New Tax Regulations Impact, but Masan Has a Specific Strategy

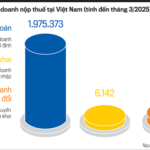

Recently, the government issued Decree 70, which mandates that business households with an annual turnover of VND 1 billion and above, using the lump-sum tax method, must switch to electronic invoices connected to cash registers from June 1, 2025. This shift from the lump-sum to declaration method is considered a necessary step to enhance tax management efficiency and establish tax equality between business households and enterprises.

Regarding this regulation, Mr. Phu pointed out the temporary closure of small shops. For Masan, the consumer goods sector experienced short-term impacts in May due to temporary store closures, reflecting a nationwide trend.

However, Mr. Phu believes that, ultimately, consumers will continue to purchase goods. During this period, the Group is implementing a strategy of visiting stores and supporting the development of a more modern distribution system for retailers. Mr. Phu also emphasized the Group’s ownership of an adjusted modern retail system, which has contributed to achieving double-digit growth.

Mr. Duong Hoang Phu, Senior Head of Capital Markets Group, Masan Group (furthest right), shares at the workshop.

|

In other discussions related to Resolution 68 on private economic development, Mr. Phu emphasized standardization, meaning that enterprises operate on the same legal framework and pay taxes equally, opening up opportunities in an economy where per capita consumer income reaches $5,000.

Masan has developed plans for modern retail and new FMCG products for consumers, such as “Asian Eateries” targeting middle and upper-class consumers.

The tax shock has a negligible impact on Masan

Regarding the impact of tariffs, Mr. Phu shared that immediately after the event, which Trump referred to as “liberation day,” the Masan leadership team held a strategic meeting to assess the overall impact.

According to Mr. Phu, Masan’s FMCG exports to the US account for only about $10 million per year out of a total of $8 billion, so the impact is not significant. Secondly, products like tungsten are not subject to tariffs, so there is no direct major impact. Additionally, the Vietnamese government’s fiscal policy to boost domestic consumption benefits Masan’s consumer retail business.

Mr. Phu also mentioned that the Group’s business plan has a wide range, indicating that they have considered the worst-case scenario.

Mr. Duong Hoang Phu sharing at the workshop.

|

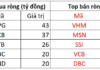

Going back to the Annual General Meeting of Shareholders in May 2025, the MSN shareholders approved the consolidated business plan with many positive aspects. Depending on internal approvals, macroeconomic conditions, and market recovery, consolidated net revenue is expected to range between VND 80,500 – 85,500 billion, corresponding to LFL growth of 7 – 14% year-on-year, after adjustment for the deconsolidation of H.C. Starck Holding (Germany) GmbH (HCS). Consolidated total revenue, excluding Masan High-Tech Materials Joint Stock Company (UPCoM: MSR), is projected to be VND 74,013 – 78,013 billion, an increase of 8 – 13%.

The company anticipates a post-tax profit of VND 4,875 – 6,500 billion, a 14 – 52% increase compared to the realized profit of VND 4,272 billion in 2024.

Also, at the meeting, regarding the impact of the trade war on Masan’s business operations, CEO Danny Le stated: “No matter the circumstances, consumers will still use essential products, and we are confident that our market share will remain protected. However, we must remain cautious and closely monitor consumer preferences.”

Huy Khai

– 17:38 16/06/2025

Unveiling the Mystery: Authorities Unearth Nearly 9 Tons of Frozen Meat of Unknown Origin in Ninh Binh

Under the guidance of the Ministry of Public Security and the Provincial People’s Committee, the Ninh Binh Provincial Police have actively implemented a range of professional measures to combat smuggling, commercial fraud, and counterfeit goods. Their timely actions have led to the detection, prevention, and handling of numerous violations involving the production, trading, and transportation of food and goods with unclear origins.

The Evolution of Electronic Billing: Seamless Efficiency at Your Fingertips

“Following the implementation of Decree No. 70/2025/ND-CP, the vast majority of citizens have cooperated and complied with the new policy. However, a significant number of businesses, particularly those run by older individuals, have faced challenges in adapting to the changes, resulting in ongoing data transmission issues. This challenge was inevitable given the short three-month preparation period for the decree and the delayed release of the guiding documents.”

The Ultimate Guide to Electronic Invoicing: Unlocking the Power of Digital Billing

The direct-to-consumer business can continue using their registered electronic invoices or switch to using a POS system that integrates with the tax authority.