Friday the 13th proved to be an unlucky day for the global markets and the Vietnam stock market. Tensions in the Middle East escalated as Israel launched an attack on Iran, causing a surge in global oil and gold prices, while stock markets took a hit.

The VN-Index faced widespread selling pressure, with the index losing up to 18 points at one point. However, gains in banking stocks pulled the index back, resulting in a closing loss of 7.50 points, settling at 1,315. This positivity was not reflected in individual stocks.

There were 263 declining stocks compared to 69 advancing ones, with hundreds of stocks losing over 1% in value. Six bank stocks supported the market today: VCB (+0.36%), TCB (+0.81%), BID (+0.71%), CTG (+3.64%), MBB (+0.61%), and MSB (+0.42%). CTG, in particular, benefited from news of a proposed 46% stock dividend, boosting investor sentiment. CTG alone contributed 1.74 points to the overall market, while BID, VCB, TCB, and MBB added another 2 points.

Oil and gas stocks rallied thanks to the surge in oil prices, with PVC hitting the daily limit, PVD (+5.68%), PVS (+6.75%), PVB (+4.21%), and PSB (+11.63%). Meanwhile, most other bank stocks and sectors suffered in the heat. Vin stocks declined, with VIC down 1.5%, VHM down 2.29%, and VRE down 2.58%, although the pace of decline slowed compared to the morning session.

Many real estate stocks underwent significant corrections, including KBC, DIG, CEO, PDR, NLG, and KDH. Securities stocks fell over 2%, with VND, VIX, FTS, SSI, and VCI among the notable losers. Exporters, materials, transportation, food and beverage, utilities, and information technology sectors also faced market pressure.

The support that helped the VN-Index limit its losses today provided some psychological relief. However, stocks are widely suffering losses, which could lead to increased selling pressure in the coming sessions.

Total matched transactions on the three exchanges reached nearly VND 30,000 billion today, with foreign investors recording a slight net buy of VND 83.6 billion. Excluding put-through transactions, they were net buyers to the tune of VND 103.0 billion. Foreign investors’ main net bought sectors were banking and oil and gas. The top net bought stocks were CTG, NVL, VPB, VHM, MSN, PVD, DBC, VIC, DGW, and PLX. On the selling side, financial services were the main net sold sector. The top net sold stocks were VIX, FPT, SHB, VND, DIG, HDG, KBC, HAH, and GEX.

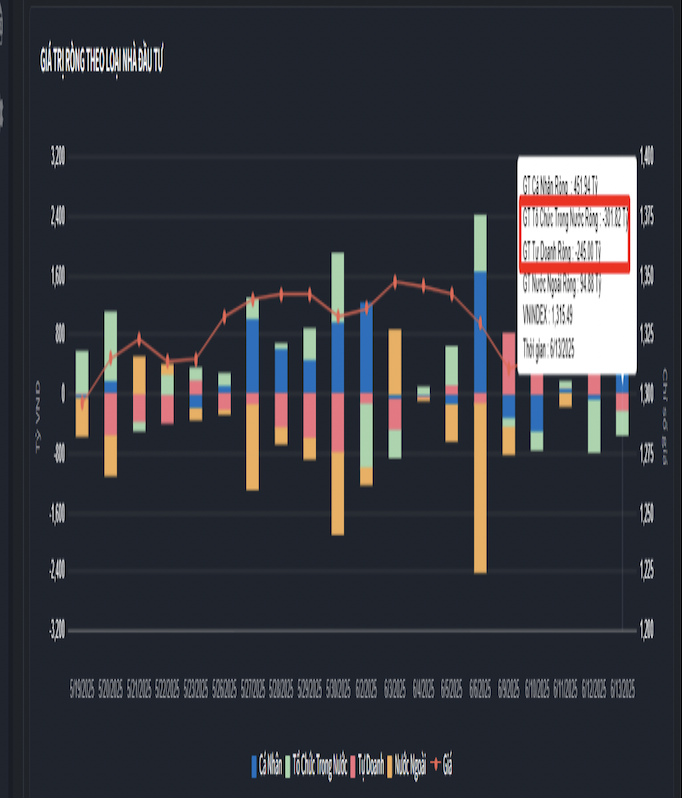

Individual investors were net buyers to the tune of VND 451.9 billion, of which VND 240.9 billion was from matched transactions. Excluding put-through transactions, they were net buyers in 7/18 sectors, mainly in banking. The top bought stocks by individual investors were MBB, VPI, FPT, TCB, SHB, STB, DPM, DIG, BID, and CTG. On the selling side, they net sold 11/18 sectors, mainly oil and gas and financial services. The top net sold stocks were SSI, PVD, NVL, BSR, HPG, TCH, TPB, HAG, and VSC.

Proprietary trading groups were net sellers of VND 245.0 billion, with a net sell of VND 302.5 billion from matched transactions. Excluding put-through transactions, they were net buyers in 5/18 sectors. The most bought sectors were Industrial Goods & Services and Oil & Gas. The top bought stocks by proprietary groups today were VND, VIB, PLX, TCB, GEX, FUEVFVND, VIX, DGC, DXG, and PVT. Banking stocks were the most sold sector. The top sold stocks were MBB, SSI, HPG, FPT, HDB, VIC, VCB, STB, MWG, and VHM.

Domestic institutional investors were net sellers of VND 301.8 billion, with a net sell of VND 41.5 billion from matched transactions. Excluding put-through transactions, they were net sellers in 7/18 sectors, with the largest net sell in banking. The top net sold stocks were CTG, MBB, TCB, VPI, MSN, DPM, VPB, DXG, STB, and DGW. On the buying side, the largest net bought sector was financial services. The top net bought stocks were SSI, VIX, HPG, HAH, HAG, HDB, MWG, EVF, VND, and HDG.

Put-through transactions today totaled VND 1,370.7 billion, down 0.2% from the previous session and contributing 4.4% of the total transaction value. Notably, there was a put-through transaction in MBB, with 7.3 million units changing hands for VND 185.6 billion between foreign investors.

Money flow by sector showed an increase in allocation to Real Estate, Securities, Construction, Chemicals, Oil & Gas, IT, and Mining, while decreasing in Banking, Steel, Food, Retail, Electrical Equipment, and Warehousing.

Excluding put-through transactions, money flow by capitalization showed an increase in allocation to mid-cap (VNMID) and small-cap (VNSML) stocks while decreasing in large-cap (VN30) stocks.

Global Oil Prices Surge by Over 10% After Israel’s Declaration of Attack on Iran

The escalating oil prices have sparked concerns about potential energy supply disruptions from the Middle East.

Middle East Tensions: Impact on the Vietnamese Stock Market

The stock market in Vietnam witnessed a decline today (June 13th), mirroring trends across the region amidst Israel’s attack on Iran. The VN-Index fell by over 7 points, despite a valiant effort by oil and gas stocks, along with select banking sector equities, to steer the market in a positive direction.

The Powerhouse Industries: Banking and Oil to the Rescue, Yet Stocks Suffer

The Middle East tensions erupted suddenly before the domestic market opened, causing a significant impact. While the VN-Index was propped up by some large-cap stocks, a deep sell-off occurred across hundreds of stocks. The index closed slightly lower, down 0.57%, but 107 stocks fell by more than 2%, not to mention nearly 70 others that declined between 1% and 2%, or on the HNX.