Record Non-Performing Loans: A Potential Capital Loss

According to Vietnam Report, the non-performing loan (NPL) ratio at commercial banks peaked in Q3 2023 and was partially curbed with the issuance of Circular 02/2023 by the State Bank of Vietnam.

Moving into 2024, NPLs began to cool down as loans were restructured, interest rates stabilized at lower levels, and businesses recovered. The NPL ratio hovered around 1.93-2.22%.

NPLs in Groups 3 and 4 (substandard and doubtful debts) also fluctuated but did not surpass the peak observed in 2023. Notably, some banks reported NPL ratios above 4%, and an outlier bank recorded an NPL ratio of over 14% in Q1, although this figure decreased from 35.3% in Q1/2024.

NPLs in Group 5 reached a record high of over VND 176 trillion.

In terms of value, the total NPLs of commercial banks exceeded VND 300 trillion at the end of Q1 this year, a 16.8% increase compared to the same period in 2024 and a 13.4% rise from the beginning of the year.

Circular 02/2023 stipulates that the deadline for debt restructuring and maintaining the debt group remains until June 30, 2024. Subsequently, the State Bank issued Circular 06, extending the debt restructuring period for another 6 months (until December 31, 2024).

Consequently, latent risks persist, and after January 1, 2025, some restructured loans may no longer qualify for this policy and will have to be reclassified as NPLs.

In reality, the NPL ratio in the first quarter of 2025 witnessed a slight increase compared to the previous quarter, but the composition of NPL groups underwent a significant shift. NPLs in Group 5 (potential capital loss) reached a record high, accounting for 1.25% of total customer loans, surpassing VND 176 trillion, a 10.7% increase from the beginning of the year and higher than the total NPL figure at the end of 2022.

According to the latest banking sector report by Rong Viet Securities Company, on-balance sheet NPLs from customer loans of 27 listed banks increased by more than VND 37 trillion in Q1. The scale of on-balance sheet NPLs at the end of Q1 rose to over VND 265 trillion, corresponding to an NPL ratio of 2.16%.

Although this ratio surged compared to 1.92% in Q4/2024, it remained lower than the peak of 2.26% in Q3/2024.

Previously, the Banking Association disclosed that on-balance sheet NPLs across the system increased from VND 778 trillion at the end of 2024 (equivalent to 4.98% of total credit outstanding in the economy) to VND 833 trillion at the end of February 2025, equivalent to 5.29% (relative to total credit outstanding in the economy).

While the NPL ratio is on the rise again, the provisioning expenses of many banks have significantly decreased. According to Rong Viet Securities Company, the provisioning expenses for credit risks in Q1/2025 across the banking sector reached nearly VND 29 trillion, accounting for 45% of net NPL formation. Consequently, the NPL coverage ratio at the end of Q1 dropped from 110% in the previous quarter to 92%.

What’s the Trend?

According to experts from Rong Viet Securities Company, NPLs will likely continue to increase in the next quarter, considering the strong net increase in Group 2 NPLs. This increase is estimated to be equivalent to the scale of net NPL formation in Q1, and there remains a large amount of potential NPLs. At the end of the first quarter of this year, Group 2 NPLs witnessed a slight increase of VND 7 trillion, ending the downward trend observed in the previous three quarters.

The experts from Rong Viet Securities Company assume that if most of the NPLs generated in Q1 originated from the reclassification of Group 2 debts, the scale of additional Group 2 NPLs formed during this period could also be substantial, possibly exceeding VND 70 trillion, equivalent to 0.6% of the scale of Group 1 NPLs at the end of last year.

“Given this development, the risk of a further sharp increase in NPLs in the next quarter is quite high if these Group 2 debts are not promptly addressed. The high level of potential NPLs, approximately VND 193 trillion (including VAMC debts, potentially risky debts, and restructured debts under Circular 02), along with the debts of customers potentially affected by retaliatory tariff policies, will likely sustain the upward trend of NPLs,” the experts remarked.

However, the scale of NPL increase will vary across different bank groups. Commercial joint-stock banks will continue to face NPLs from retail lending related to real estate project loans of developers encountering difficulties in Q2 this year before legal issues are resolved in the second half of the year.

Additionally, the composition of NPL groups in large and medium-sized commercial joint-stock banks indicates a considerable proportion of Group 2, 3, and 4 NPLs (for which provisions have not been fully made after discounting the value of collateral) compared to Group 5.

Provisioning expenses in the group of commercial joint-stock banks are expected to continue rising compared to Q1 as they make provisions for existing on-balance sheet NPLs and manage the NPL ratio after being impacted by potential NPLs arising from Group 2 debts in the next quarter.

“May 2025 Bond Market: New Issuance Values Surge by 35% Month-on-Month”

The corporate bond market in May 2025 was abuzz with activity, witnessing a total of VND 66 trillion in new issuances, a substantial 35% increase from the previous month.

The Novaland Group’s New Move: $320 Million Convertible Bond Offering

The bondholder must consent to or reject both the proposed waivers and the proposed amendments. Once given, consent cannot be revoked.

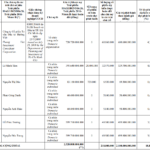

“HAGL Proposes Issuing 210 Million Shares to Swap Bond Debt, with a Focus on Fruit-Centric Business Ventures”

At the upcoming 2025 Annual General Meeting, HAG is expected to propose a plan to issue 210 million shares at VND 12,000 per share to swap bond debts with eight bondholders. These bondholders include several individuals who have lent the company billions of VND, ranging from tens to hundreds of billions.