Sacombank has just announced the application of new fees for Combo Account and SMS Banking services for individual customers.

According to the Combo account fee schedule, individual customers maintaining an average monthly balance of 1 million dong or more will be free. Meanwhile, accounts with a balance of less than 1 million dong will incur a fee of 22,000 dong/month (including VAT).

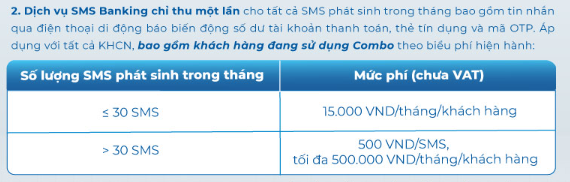

Sacombank also announced that it will charge a one-time fee for SMS Banking service for all SMS generated in the month, including messages via mobile phone notifying changes in the balance of payment accounts, credit cards, and OTP codes. This fee applies to all individual customers, including customers using the Combo service.

Specifically, if the number of SMS generated in the month is less than 30 messages, the bank will charge a fee of 16,500 dong/month/customer (including VAT). If the number of SMS generated in the month exceeds 30 messages, a fee of 550 dong/SMS (including VAT), with a maximum of 550,000 dong/month/customer, will be charged.

Therefore, for example, if a customer generates 50 SMS Banking messages in a month, the fee to be paid is 50 x 550 = 27,500 dong. Customers who generate 1,000 or more SMS will pay a fee of 550,000 dong/month.

Previously, the bank separated the fee for notifying changes in balance (550 dong/message for more than 30 messages) and the fee for OTP authentication service via SMS (11,000 dong/month).

Note that to avoid SMS Banking fees, customers can enable the automatic notification feature through Sacombank Pay/mBanking app; register for Smart OTP/mSign authentication. Premium banking service customers of Sacombank Imperial, Sacombank Sapphire VIP, Social Security Account package, and Hi-tek Combo are not affected by this notification and remain subject to the current fee schedule.

New fee schedule of Sacombank

Not only Sacombank, a major private bank, Eximbank, has also changed its SMS Banking services starting today. The bank announced that from 01/03/2024, it will officially adjust the fee policy for exceeding the number of SMS messages when customers have more than 20 SMS Banking messages per month for individuals and businesses.

Specifically, if in a month customers receive more than 20 SMS Banking messages (SMS Banking messages refer to SMS messages notifying changes in payment deposit balance), in addition to the fees for SMS Banking services, Combo packages, etc., (prepaid: monthly, quarterly), Eximbank will charge an additional fee for exceeding the number of SMS messages, which is 770 dong/message/month/account/subscription * (the actual number of SMS messages generated in the month – 20 messages).

Eximbank will charge the additional fee for exceeding the SMS Banking messages on the first working day of the next month after the month of exceeding the messages, specifically from 01/04/2024. At the same time, the balance change notification will only be sent via SMS for transactions of 50,000 dong or more.

Prior to Eximbank, from January 1, 2024, the fee schedule for SMS Banking services at many banks such as Vietcombank, ACB, NamABank, etc., has also undergone similar changes. For example, at Vietcombank, the bank has officially stopped sending balance change messages for transactions valued below 50,000 dong. For proactive SMS services, Vietcombank will charge a fee based on the number of SMS messages generated in the month. If the number of messages is below 20 messages/month/phone number, the service fee is 10,000 dong/month/phone number. If the number of messages exceeds 20 messages/month/phone number, Vietcombank will charge a fee based on the actual number of messages generated in the month, with a fee of 700 dong/message. These fees do not include VAT.

From 1/1/2024, ACB also changed the fee calculation mechanism and the fee for SMS Banking services for individual and business customers. Accordingly, the lowest fee is 15,000 dong/month (including VAT) for the number of SMS messages below 20 messages. The number of SMS messages exceeding 20 messages will be 15,000 dong plus 700 dong/message, calculated from the 21st message onwards, calculated per month/subscriber/customer. The balance change notification will only be sent via SMS for transactions of 50,000 dong or more.

SMS Banking is a very popular service for bank users. This service helps them quickly grasp balance changes without the need for an internet connection. Recently, changes in SMS Banking fees at many major banks have surprised users because they were not aware of the new fee schedule, while the number of SMS Banking messages has increased significantly.

Especially for business households, traders with a large volume of transactions into and out of their accounts of thousands of messages/month may have to bear millions of dong in fees. Many customers have reflected that since adjustment fee notifications are sent through apps or emails, they did not pay attention and confused them with promotional programs. Only when a sudden surge in SMS Banking fees occurred did many people realize the new fee policy.

In reality, almost every bank has implemented balance change notifications through apps completely free of charge to replace SMS Banking services. However, for many customers, they still prefer SMS Banking over notifications via apps. The first reason is that they are concerned about the need for an Internet connection to view balance change notifications on the app, while with SMS Banking, they only need a mobile network signal. Another reason is mainly related to the difficult habit of giving up; receiving balance change notifications via SMS Banking with low fees has become a natural thing for many users for many years. Now the sudden fee increase has caught them off guard.