As Vietnam navigates economic growth, competition, and sustainability, a crucial indicator of organizations’ contribution to the country’s economic development is their tax revenue. For many businesses, tax revenue is a key annual business goal.

Alongside state-owned enterprises, leading private enterprises such as Vingroup, Hoa Phat, Masan, Techcombank, VPBank, and HDBank are making significant contributions, with annual tax payments ranging from thousands to tens of thousands of billions of VND.

To recognize the important role of enterprises in economic development and social service, CafeF introduced the CafeF Lists in 2024, comprising two rankings: PRIVATE 100 and VNTAX 200 – honoring enterprises with the largest tax contributions to Vietnam.

VNTAX 200 lists enterprises with annual tax contributions of VND 200 billion or more, including state-owned, private, FDI, and joint-venture enterprises. PRIVATE 100, on the other hand, exclusively recognizes private enterprises with tax contributions of VND 100 billion or higher.

The inaugural PRIVATE 100 and VNTAX 200 rankings in 2024 received overwhelming support from businesses, readers, and economic experts. These rankings not only acknowledge financial contributions but also foster a sense of social responsibility and affirm the enterprises’ standing in the economy.

With hundreds of thousands of billions of VND in total contributions from leading enterprises, these rankings uniquely reflect the comprehensive extent of enterprises’ contributions across all economic sectors.

According to our preliminary data for PRIVATE 100 – Top Private Enterprises with the Largest Tax Contributions in Vietnam, 209 private enterprises have tax contributions of VND 100 billion or more in 2024. Notably, 56 of these companies contributed over VND 1,000 billion.

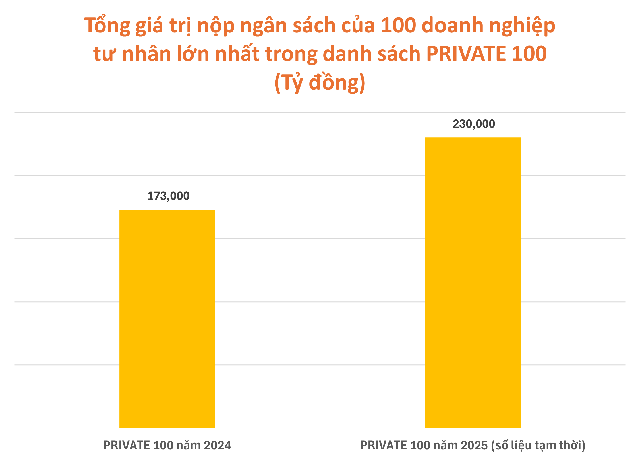

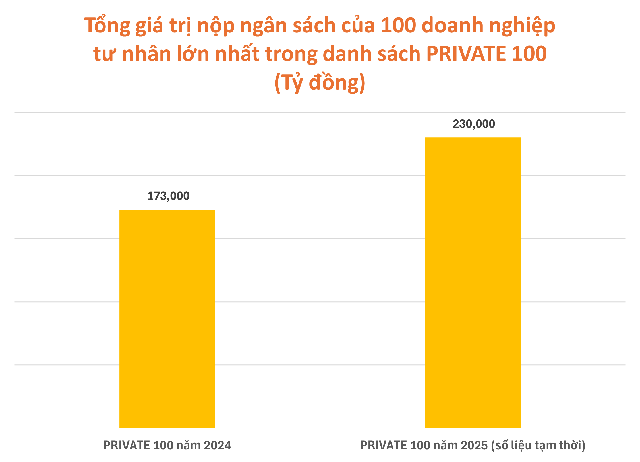

The top 100 enterprises in the current ranking have a total tax contribution of VND 230,000 billion, a significant increase from the VND 173,000 billion contributed by the top 100 in the 2024 PRIVATE 100 ranking. This reflects the resilience and growth of private enterprises amid domestic and global economic fluctuations.

The scale of the 2025 PRIVATE 100 ranking is expected to be even larger as many large enterprises are yet to disclose their data.

CafeF anticipates that PRIVATE 100 and VNTAX 200 in 2025 will continue to inspire and motivate Vietnamese enterprises to contribute further to the country’s prosperity.

In addition to data collected by the organizers, all enterprises with annual tax contributions of VND 200 billion or more, or private enterprises with contributions of VND 100 billion or higher, can submit their information to the organizers to participate in the rankings.

The 2025 PRIVATE 100 ranking for private enterprises is expected to be announced in July 2025, followed by the VNTAX 200 ranking for all enterprises.

Top 30 private enterprises leading the PRIVATE 100 ranking in its inaugural year, 2024

BASIC INFORMATION ABOUT THE PRIVATE 100 AND VNTAX 200 RANKINGS

The PRIVATE 100 – Top Private Enterprises with the Largest Tax Contributions in Vietnam and VNTAX 200 – Top Enterprises with the Largest Tax Contributions in Vietnam rankings are compiled by CafeF from publicly available sources, including financial statements and data provided by the enterprises, with necessary verification and adjustments.

In addition to the general ranking, PRIVATE 100 also includes rankings by industry group

Alongside the main rankings, PRIVATE 100 and VNTAX 200 feature additional rankings by industry groups such as Banking, Real Estate – Construction, Consumer Goods, Securities and Finance, Retail, etc.

Tax revenue data includes various taxes, fees, land rent, and other budgetary contributions as stipulated by law, which the enterprise (including consolidated contributions from parent and subsidiary companies) has paid during the year.

Private enterprises are defined as those with 100% private capital, without a state-owned parent company, or public companies with foreign room over 50% but not controlled by a foreign investor or group of foreign investors.

The 2025 rankings are based on financial year data [12 months] ending on June 30, 2024, September 30, 2024, December 31, 2024, and March 31, 2025.

PRIVATE 100 and VNTAX 200 rankings for 2024 (based on 2023 contribution data):

VNTAX 200 Ranking: https://cafef.vn/du-lieu/vntax200/doanh-nghiep.chn

PRIVATE 100 Ranking: https://cafef.vn/du-lieu/private100/top-100-doanh-nghiep.chn

Articles announcing the 2024 PRIVATE 100 and VNTAX 200 rankings:

Related articles: https://cafef.vn/cafef-lists.html

To submit data for the rankings, please send your information to the email address [email protected] or contact Ms. Linh at 0847611565.

Tax Authorities Conducted Nearly 16,000 Inspections in the First Five Months of the Year:

This title maintains the essence of the provided text but is crafted with a more engaging and informative tone, suitable for an English-speaking audience.

As of May 2025, the tax industry has conducted 15,848 inspections and audits, resulting in a proposed handling amount of VND 20,490 billion, a significant increase of 142% compared to the same period last year.

Maximizing Online Business Tax Revenue: A Robust Strategy

The tax authorities have been scrutinizing and collecting data on e-commerce business operators, warning of strict action against tax evasion and non-compliance. In the first four months of the year, tax revenues from organizations and individuals engaged in this sector amounted to VND 42.6 trillion.

What Do We Learn from the Record State Budget Collection?

This year, for the first time, the budget revenue reached an impressive figure of over 1.7 quadrillion VND, surpassing the 2023 figure by 13.7%. Despite this remarkable achievement, there are still underlying issues with the budget revenue, including an outdated personal income tax policy that poses the risk of tax losses.

“A Taxing Matter: Curbing Property Speculation with Time-Based Levies”

The Ministry of Finance is proposing to study and implement a tax on capital gains from real estate transfers. This progressive initiative aims to revolutionize the nation’s tax landscape by introducing a nuanced approach to taxation, one that is sensitive to the varying financial circumstances of citizens. By taking into account the duration of property ownership, this proposed tax adjustment has the potential to foster a more equitable society, where the tax burden is distributed in a manner that accounts for the diverse economic realities of the populace.