Decree 70/2025 on electronic invoicing has had a significant impact on Vietnam’s banking system. The decree mandates that from June 1st, businesses with an annual turnover of over 1 trillion VND in six specified sectors must use electronic invoices from their cash registers, directly linked to tax authorities. This change has created a transition challenge and led to many small-scale retailers temporarily closing their doors or refusing non-cash payments, favoring cash transactions only.

This wave of cash-only operations has affected the volume of non-term deposits held by these businesses in banks. With lending rates remaining low, banks also face challenges in increasing deposit rates without impacting profit margins. As a result, the decline in non-term deposits is putting additional pressure on the banks’ cost of funds (COF).

Understanding the dynamics of CASA (current account and savings account) is crucial to grasping the potential chain of consequences that even a small decline in non-term deposit ratios can have on a bank’s financial performance.

CASA is a low-cost source of funding, typically ranging from 0.1-0.5%/year. Its greatest advantage lies in its flexibility and near-instant availability for credit or investment activities. With a significantly lower cost of capital compared to term deposits, CASA serves as a financial lever for banks, improving their net interest margin and return on equity (ROE). A high CASA ratio also reflects a bank’s long-standing reputation, technological capabilities, and customer retention.

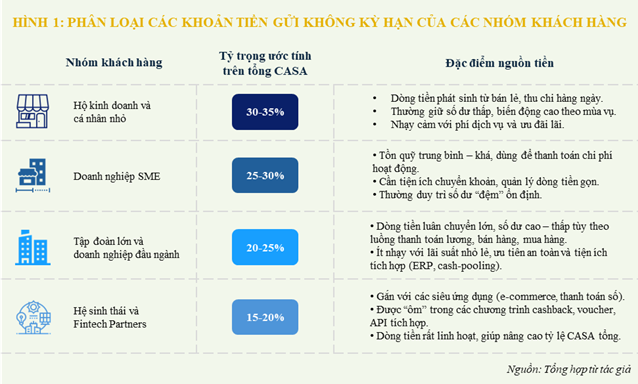

However, when CASA declines, banks must turn to alternative sources of funding, which often come at a higher cost. This scenario increases pressure on the cost of capital and negatively affects profits. In Vietnam, the CASA system comprises four main customer groups, each with unique characteristics and contributions to the overall CASA landscape.

The first group, individual households, and small-scale retailers, account for 30-35% of CASA. Their daily transactions and retail activities provide a substantial but sensitive source of CASA, influenced by fee policies and interest rates. The second group, SMEs, is characterized by stable cash flows for operational needs, salary payments, and order settlements. These businesses often maintain stable account balances, especially when banks offer digital tools like electronic invoices, integrated accounting software, and API connections.

The third group consists of large corporations and enterprises, contributing 20-25% to CASA through internal payments and treasury management within their ecosystem. Finally, the fourth group is the digital ecosystem and Fintech partners, including e-wallets, e-commerce platforms, and BNPL apps, which offer flexible CASA through promotions, cashback programs, and integrated payment services.

Banks employ strategies to retain CASA, such as smart accounts with automated reporting and cash flow management software for businesses and fee waivers, gifts, and cashback incentives for individuals. At the macro level, cash flow management services for large corporations and ecosystems are effective tools for banks to control cash flow and increase CASA ratios.

However, CASA ratios vary significantly between banks. Those with strong ecosystem linkages, like MBB and Techcombank, often have higher CASA ratios of 30-40%. Retail-focused banks with extensive digital banking systems, like ACB and Sacombank, typically maintain stable CASA ratios of 15-25%. In contrast, smaller banks without ecosystem advantages or robust digital financial tools often have CASA ratios below 10%, resulting in higher COF and lower profit margins.

To illustrate the impact of declining CASA, two hypothetical scenarios are simulated: a 2% and a 4% decrease in system-wide CASA from the baseline. Key financial indicators, including COF, interest expense, net interest income, net interest margin, profit before and after tax, ROE, and liquidity through the LDR (loan-to-deposit ratio) index, are monitored. These scenarios highlight the absolute losses, demonstrating a concerning decline in the financial structure of the banking system.

In the first scenario, a 2% decrease in CASA from 21.4% to 19.4% results in a COF increase from 3.82% to 3.91%, a difference of 9 basis points. Consequently, the industry’s interest expense increases from 561.9 trillion VND to 574.2 trillion VND, an additional burden of 12.3 trillion VND annually. This leads to a decline in net interest income from 511.2 trillion VND to 498.9 trillion VND, a decrease of almost 2.5%. The net interest margin also narrows from 3.01% to 2.94%, while ROE drops from 15% to 14.42%, and profit after tax falls from 228.5 trillion VND to 218.6 trillion VND.

Similarly, in the second scenario, with a 4% decrease in CASA, the interest expense burden increases to 26 trillion VND, and ROE plunges to 13.69%, a decrease of over 1.3% from the initial level. Notably, in both scenarios, the LDR is maintained at a nominal 100%. However, the capital structure changes as the lost CASA is replaced by more expensive term deposits, potentially impacting liquidity quality.

As banks seek to replace non-term deposits, they engage in a competitive race to increase deposit rates, further elevating the cost of capital. This dynamic leads to higher liquidity reserves and a potential widening of the interbank lending rate, creating localized liquidity risks during peak periods, especially in the last quarter of the year when loan demands surge.

The simulations reveal that even a 2-4% decline in CASA could result in a 5-10% loss of net profit for the entire banking sector. Additionally, the return on investment becomes less attractive from an investor’s perspective, while system liquidity increases. Thus, maintaining CASA is not just about optimizing costs but also a competitive strategy to safeguard the financial health and profitability of banks.

While Decree 70 is a step forward in modernizing tax administration and enhancing transparency, its implementation has triggered a reluctance among businesses to use bank accounts, favoring cash transactions instead. This shift has led to a rapid decline in CASA, a critical source of low-cost funding for banks, impacting their financial structure and profitability, especially with narrowing net interest margins and increasing profit pressures.

Lê Hoài Ân, CFA

The Evolution of Electronic Billing: Seamless Efficiency at Your Fingertips

“Following the implementation of Decree No. 70/2025/ND-CP, the vast majority of citizens have cooperated and complied with the new policy. However, a significant number of businesses, particularly those run by older individuals, have faced challenges in adapting to the changes, resulting in ongoing data transmission issues. This challenge was inevitable given the short three-month preparation period for the decree and the delayed release of the guiding documents.”

Tax Crackdown: Revenue Targets 25,201 Individuals and Businesses in May 2025

“In the first five months of 2025, the Ministry of Finance reports that tax authorities scrutinized 164,661 taxpayers, resulting in additional tax collections of over VND 416 billion from businesses. Moreover, they pursued tax evasion cases involving 25,201 individuals and households, recovering a total of more than VND 331 billion in taxes.”

The Ultimate Guide to Electronic Invoicing: Unlocking the Power of Digital Billing

The direct-to-consumer business can continue using their registered electronic invoices or switch to using a POS system that integrates with the tax authority.