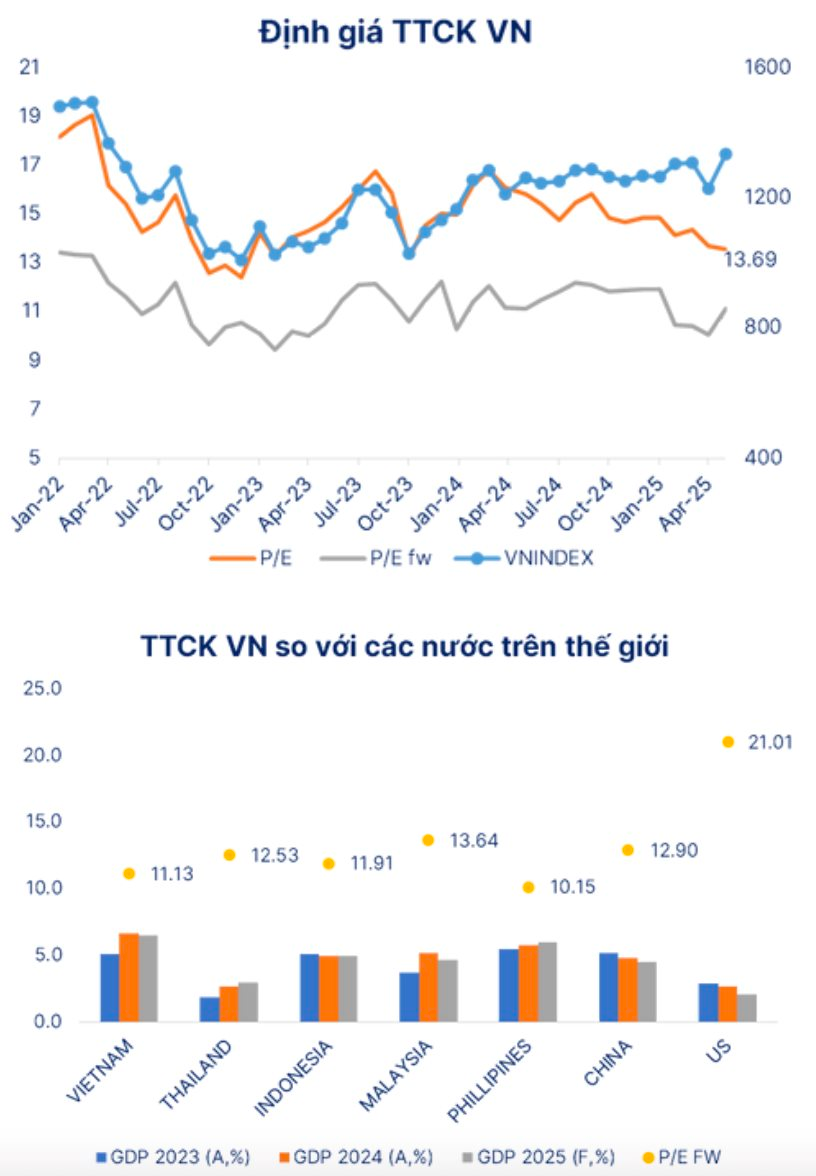

SHS assessed that the VNINDEX’s P/E ratio of 13.54 is lower than the 3-year average (14.7) and the 5-year average (16.7). The forward P/E of 11.1 is still considered attractive relative to the current growth prospects.

Looking further ahead, the VN-Index’s target price range for 2025 is still expected to increase by 11-12% compared to 2024, aiming for the 1,400 – 1,420-point range.

Stock Market Outlook for Tomorrow, June 12: Buying Pressure on Stocks Yet to Break Through

The equity research firms assert that while the supply of stocks is not substantial, the demand remains weak. Investors are advised to trade with caution.

Market Pulse June 12: Afternoon Jitters Shake Markets, Late Rally Boosts VN-Index by Almost 8 Points

The market opened the afternoon session with a strong rally, surging towards the 1,326-point mark, but this momentum was short-lived as it quickly faced resistance and entered a corrective phase, dipping to 1,317 points. It was only in the final hour of trading that the market staged a recovery, returning to the morning’s price levels.

Two Bank Stocks Were Actively Net Purchased by Proprietary Securities Companies in the June 11th Session

The proprietary trading arms of securities companies recorded a net buy value of VND 27 billion on the Ho Chi Minh Stock Exchange (HoSE).