Mirae Asset has just released an updated report on the outlook for the information technology sector after a long period of sideways trading in this group of stocks due to foreign selling pressure amid profit-taking in tech stocks globally.

In Vietnam, for the three months ending in May 2025, the information technology industry recorded revenue of VND 19,020 billion, a 20% increase compared to the same period last year. Gross profit margin improved to 32.4%, up from 31.9% in 2024, thanks to cooling inflation and tight cost control. The technology sector continues to grow in double digits, supported by a skilled workforce and government incentives.

Demand remains strong in key foreign markets such as Japan, the US, and ASEAN, especially in sectors accelerating their digital transformation, including finance, manufacturing, and retail. As businesses shift to cloud, automation, and AI, Vietnamese information technology enterprises are well-positioned in terms of cost competitiveness to expand their market share.

FPT, the industry leader, recorded a nearly 20% revenue increase in 2024 (US$2.17 billion) and maintained this growth momentum in the first quarter of 2025, with a 17% year-on-year increase in global information technology services revenue, including a remarkable 30% surge in the Japanese market. CMG, focusing on Japan, aims for this market to contribute ~50% of its foreign revenue by 2028.

However, as of 4Q2025, FPT’s new global information technology services bookings (an early indicator) reached VND 15,000 billion, a 10.4% increase, slower than the historical growth rate of 20%, reflecting a possible slowdown in technology project spending due to global trade concerns.

The Vietnamese government has implemented policies to foster technology development, including Resolution 57-NQ/TW (December 2024), emphasizing that science, innovation, and digital transformation are the “decisive driving forces” for growth. To boost this direction, the state is expanding preferential policies related to credit, land, and taxes. In March 2025, a VND 500 trillion credit package (equivalent to US$20 billion) was deployed through 21 banks, providing long-term low-interest loans for digital infrastructure projects such as data centers and broadband.

So far, Vietnam has attracted 174 FDI projects in the semiconductor sector, with a total registered capital of nearly US$11.6 billion (including 50 IC design companies), and has approved 10 national IT parks (in Da Nang, Hoa Lac, and Thu Duc), aiming for 16-20 parks by 2030.

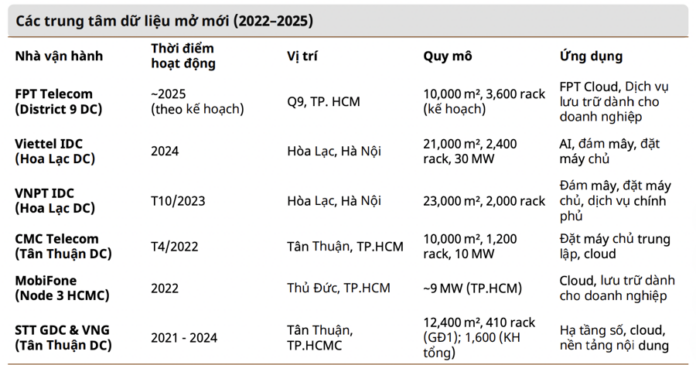

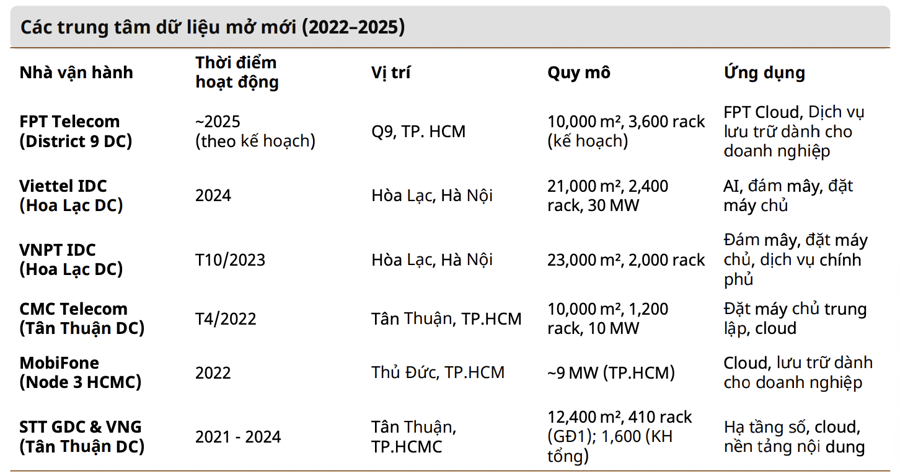

AI Infrastructure Development: Driven by the surge in AI demand and the expansion of cloud services, Vietnam is entering a crucial phase of digital infrastructure development, particularly in data centers and 5G networks. Data centers are bifurcating into two segments: compute and cloud storage, each with distinct power and scale requirements.

Major players like Viettel, CMG, FPT, VNPT, and VNG are expanding rapidly: Viettel with 14 data centers (~87 MW), FPT with 4 data centers (~30 MW), and VNPT with 8 data centers (~38 MW). Viettel’s 2025-2030 plan includes adding 11 hyperscale data centers, increasing capacity to 400 MW. CMG plans to invest $500 million in Vietnam and Japan by 2028.

Competitive Infrastructure Costs: Cushman & Wakefield estimates the cost of building data centers in Vietnam at $5.4-8.4 million/MW, averaging $6.9 million, a 3.5% increase year-over-year, higher only than Taiwan ($6.4 million) but lower than mainland China ($7.1 million), Thailand ($7.6 million), Indonesia ($8.7 million), and Malaysia ($9.0 million).

However, challenges remain. Data centers for AI are estimated to consume two to five times more electricity than traditional models, straining the power grid. Without timely upgrades and stable power supply, electricity could become the most significant bottleneck for digital infrastructure. KPMG forecasts a 13.1% CAGR in data center capacity in the APAC region from 2025 to 2030, higher than the 9.2% in North America and 5.3% in the EU.

Viettel plans to invest $1.2 billion in 5G deployment, supporting the Ministry of Information and Communications’ goal of nationwide coverage by 2030. While not directly profitable, 5G is a crucial platform for deploying low-latency AI applications in logistics, healthcare, and smart manufacturing. The Ministry is also considering allocating the 6GHz band, creating growth opportunities for IoT and cybersecurity—areas where Vietnamese IT enterprises are just beginning to build capabilities.

In terms of valuation, in January 2025, Nvidia’s stock fell 17%, wiping off $593 billion in market capitalization, triggering a sell-off in semiconductor, energy, and AI stocks in the US, with a total value loss of over $1 trillion. The launch of DeepSeek, an affordable AI model, raised concerns about valuation bubbles. The April 2025 tariff tensions further added to market uncertainty.

Although not directly impacted, the Vietnamese information technology industry, with its export orientation and deep integration into global supply chains, experienced psychological effects, causing leading stocks to drop by 20-30% as growth expectations were adjusted. Nevertheless, FPT and CMG’s PEG ratios remain attractive at around 0.9x-1x, compared to 2-3x in India.

Based on this analysis, Mirae Asset recommends buying FPT with a target price of VND 134,800 per share and CTR with a target price of VND 106,700 per share.

The Digital Revolution: Unveiling the Latest Updates to the Draft Law on the Digital Technology Industry

The Digital Technology Industry Law draft has institutionalized the major guidelines outlined in Resolutions No. 57-NQ/TW and No. 68-NQ/TW of the Political Bureau.

“Empowering SMEs: Streamlining Operations with Low-code/No-code Solutions”

In the ever-evolving digital age, Vietnamese SMEs face the constant pressure to innovate for survival and growth. Innovation goes beyond mere “application of new technology”; it lies in the mastery of technology and the ability to proactively design, adjust, and expand operational systems in alignment with the unique realities of each business.