Oil stocks surge as Middle East tensions push up oil prices.

The trading session on June 16th witnessed a boom in oil stock prices with a slew of stocks surging, even hitting the ceiling at some point. So far, PVC stock has risen to the ceiling at VND 12,100/share, OIL increased by 9.73%, PVD by 5.62%, PVS by 4.6%, and many other stocks also saw positive gains.

Oil stocks are on the rise as tensions in the Middle East push up oil prices.

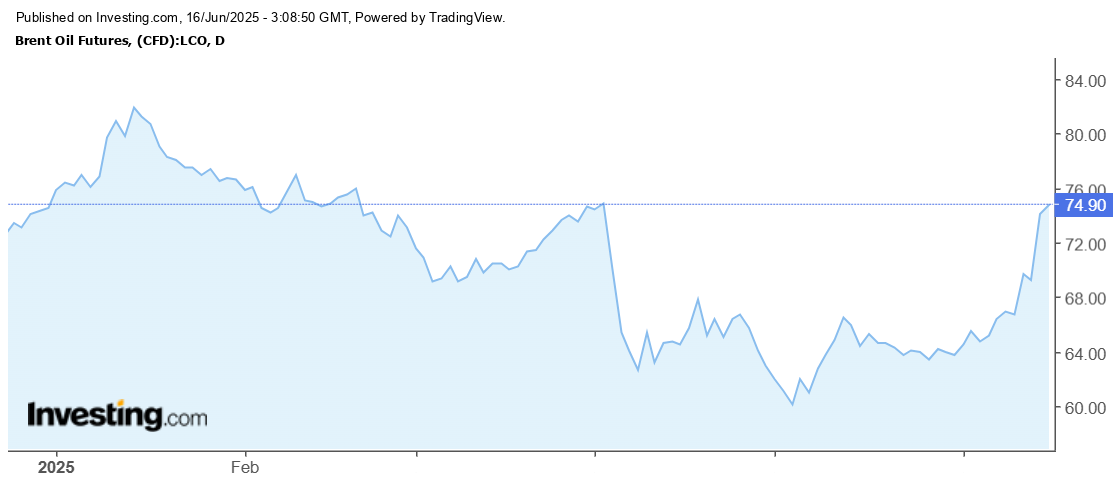

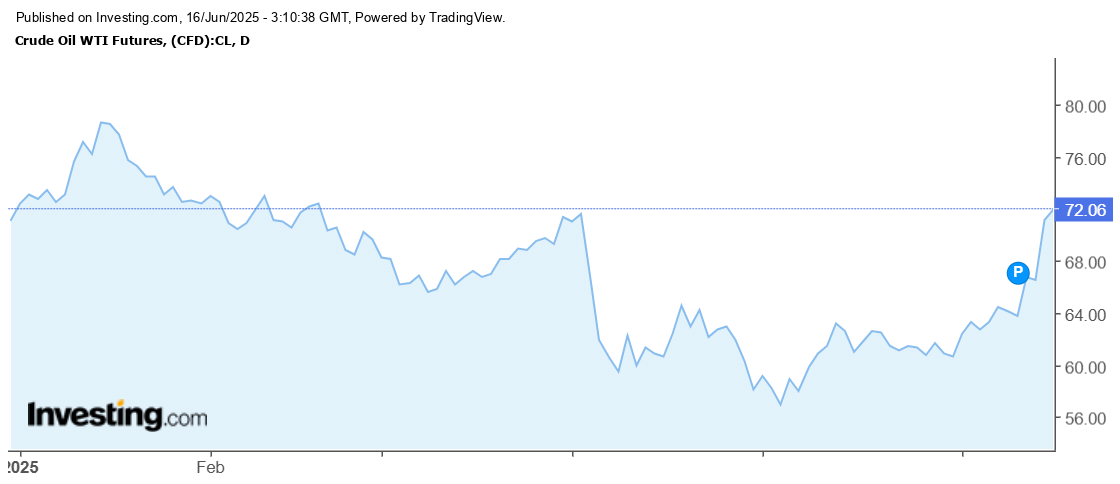

The positive performance of oil stocks stems from the sharp rise in oil prices due to the complex developments in the Israel-Iran conflict. As a crucial oil-producing region, tensions in the Middle East immediately impact oil prices. Currently, Brent crude oil prices have surged to nearly USD 75 per barrel, while WTI crude oil is trading at around USD 72 per barrel, both up over 20% from early May and more than 7% on June 13th.

The upward trend in oil prices is directly linked to the escalating conflict between Israel and Iran, with the US not intervening to ease tensions. Experts warn of potential risks to the oil market as other major oil-producing countries in the region could get drawn into the conflict if military hostilities escalate.

The International Energy Agency (IEA) has approximately 1.2 billion barrels of oil in reserves and is prepared to intervene if oil prices surge drastically.

The upward trend in oil prices is directly linked to the escalating conflict between Israel and Iran, with no signs of de-escalation. Experts warn of a potential impact on the oil market as other major oil-producing countries in the region could get involved if tensions continue to rise. The International Energy Agency reassures that they have approximately 1.2 billion barrels of oil in reserves and are prepared to intervene if necessary to stabilize the market and prevent drastic price surges.

Has the Market Bottomed Out? A Confident Prediction Amidst Uncertain Variables.

“On the Vietnam and Its Indices show on June 16th, Mr. Nguyen Viet Duc, the Digital Sales Director of VPBank Securities (VPBankS), offered his insights on the stock market amidst the emerging risks of war in the Middle East and the pivotal stage of the US-Vietnam trade agreement.”

What Stocks Surge Amid the Israel–Iran Armed Conflict?

The Israeli preemptive strike in the early hours of June 13 and Iran’s retaliation risk escalating tensions between the two Middle Eastern nations, potentially leading to a direct conflict with devastating humanitarian and economic consequences. Financial markets have already reacted, reflecting expectations and predictions about the war’s impact.

“Global Commodities Spike: Oil and Gold Surge, Coffee Plunges to 10-Month Low”

As of the market close on June 13, 2025, escalating tensions between Israel and Iran have sparked concerns about oil supplies in the Middle East, driving up the demand for gold as a safe-haven asset and pushing oil and gold prices to soar. Robusta coffee plunged to a 10-month low, while sugar prices hit their lowest level in over four years.