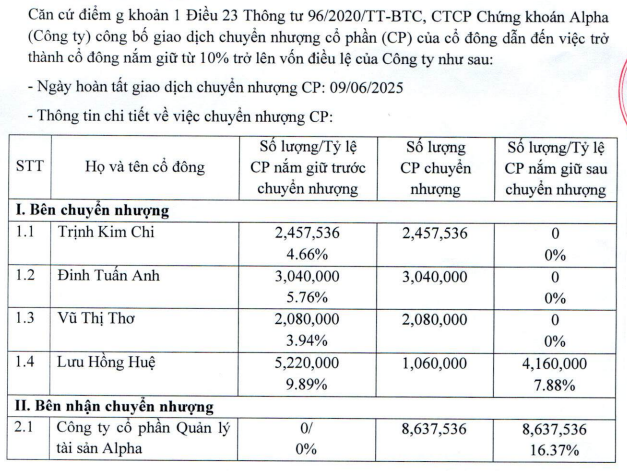

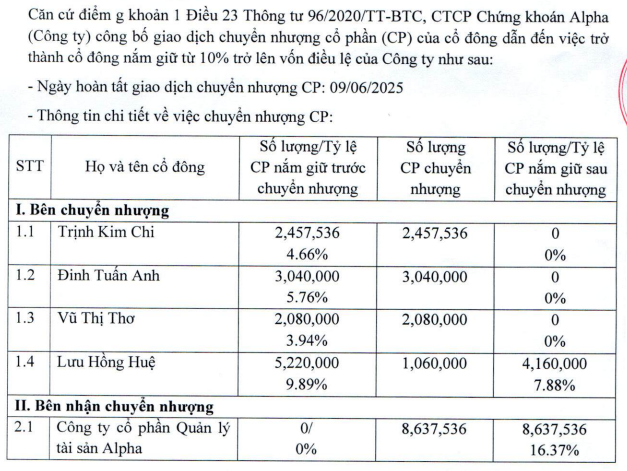

The shareholders who transferred their APSC shares to Alpha AM include four individual shareholders: Mr. Đinh Tuấn Anh with over 3 million shares (5.76%), Mrs. Trịnh Kim Chi with approximately 2.5 million shares (4.66%), Mrs. Vũ Thị Thơ with nearly 2.1 million shares (3.94%), and the Chairman of the Board of Directors, Mrs. Lưu Hồng Huệ, with almost 1.1 million shares (2.01%).

Following the transaction, Chairman Lưu Hồng Huệ‘s ownership decreased from over 5.2 million shares (9.89%) to nearly 4.2 million shares (7.88%), while the other three shareholders no longer hold any shares.

Source: APSC

|

Alpha Asset Management Joint Stock Company (Alpha AM), established on June 26, 2023, primarily engages in investment consulting. At its inception, Alpha AM had a charter capital of VND 20 billion, with three founding shareholders: Mr. Nguyễn Anh Trung holding 51%, Mr. Nguyễn Hoàng Nam holding 30%, and Mr. Ngô Tuấn Hiệp holding 19%. In June 2024, the company significantly increased its capital to VND 105 billion.

Alpha AM is headquartered at 389 De La Thanh, Thanh Cong Ward, Ba Dinh District, Hanoi, which is also the current address of APSC. However, in a recent development, the company announced its relocation to SISC Tower, 71 Lang Ha, Thanh Cong Ward, Ba Dinh District, Hanoi, effective June 9, 2025.

According to its website, Alpha AM has three branches located in Ho Chi Minh City, Hai Phong, and Thanh Hoa, which share the same addresses as the three branches of APSC.

The company also introduces its ecosystem of services, encompassing asset management, corporate governance consulting, portfolio management, investment consulting, project development consulting, M&A, and corporate restructuring.

|

There is a connection between Alpha AM and APSC. Mr. Đinh Tuấn Anh, a former member of APSC’s Board of Directors and a shareholder who transferred his shares to Alpha AM, is currently the General Director and Legal Representative of Alpha AM. Additionally, two of Alpha AM’s founding shareholders, Mr. Nguyễn Hoàng Nam and Mr. Nguyễn Anh Trung, have also held leadership positions at APSC.

APSC is expected to undergo significant personnel changes in the near future. The company will propose to the upcoming extraordinary general meeting of shareholders on July 18, 2025, to accept the resignation of Mrs. Lưu Hồng Huệ from the Board of Directors, honoring her personal request.

Moreover, Mr. Nguyễn Như Nam, the Chief Inspector, has also submitted his resignation from the role of Board of Inspectors member due to personal reasons, despite being appointed just recently on April 18, 2024.

APSC has attracted attention with a series of recent events, including a connection issue with the Stock Exchange on the morning of May 19, 2025, which impacted clients’ securities trading activities. Additionally, on April 29, 2025, the company was fined over VND 1 billion by the State Securities Commission for multiple violations in securities business operations and information disclosure.

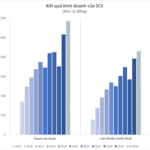

In terms of financial performance, APSC recorded an impressive growth in the first quarter of 2025, with a net profit of over VND 5.2 billion, nearly five times higher than the same period last year. This remarkable growth was driven by improved proprietary trading, margin trading, and financial activities.

| APSC’s Quarterly Financial Results in Recent Years |

– 5:38 PM, June 13, 2025

A Real Estate Firm Compounds Dividends with a 5-Year Stock Payout Strategy

The Ho Chi Minh City Stock Exchange-listed SJ Group Joint Stock Company (HOSE: SJS) has unveiled a plan to issue bonus shares and pay dividends in shares with a payout ratio of 159%. The issuance ratio relative to the number of shares currently in circulation stands at 160.33%, with the company holding nearly 1 million treasury shares.

Aerial Enterprise Allocates 60% Dividend Payout in Cash, Prepares for Takeoff on the “$16 Billion Mega Project”

Introducing a dynamic enterprise that is soaring to new heights; with an impressive performance in 2024, this business is taking off. The company has proposed a generous cash dividend, reflecting its financial prowess and confidence in its future endeavors. This year, one of its key objectives is to forge a strategic partnership with ACV in operating a cargo terminal at the prestigious $16 billion airport project. With meticulous preparation, this enterprise is poised to take flight, reaching new horizons of success.

A Private Bank to Boost Capital, Closing in on Agribank

“With a recent capital boost, this bank is poised to soar. The financial institution has just received approval for a substantial increase in its capital, setting the stage for dynamic growth and expanded services. This development signifies a pivotal moment in the bank’s journey, marking its transition into a new era of enhanced capabilities and broadened horizons.”