Source: VietstockFinance

|

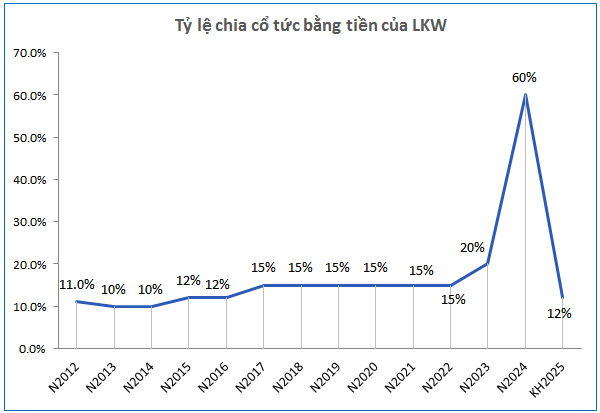

With nearly 2.5 million shares outstanding, LKW will dish out approximately VND 15 billion in dividends – the highest payout since its listing on UPCoM. This figure comes as a surprise, given that net profit for 2024 only increased by roughly VND 1 billion year-over-year, yet the company opted to distribute 60% of its remaining profit after provisioning to shareholders. Post-dividend, retained earnings rolling into 2025 stand at approximately VND 9.6 billion.

| LKW’s Financial Performance Over the Years |

LKW has a long history of paying consistent cash dividends, maintaining a stable payout ratio of 11-15% during 2012-2022. In 2023, the company raised its dividend ratio to 20%, which was considered a high rate at that time.

By prioritizing profit distribution for 2024, the projected dividend payout ratio for 2025 is expected to decrease to 12%. This is partly due to a forecasted 24% decline in net profit for 2025, amounting to over VND 10 billion, while revenue is anticipated to remain steady at approximately VND 48 billion.

Source: VietstockFinance

|

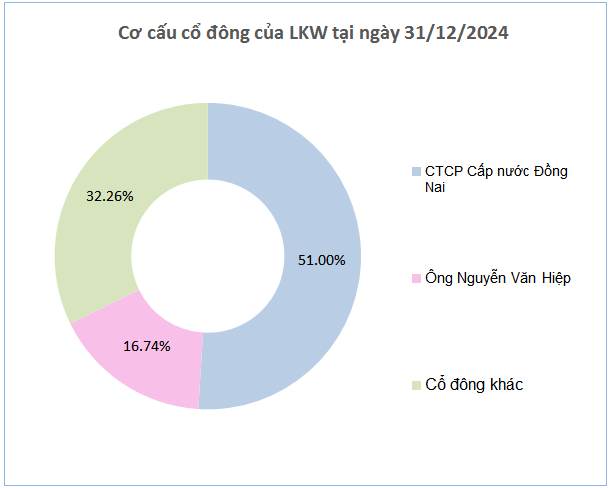

As of the end of 2024, LKW‘s parent company, Dong Nai Water Supply Joint Stock Company (DNW), which holds a 51% stake, is expected to receive approximately VND 7.65 billion in dividends. Major shareholder Nguyen Van Hiep, with a 16.74% ownership, will receive over VND 2.5 billion from this payout.

– 08:08 19/06/2025