At the Practical Discussion: Hanoi Apartment Market and Northern Provincial Land Market, Mr. Duong Van Sy, CEO of An Vuong Land, shared his insights on the 2022-2025 cycle of the land market. According to Mr. Sy, the Northern land market witnessed a rare boom in early 2022, with prices surging.

However, the fever quickly cooled down as banks tightened credit, interest rates rose, and the government intensified legal reviews of projects. From the third quarter of 2022, liquidity plummeted, and losses spread widely.

Entering 2023, the market fell into a deep lull. Transactions were almost frozen in the first half. A defensive mindset prevailed as many investors withdrew from the market. Supply decreased, and so did demand. Land prices in many localities were reassessed, with a common reduction of 20-50%.

By 2024, the market started to show slight recovery signs, especially from the middle of the year. Easing credit policies attracted small capital back to the market. Many localities announced infrastructure development plans, contributing to the market’s new momentum. Prices stabilized, with some areas recording slight increases of 5-10%. Liquidity improved significantly in the peripheral markets of Hanoi and the industrial provinces.

The year 2025 is expected to continue the recovery momentum, but the market will be polarized. Investor sentiment is more positive, and transactions are vibrant again in areas with planning information, administrative mergers, and synchronous infrastructure.

According to Mr. Duong Van Sy, the supply of land is currently not scarce, but there is a strong polarization among localities. Specifically, the provinces that develop industry and have good regional connections with Hanoi, such as Bac Giang and Thai Nguyen, have recorded six new projects each. Bac Ninh has three projects, Hai Phong has four, and Hung Yen also has three projects underway.

In contrast, in less developed areas like Lang Son, Cao Bang, Tuyen Quang, and Yen Bai, mainly the northern midland and mountainous provinces, the new supply is quite limited, mostly from small-scale auctioned lots.

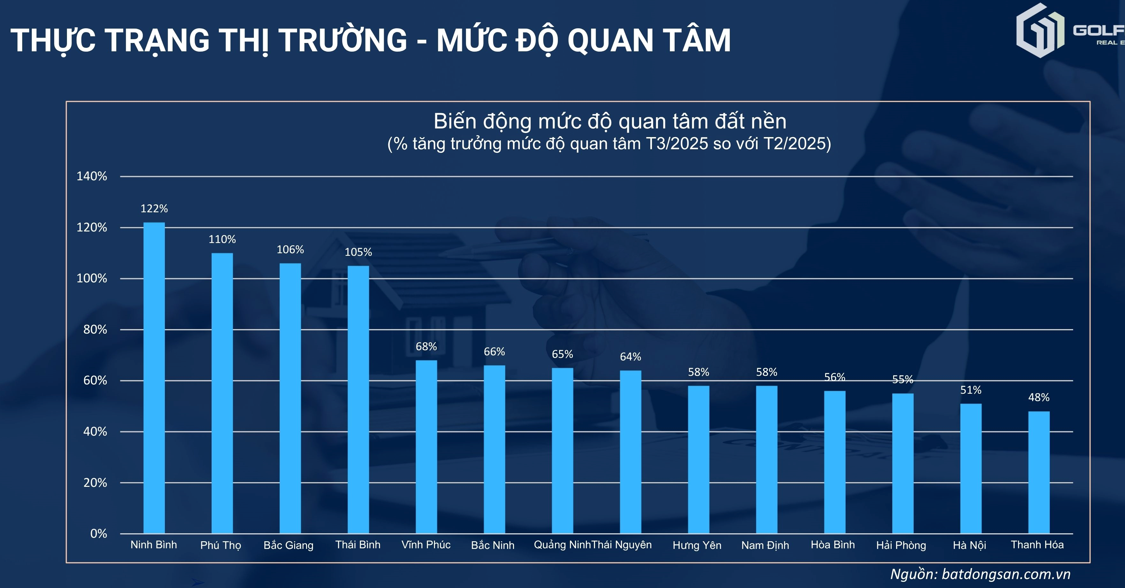

In the first quarter of 2025, interest in land in the northern provinces surged, reflecting the market’s recovery after a lull, especially in areas with developed infrastructure and economic potential.

Commenting on the future trends of the land market, the CEO of An Vuong Land believes that supply will recover thanks to a series of legal solutions, along with a growing economy, well-developed transport infrastructure, and low-interest rates.

On the demand side, the trend of “surfing” investment is showing signs of slowing down as investors temporarily observe the impacts of tax policies and macroeconomic fluctuations. Instead, money tends to flow to areas with room for price increases – the “price troughs” with development momentum from planning, improved infrastructure, and local economic growth.

Regarding price levels, Mr. Sy opined that the market is unlikely to plunge. Provinces with strong internal resources and well-connected transport systems will continue to maintain a certain “heat,” but the price increase will generally slow down compared to previous periods.

Transactions in the market are still cautious. As confidence has not fully recovered, the absorption rate has slowed down, especially when the current price level remains high, while supply is no longer scarce.

Therefore, Mr. Sy recommended that investors carefully select products based on legal status, infrastructure, and liquidity. Allocate capital to real estate types that can generate stable cash flow, such as residential, commercial, and office properties. Focus on investing in localities that attract FDI, develop industry, and have high GDP. Along with this, build a long-term investment strategy and avoid following the crowd or expecting short-term surfing.

“T-Corp’s Strategic Retreat: A Bold Move with a New Name and Real Estate Venture”

The Asset Management Group Tri Viet Joint Stock Company (HNX: TVC) held its 2025 Annual General Meeting of Shareholders on the morning of June 14, approving key agenda items. These included a conservative business plan, the distribution of additional dividends for 2021, a share buyback program to reduce charter capital, changes to the board of directors, and a proposal to change the company name to T-Corp.

The Pathway: A Dual-Asset Opportunity in the Heart of Sam Son’s Tourism Hub

The beach buzzes with a crowd of sun-seekers, the seaside square heaves with excited onlookers, and the skyline illuminates with a dazzling display of fireworks. From dawn till dusk, a vibrant series of shows and street festivals keep the energy alive.

The Land Grab: Investors Flock to Cuchi and Can Gio

The rising land prices and sluggish liquidity have left many investors in a waiting game, as those who bought land in Cu Chi and Can Gio remain stagnant.