Mr. Christopher E. Freund is one of the seven new board members of TNH for the 2025-2030 term. Born in 1972, Mr. Freund is an American national and holds a Bachelor’s degree in Psychology from the University of California, Santa Cruz. He started his career in Vietnam in 1995 and is the founder and CEO of Mekong Capital. He is also a board member of F88 Investment Joint Stock Company.

Mr. Christopher E. Freund. Source: Mekong Capital

|

Mr. Freund was nominated by Blooming Earth Pte. Ltd. (Singapore), a major shareholder owning 13.74% of TNH‘s capital. Previously, in March 2025, Mekong Enterprise Fund IV (MEF IV), a member fund of Mekong Capital, officially became a shareholder of TNH.

MEF IV was launched in 2019 with total committed capital of $246 million, double that of its predecessor, MEF III. The fund invests in private enterprises in Vietnam across various sectors, including consumer goods, education, restaurants, financial services, FMCG, and healthcare. Investment amounts range from $10-35 million, with a ten-year fund life. As of May 2024, MEF IV had invested in nine enterprises.

In addition to Mr. Christopher E. Freund, the other newly elected board members of TNH include Mr. Tran Ngoc Minh, Mr. Romeo Fernandez LLedo, Ms. Nguyen Thi Thuy Giang, Mr. Hoang Tuyen, Mr. Le Xuan Tan, and Mr. Nguyen Huu Diep. Four members were re-elected: Mr. Hoang Tuyen, Mr. Le Xuan Tan, Mr. Romeo Fernandez LLedo, and Ms. Nguyen Thi Thuy Giang.

2025 profit target hits a ten-year low

In 2025, TNH‘s leadership set a revenue target of VND 620 billion, a 41% increase from the previous year, thanks to contributions from new facilities, especially the TNH Viet Yen Hospital as its operations stabilize. However, the expected profit after tax is only VND 31 billion, a 30% decrease and the lowest in the past ten years.

In the profit structure, the International Hospital of Thai Nguyen continues to play a leading role with a target of VND 114 billion, a 66% increase. TNH Pho Yen Hospital is expected to contribute nearly VND 16 billion, a 25% growth. In contrast, TNH Viet Yen Hospital is projected to incur a loss of VND 54 billion, higher than the VND 19 billion loss in the previous year, due to pending operating permits and social insurance codes, which affect the progress of service deployment.

TNH held its 2025 Annual General Meeting of Shareholders on June 16. Source: TNH

|

To improve business results, TNH plans to boost revenue from periodic health examination services for industrial parks in Viet Yen. The company expects this facility to break even and turn profitable starting in 2026.

In parallel with controlling costs to maintain business efficiency, TNH plans to continue investing in key projects in the coming year, including the TNH Lang Son Hospital, the International Hospital of Thai Nguyen Phase 3, the TNH Pho Yen Hospital Phase 2, and the TNH Da Nang Hospital. Additionally, the three existing hospitals will be upgraded with new equipment and services to maintain their growth trajectory.

In the long term, when asked about the roadmap to expand the system to ten hospitals by 2030, the TNH leadership acknowledged that this goal is challenging and requires significant resources and strategic coordination. The company is currently seeking land for a hospital project in Ho Chi Minh City, but this process may take longer than in other localities. For now, TNH is prioritizing the Da Nang project.

Macroeconomic factors, such as fluctuations in construction material prices or global policy changes, may impact the progress of project implementation, although the domestic healthcare sector has not yet been significantly affected by these factors.

Key projects that are being expedited include the TNH Lang Son Hospital, expected to operate in Q1/2026, and the IVF Support Center, which will open in Q4/2025 with a focus on providing modern and advanced facilities. Simultaneously, TNH is finalizing legal procedures for new projects, including the TNH Eye Hospital, the TNH Hanoi Hospital, and the TNH Da Nang Oncology Hospital.

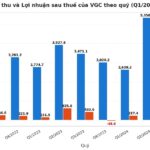

In the first three months of this year, TNH recorded a revenue of VND 93 billion, while the cost of goods sold exceeded VND 100 billion, resulting in a post-tax loss of nearly VND 35 billion. This performance is considered one of the main reasons for the company’s cautious profit plan for 2025.

| TNH forecasts 2025 profit to be the lowest in a decade |

A Major Textile Business Reports Over $5 Billion in Profits After Five Months, Achieving 50% of Annual Target

The parent company, TCM, witnessed a remarkable performance with a revenue of VND 1,608 billion, reflecting a 7% increase compared to the same period in the previous year. This achievement signifies a strong step towards the annual plan, as it accounts for a substantial 36% of the yearly target.

The Nourishing Journey: A Tale of Ethical Entrepreneurship and Russia’s Fresh Dairy Revolution

TH has brought about a paradigm shift in the landscape of Russian agriculture. It is not just about investment figures and production capacity; the company’s greatest achievement is instilling hope and providing a livelihood for hundreds of local residents. Together, they have forged a new and modern path, setting a precedent in the country’s agricultural sector.

“Ho Chi Minh City Proposes Several Initiatives to the General Secretary and Central Working Committee”

“During a meeting with the General Secretary and the Central Work Delegation, Mr. Nguyen Thanh Nghi, Standing Vice-Secretary of the Ho Chi Minh City Party Committee, eloquently presented a proposal on behalf of the three provinces. He advocated for innovative mechanisms, forward-thinking policies, and robust resources to propel the dynamic development of Ho Chi Minh City and its neighboring areas.”