DCM aims to surpass its 2025 targets with a projected net profit of over 1.2 trillion VND in just 6 months, despite setting conservative goals.

For 2025, DCM targets nearly 14 trillion VND in total revenue, a 4% increase, but a net profit of only 774 billion VND, almost half of the 2024 performance. However, it’s important to note that DCM has consistently set low targets and exceeded them in previous years.

In terms of production volume, the company plans to produce 910,000 tons of urea equivalent and 340,000 tons of NPK (with 220,000 tons of self-produced and the rest from the KVF factory). DCM aims to sell 759,000 tons of urea and 340,000 tons of NPK.

Screenshot

|

General Director Van Tien Thanh shared that the cautious planning reflects the realistic outlook inherited from the parent group, PVN. Each year, DCM creates scenarios based on oil and urea price forecasts to determine revenue and profit targets. However, the actual context and reality differ significantly.

“We don’t want to set low targets, but what if we don’t achieve them due to unfavorable conditions? Our employees’ salary funds are based on profits. Setting conservative targets ensures stable salaries. Nevertheless, we usually request to raise the targets instead of lowering them at the end of the year”, said Mr. Thanh.

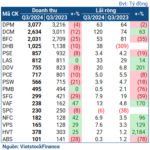

As of Q1/2025, DCM achieved 3.4 trillion VND in net revenue, a 24% increase year-on-year, with a net profit of 411 billion VND, a 19% increase. Compared to the set targets, the fertilizer giant has achieved 24% of the revenue target and nearly 54% of the profit target after the first quarter.

Notably, General Director Van Tien Thanh revealed that the estimated pre-tax profit for Q2 exceeded 1,247 billion VND, surpassing the plan by about 21%. This positive signal indicates a promising 2025, with the company aiming for new records.

| DCM’s business results |

Regarding dividends, DCM proposed a 20% dividend for 2024 and a 10% dividend for 2025. When asked about not distributing more, General Director Van Tien Thanh explained that the fertilizer industry typically grows by 10-20% annually, with profits ranging from 8-10%. In reality, maintaining a 20% dividend indicates effective management in recent years.

“From 2022 to 2024, we’ve sustained this dividend rate. If we distribute all our earnings, we won’t have advantages in the following periods. A business needs healthy working capital to adapt to different situations, such as purchasing goods or foreign currency needs, which enhances resilience. We can slightly increase the dividend if we perform well, but let’s consider the company’s resilience in today’s challenging context”.

For 2025, DCM provides a relatively positive outlook. Regarding urea fertilizer, the company forecasts global production to reach 190 million tons, with increased output from China, the Middle East, Russia, and North Africa. Consumption is expected to grow by 2-3% due to the recovery of agriculture in developing countries, as positive signs in agricultural commodity prices improve farmers’ ability to afford fertilizers and other inputs.

Urea will remain the most popular fertilizer. Asia-Pacific is expected to dominate the market, especially in countries like China and India, where agriculture plays a significant role in the economy. Government support and subsidies for fertilizers drive market growth.

Similarly, the global potash market is projected to continue its upward trend, with demand and prices tending to increase. However, this market faces challenges related to supply chains. Potash demand is estimated at 68-71 million tons this year. The primary sources of global potash supply are major producers like Canada, Russia, and Belarus. Nevertheless, sanctions and geopolitical tensions could impact supply capabilities, leading to shortages and price increases during specific periods.

The DAP market is expected to reach 52 million tons in production with recovering supply from China, while consumption is projected to stabilize around 48-50 million tons. However, sanctions and geopolitical tensions may affect supply capabilities from countries like Russia and Belarus, leading to shortages at certain times. Additionally, China’s restrictions on DAP exports influence market supply. DCM believes that DAP/MAP prices will continue their upward trend in 2025.

Regarding the NPK market, DCM forecasts rising prices due to higher input costs. In reality, NPK production relies heavily on the prices of raw materials such as urea, DAP, and potash.

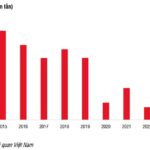

Regarding the domestic market, DCM predicts that Vietnam’s fertilizer market will continue to grow in 2025 due to factors such as domestic and international agricultural demand, government support, policies promoting agriculture, encouraging crop diversification, and adopting sustainable farming practices. Vietnam’s fertilizer consumption is estimated at 10.5-11 million tons/year.

Notably, the application of a 5% VAT on fertilizers from July 2025 is expected to support the profits of domestic fertilizer producers by refunding input VAT, reducing production costs, and enhancing the competitiveness of domestic fertilizers compared to imported ones.

“Before the VAT application, all input VAT was reflected in the selling price to farmers. Meanwhile, foreign companies were refunded when their goods left the border, putting us at a disadvantage in our home market. So, the industry proposed to the National Assembly, and adjustments were made.”

“The fertilizer VAT will take effect on July 1st. On average, input with VAT is about 7.5%, and output is 5% of the selling price. Input accounts for 85% of the cost, while the selling price includes management, sales, and profit margins, making the selling price much higher. 5% of the selling price can be higher than 7.5% of the cost, so can we get a refund? However, the selling price also depends on world prices, so sometimes we have to balance profits to enter the market or reduce them” – added Mr. Van Tien Thanh.

Continuing to increase factory capacity

To achieve its goals, DCM focuses on key tasks for 2025. Firstly, ensuring the efficient, safe, and stable operation of the Ca Mau Fertilizer Plant and optimizing its capacity. Simultaneously, the company aims to control costs and save energy, targeting a 5% reduction in energy consumption by 2025 compared to the 2022 baseline. According to Mr. Van Tien Thanh, with the double-digit growth target set by the parent group PVN, DCM plans to continue increasing factory capacity, aiming for over 120% of the designed capacity (compared to the current 115%).

General Director Van Tien Thanh speaking at the 2025 AGM of DCM

|

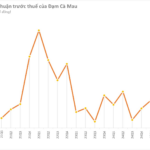

“This is DCM’s strength. When we first took over, the Ca Mau Fertilizer Plant operated at 100% of its designed capacity, and we managed to increase it to 102-103%, but then we encountered technological bottlenecks. DCM’s engineers addressed these issues and further improved efficiency to 105-106%. We then modified the equipment, reaching 110-111%. In 2022-2023, we made significant improvements, achieving 115% of the designed capacity.”

“Since 2013, we haven’t just increased capacity, but we’ve also saved 8% in energy. We consume about $200 million worth of gas each year, so the 8% savings is significant. From 2022 onwards, our engineers have proposed modifications that could save an additional 5% in energy. We can reach 120% and even push further to 125%” – quoted DCM’s General Director.

Additionally, DCM will focus on implementing various management approaches: managing volatility, value chain management, ecosystem management, and management based on digital platforms. The company will also be ready to transition its business model according to trends. Furthermore, DCM will explore diversifying raw material and fuel sources for fertilizer production, aiming for sustainable and green production.

The company also aims to develop high-tech agricultural cultivation solutions based on crop nutrition and scientific and technological advancements. It plans to expand exports to neighboring countries and regions, offering diverse fertilizers based on urea and organic NPK.

Regarding personnel, the General Meeting approved the resignation of Mr. Truong Hong as an independent member of the Board of Directors. Simultaneously, shareholders will elect one member to the Board of Directors and one independent member for the term 2025-2030. The candidates, nominated by the major shareholder, the Vietnam National Oil and Gas Group (PVN), are Mr. Nguyen Duc Hanh (candidate for the Board of Directors), currently a member of the Board of Directors, and Mr. Le Viet Dung (candidate for the independent member of the Board of Directors), currently a senior lecturer at Can Tho University.

Additionally, the General Meeting approved the election of one member to the Supervisory Board for the term 2025-2030 to replace Ms. Phan Thi Cam Huong, whose term has ended. The replacement is Mr. Tong Viet Thong, a candidate nominated by PVN and currently the Head of the Legal and Compliance Department of the Company.

The General Meeting concluded with the approval of all proposals.

– 13:52 16/06/2025

The First Enterprise to Unveil Q2 2025 Financial Results

In Q2 of 2025, estimated revenue reached an impressive VND 6.2 trillion, marking a remarkable 60% growth compared to the same period last year.

What Impact Does the Change in VAT Law Have on Fertilizer?

The resolution 71/2014/QH13 exempts fertilizers from VAT from January 2015 onwards. However, this has put domestic fertilizer producers at a disadvantage compared to importers, as their production costs are not exempt from VAT either.